Get Ed Crooks' Energy Pulse in your inbox every week

Walking on hot coal

Record prices an are indicator of the challenges in the energy transition

1 minute read

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed examines the forces shaping the energy industry globally.

Latest articles by Ed

-

Opinion

The Big Beautiful Bill is close to passing

-

Opinion

Ceasefire in the Israel-Iran conflict

-

Opinion

The impact of the Israel-Iran conflict escalation on the global energy market

-

Opinion

EBOS: the unsung hero that’s accelerating clean energy deployment

-

Opinion

What the US attack on Iran’s nuclear installations means for energy

-

Opinion

How do we adapt to a warming world?

Rudyard Kipling’s poem ‘Tommy’ is a brilliant skewering of the hypocrisy of Victorian society, which mocked and despised soldiers in peacetime, but hailed them as the “thin red line of ‘eroes” when Britain was at war. The coal industry feels very similar. For good reasons, global policymakers are determined to shift the world away from coal. There is no way the goals of the Paris climate agreement can be achieved without a steep reduction in world coal consumption. But when energy supplies are tight, as they have been over the summer, then coal is in demand again, playing an essential role in keeping the lights on.

Thermal coal prices have been hitting record highs in recent months. The benchmark Newcastle coal futures contract for October 2021 this week hit $189 per ton, up about 125% from its level in March. Coal is still on a path towards long-term decline. China underlined that this week, with a promise to stop building coal-fired power plants abroad. But this year’s price surge, which does not seem likely to abate any time soon, has been a reminder that as the world transitions towards lower-carbon technologies, its continuing reliance on fossil fuels can stoke price volatility and impose severe strain on energy systems.

The coal price surge has been driven by the same forces that have stoked many other commodity markets this year, says Dale Hazelton, Wood Mackenzie’s head of thermal coal: demand has come roaring back as the world economy recovers from the pandemic-induced slowdown, and supply has been unable to keep pace. World demand for global coal dropped by 7% last year, but it is rebounding strongly, and is expected to grow by about 5% this year.

The uninspiring long-term outlook for coal demand, and pressure from investors that are increasingly focused on climate goals, have meant that there has been very little investment in new coal supply in recent years. Numerous disruptions to supply around the world this year, including floods in Indonesia and Russia, have further hampered the mining industry’s ability to respond to higher prices. The result is that demand is outstripping supply, and power generators and other customers have been running down their stocks.

Meanwhile, gas prices in Europe and Asia have been driven higher by a combination of factors including disappointing wind power output and a sharp drop in North Sea production for maintenance. With gas this expensive, some companies have been switching from gas to coal for power generation as a lower-cost-option, even allowing for the high price of European emissions allowances. That is adding further support to demand for coal.

None of what is happening now changes the long-term outlook for coal. As Hazelton explained in a recent briefing on the COP26 climate talks, the big uncertainty is over the pace of decline in demand over the coming decades. China’s decision to stop building coal-fired plants abroad will put downward pressure on long-term demand, but does not mean the outlook has been transformed. Wood Mackenzie’s Shirley Zhang commented that the real issue was not how many new coal-fired plants are built, but how many existing plants are shut down. “Due to the relatively young coal plant ages in developing Asia and the lack of new coal financing, countries may be forced to extend the life of their existing coal fleets to accommodate a less disruptive transition,” she said.

The strains caused by today’s high gas and coal prices, including protests in the streets and government action against suppliers, are a warning that the transition to low-carbon energy will not be smooth and seamless. We are seeing it with gas and coal today. In the future, it could be oil.

ConocoPhillips steps up in the Permian as Shell backs out

In the past year or so, a dominant model has emerged for merger and acquisition activity in the US oil industry. Companies have been combining in all-stock deals, typically with very little acquisition premium, sometimes in mergers of two similar-sized businesses, with cost reductions through reduced general and administrative expenses a key driver of consolidation. ConocoPhillips’ US$9.7 billion acquisition of Concho Resources, announced last October, broadly fit that model. Now it has done another deal, acquiring Royal Dutch Shell’s assets in the Permian Basin for US$9.5 billion, that breaks decisively from that pattern.

The deal is for cash, enabling Shell to pass US$7 billion of the proceeds on to its shareholders, and cost savings are not identified as a critical factor. Indeed Ryan Lance, ConocoPhillips’ chief executive, highlighted Shell’s workforce as a key attraction in the deal. ConocoPhillips was generating free cash flow even through a difficult 2020, and had US$6.9 billion of cash and short-term investments on hand at the end of last year. With returns surging as oil and gas prices have risen this year, that has put the company in a position to do a large deal for cash.

Buying the assets will make ConocoPhillips the second largest producer in the Permian Basin, after Pioneer Natural Resources, and increases the upside if oil prices go higher. It presents the outlook over the next ten years at a reference price of $50 a barrel for WTI crude. If the price averages $10 a barrel more, it expects to generate an additional US$35 billion cash from operations. That is up US$5 billion from its previous plan as a result of buying the Shell assets. As Lance put it on a call with analysts, the deal creates “greater torque to the upside”.

