Sign up today to get the best of our expert insight in your inbox.

Could US LNG become a victim of its own success?

Investment is attractive despite looming risk of oversupply

4 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

War is once again reshaping gas and LNG

-

Opinion

Middle East conflict set to drive oil and LNG prices significantly higher

-

The Edge

Can natural hydrogen deliver its potential?

-

The Edge

The big themes on Big Oil’s mind

-

The Edge

India’s energy challenge

-

The Edge

Is there still life in decarbonising hard-to-abate sectors?

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin oversees our Europe, Middle East and Africa research.

View Gavin Thompson's full profileMassimo Di Odoardo

Vice President, Gas and LNG Research

Massimo Di Odoardo

Vice President, Gas and LNG Research

Massimo brings extensive knowledge of the entire gas industry value chain to his role leading gas and LNG consulting.

Latest articles by Massimo

-

The Edge

War is once again reshaping gas and LNG

-

Opinion

Middle East conflict set to drive oil and LNG prices significantly higher

-

Opinion

European gas: 6 Q&As on prices, supply, and regulatory impact

-

The Edge

A wild week for gas markets

-

Featured

Gas & LNG: region-by-region predictions for 2026

-

Opinion

Five key takeaways from our Gastech 2025 Leadership Roundtables

Frank Harris

Head of Global LNG Consulting

Frank Harris

Head of Global LNG Consulting

Frank is a recognised expert on the global LNG industry and leads our global consultancy practice in this area.

Latest articles by Frank

-

The Edge

War is once again reshaping gas and LNG

-

Opinion

Five key takeaways from our Gastech 2025 Leadership Roundtables

-

The Edge

Gastech 2025: when will the music stop for US LNG?

-

The Edge

Could US LNG become a victim of its own success?

-

The Edge

Taking the pulse of the global LNG industry

-

Opinion

Debating the future direction of the LNG market

Kristy Kramer

Head of LNG Strategy and Market Development

Kristy Kramer

Head of LNG Strategy and Market Development

Kristy brings over fifteen years of gas and energy industry experience to her role leading our Gas and LNG Consulting.

Latest articles by Kristy

-

The Edge

War is once again reshaping gas and LNG

-

Opinion

Five key takeaways from our Gastech 2025 Leadership Roundtables

-

Opinion

US LNG expansion: Balancing growth ambitions with oversupply risks

-

Opinion

Managing the nitrogen challenge in Permian gas

-

Opinion

How LNG and power are shaping US gas pipeline development

-

The Edge

Gastech 2025: when will the music stop for US LNG?

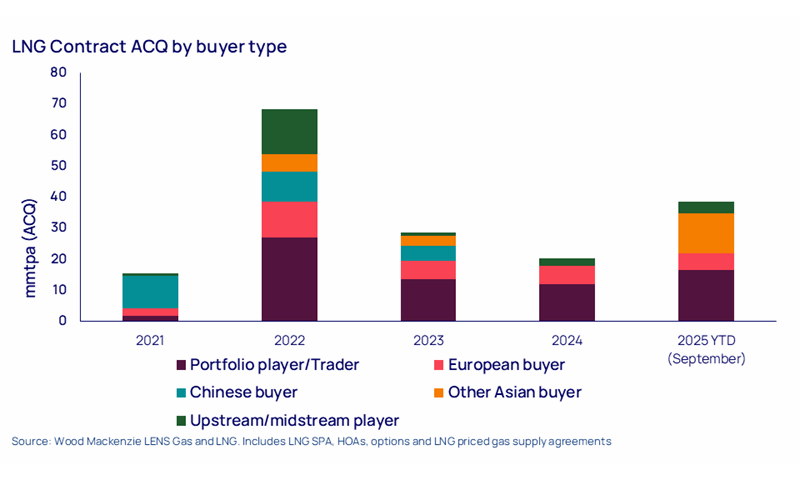

The world needs more LNG supply to meet soaring demand. With its abundant gas resource, multiple pre-FID projects and a supportive administration, US LNG looks a solid bet to capture the lion’s share of new supply volumes. Three new US developments have already taken FID this year, with several more building contracting momentum and expected to be sanctioned within the next two years.

While new supply is undoubtedly required, scale and timing are everything. We are already forecasting a period of low spot prices over the next few years. The more US LNG capacity that takes FID, the bigger the oversupply and longer and deeper the price drop could be. Good news for end-users buying at spot prices but challenging for US LNG offtakers.

Ahead of next week’s gathering of the global gas industry in Milan for Gastech 2025, our team considers why, despite the emerging risks, US LNG is still one of the hottest investments in energy.

First, the world needs more US LNG

In Europe, gas demand is proving resilient, domestic production is declining, while the EU is aiming to ban Russian imports entirely from 2028. Across Asia, lower prices will help LNG’s affordability and kick-start the next phase of demand growth, while the regional supply gap will be exacerbated by South and Southeast Asia’s dwindling domestic gas production. LNG was also the ‘oven-ready’ solution for Egypt when pipeline imports were cut this summer.

Buyers scouring the globe for new supply have few material alternatives to meet their future demand growth beyond the US. Other than Qatar, the other global heavyweight, LNG projects in the rest of the world lack scale and face ongoing challenges ranging from securing long-term gas supply, regulatory approval and high costs. Political considerations are a new factor, with US LNG offering barter potential to soothe trade imbalances with the White House.

Second, US LNG contracts will remain commercially attractive to offtakers on a long-term basis

While the developers of liquefaction projects are relatively immune to spot LNG price risk, lower traded prices pose a commercial challenge for offtakers. Moreover, we forecast low global LNG prices may coincide with higher Henry Hub prices, squeezing the profit margin of traded US LNG cargoes. A worst-case scenario would be periods of US LNG underutilization.

However, with LNG deals typically a 15–20-year commitment, offtakers will take a longer-term view. Even with a margin squeeze over the next few years, the market will rebalance and spreads between Henry Hub and TTF/JKM should put US LNG in the money over a contract’s life.

Offtakers can also mitigate downside risk through the unrivalled trading optionality US LNG contracts offer. Unlike point-to-point contracts that dominate most LNG sales, the Free-on-Board structure means offtakers of US LNG aren’t stuck with a single buyer but can direct volumes wherever they can maximise overall portfolio value. The Henry Hub price linkage opens the door to arbitrage with both spot LNG prices and oil-indexed options.

Increased market volatility will amplify the opportunities for traders. US LNG offtakers might well face periods of low margins, which, in extreme cases could lead to cargo cancellations. But the maximum loss would only be equivalent to the contracted liquefaction fee. On the upside, there is no limit to profits achievable at times of higher LNG prices, as bountiful returns for some companies in recent years clearly demonstrated.

IOCs have long been the biggest offtakers of US LNG, but the contract flexibility and optionality of US contracts is increasingly attractive to a growing pool of companies. ADNOC and PetroChina International are among those looking to build material LNG trading portfolios.

Third, US LNG has access to a deepening pool of capital

An increasing number of investors want a slice of the action, while some existing investors are expanding their positions. Infrastructure investors, including funds such as GIP, KKR and Stonepeak have long sought the long-term steady cash flows and limited commodity price risk of US liquefaction infrastructure and are now upping their game.

Strategic investors including Middle Eastern NOCs, dedicated new LNG players such as MidOcean and established LNG operators like Woodside are now committing capital to US LNG projects. Their focus is primarily on offtake and, for some, combining this with an upstream/US domestic gas market presence.

Debt markets have long been attracted to US LNG as an efficient way to deploy large volumes of capital and the appetite shows no sign of abating. With US renewables growth under pressure from the OBBBA, US LNG is the big show as banks rethink their approach to ESG and the Trump administration doubles-down on policies to support LNG exports.

An ongoing success story - but with nuance

US LNG developers across the board are accelerating timelines and racing towards FID. But there’s a limit to how much US LNG the market can absorb in the coming years and risks pushing traded prices even lower than forecast. Nor can concerns over rising US gas prices and project cost inflation be sidelined. Despite all this, the US LNG story remains fundamentally investable.

Wood Mackenzie at Gastech 2025: Wood Mackenzie is the official knowledge partner for Gastech 2025. Our team will be moderating strategic panel discussions, presenting and chairing Leadership Roundtables throughout the conference. Please visit us at Stand F1, well placed adjacent to the commercial theatre.

Make sure you get The Edge

Every week in The Edge, Simon Flowers curates unique insight into the hottest topics in the energy and natural resources world.

Sign up today using the form at the top of the page.

The official Knowledge Partner of Gastech 2025

We’re proud to bring our unique insights to the forefront of the energy conversation. Throughout the week, our experts will be contributing to exclusive leadership roundtables, presentations, and panel discussions - shaping the dialogue on the future of gas and LNG. Want to connect? Discover more and book a meeting with one of our experts.