Shell’s exit from the Permian is the latest stage in a staged retreat from US unconventional resources by international companies, following Equinor’s sale of its assets in the Bakken shale in February. The Shell Permian assets are not particularly carbon-intensive: the company has made great efforts to cut emissions, for example by ending routine flaring in 2018. Acquiring them is enabling ConocoPhillips to set a more ambitious target for reducing the emissions intensity production. But in absolute terms, the emissions are significant.

In May the district court in The Hague ordered Shell to cut the emissions from its operations by 45% from 2019 levels by 2030, and to take best efforts to reduce the emissions resulting from the use of its products by the same percentage. Shell has appealed against the ruling, but selling oil and gas assets is the most effective way to cut absolute emissions quickly.

In brief

The International Energy Agency, which is backed by developed countries including many of the world’s largest energy consumers, has suggested that Russia could “do more to increase gas availability to Europe and ensure storage is filled to adequate levels in preparation for the coming winter heating season”. Stepping up gas exports to Europe would be “an opportunity for Russia to underscore its credentials as a reliable supplier to the European market,” the IEA said in a statement on its website.

The IEA identified a range of factors driving gas and power prices higher, including low wind generation, the cold European winter, and droughts that have hit hydro power output in Brazil and other countries. Fatih Birol, the IEA’s executive director, said: “It is inaccurate and misleading to lay the responsibility at the door of the clean energy transition… Well-managed clean energy transitions are a solution to the issues that we are seeing in gas and electricity markets today – not the cause of them.”

Mohammad Barkindo, secretary general of Opec, took a different line, telling CNBC that current gas prices reflected what he described as “the transition premium”.

Germany’s government has promised continuing support for both production and uses for hydrogen.

A California company called B2U Storage Solutions has developed a way to offer lower-cost energy storage to support power grids using old electric vehicle batteries. The company has a project that has been operating for over a year, Canary Media reported.

And finally: making fun of climate change. Seven of the leading late-night talk-show hosts in the US, including Stephen Colbert, Trevor Noah, James Corden and Samantha Bee, agreed to make Wednesday night Climate Night, devoting their shows to jokes and chat related to climate change. If the idea sounds awkward, the results do not seem to have been any better. Brian Kahn and Molly Taft rounded up the night’s hits and misses for Gizmodo, and a team from Grist also reviewed the seven shows, but even the supposed highlights were not exactly barnburners. Bee’s segment on water treatment was probably the best, highlighting problems with sewage systems exacerbated by increasingly heavy rainstorms.

Steve Bodow, the veteran comedy producer whose idea it was, told CBS News that he hoped to encourage people to talk and think and even joke about climate change. "Getting people to hear and talk and think more about climate is one of the necessary steps to making that change even possible,” he said. “And, God help us, late-night TV is a place where a lot of people do get a lot of information."

Polling evidence suggests, however, that people do think about climate change quite a bit. Pew Research found that in the spring of this year, 60% of Americans said they were somewhat or very concerned that climate change would harm them at some point in their lifetimes, compared to 39% who were not too concerned or not at all concerned. Increased awareness may help accelerate global solutions, as Bodow hopes. But awareness is pretty high already.

Other views

Simon Flowers — How capital markets will drive the decarbonisation of oil and gas

Mhairidh Evans — COP26: Carbon capture & storage and low-carbon hydrogen

Gavin Thompson — The fork in the road for Asia’s oil and gas demand

FT View — Net zero goals cannot fall victim to the energy crisis

Michael Shellenberger — Skyrocketing natural gas prices create new opportunity for nuclear energy

Quote of the week

"There's absolutely no question of the lights going out or people being unable to heat their homes. There will be no three-day working weeks or a throwback to the 1970s." — Kwasi Kwarteng, UK business secretary, rejected suggestions that soaring energy prices could lead to power cuts and force businesses into shorter working weeks over the winter.

Chart of the week

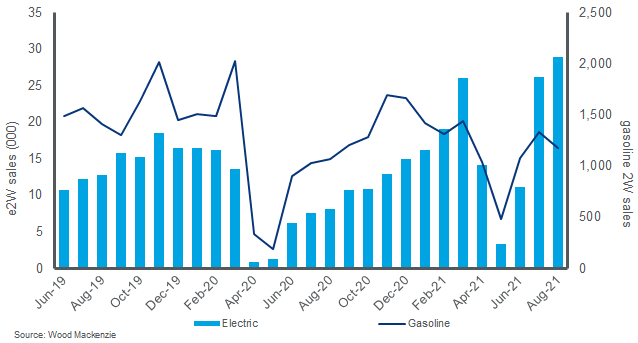

This comes from a recent note by Wood Mackenzie’s Qiao Ling Chen, Masaatsu Koyama and Ram Chandrasekaran on the market for two-wheelers — motorbikes and motor scooters — in India. About 200 million two-wheelers are registered in India, and they account for almost 60% of the country’s gasoline consumption. The electrification of transport in India, an objective for both climate and energy security reasons, is likely to begin with two-wheelers. It is a much less expensive option than shifting to electric passenger cars, in terms of vehicle ownership and development of charging infrastructure.

There is great potential for a transition. Electric two-wheelers still have a very small share of the market, but sales have been growing fast since last year. The market share for electric two-wheelers, which was 0.8% last year, rose to 2.4% in August.