Identifying key risks and uncertainties in 2020

Five to watch – oil demand, US election, climate change, sector credibility, financing gas

1 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

A world first: shipping carbon exports for storage

-

The Edge

WoodMac’s Gas, LNG and the Future of Energy conference: five key themes

-

The Edge

Nigeria’s bold strategy to double oil production

-

The Edge

US tariffs – unpredictability is the strategic planners’ nightmare

-

The Edge

US upstream gas sector poised to gain from higher Henry Hub prices

-

The Edge

What comes after the Permian for IOCs?

What risks might lurk in the shadows next year that could change the outlook for the energy world? Here are five.

A trigger point for climate change

New EU legislation could be the catalyst. The EU leads the world in aspiration and policy, and a new regime is cranking up the pace. The ‘green deal’, legislation planned for Q1 2020, envisages a binding commitment to net-carbon neutrality by 2050. Another EU initiative that could galvanise global acceptance of carbon taxes are border tariffs. These aim to protect EU-produced goods from cheaper imports with a heavy carbon footprint. The timing for new legislation sets up COP26, the UN climate conference, in Glasgow in December 2020 as a possible turning point for climate change. Global emissions have risen since the Paris Agreement five years ago. COP26 must commit the 196 Paris signatories to the tougher emissions reductions now needed to get the world on track for a 2 °C pathway.

US election and geopolitics

The November presidential election could have big implications for energy markets. Domestically, the US oil and gas industry fears a backlash after the halcyon days of this Trump term. A Democratic victory would change the agenda, the question is how far – to Obama-plus under Joe Biden or that of a hard-core environmentalist? The Warren proposal to ban fracking hints at the latter, though it’s doubtful Washington has the requisite power to cut the legs off shale gas and oil development. Globally, a change in administration would be impactful. There’s the possibility of re-signing the Paris Agreement; the US-China trade dispute; and US foreign policy which, emboldened by tight oil growth, has reached far and wide under this administration. For starters, what would the Democrats do about sanctions on Iran and Venezuela that are keeping 2 million b/d of crude exports off the market? A second Trump term will mean more of the same from these last four years.

The global economy and oil demand

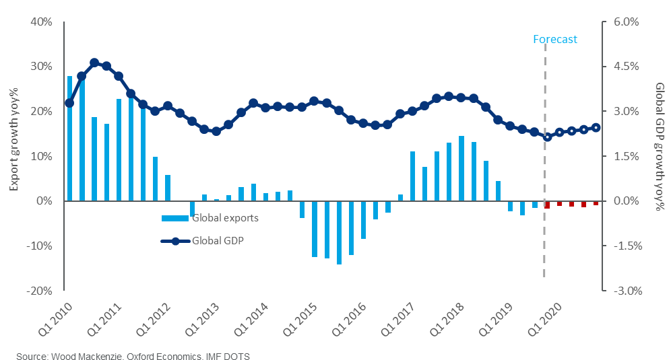

No recession, but global GDP growth slid from 2.9% in 2018 to 2.3% in 2019 with the US-China trade dispute weighing on industrial production. Oil demand disappointed, growing at half the rate forecast at the start of the year. In 2020, we expect a bounce in oil demand growth despite tepid GDP growth of 2.4%. We forecast 1.35 million b/d, more than double the 0.6 million b/d of 2019 (the lowest since 2011). One-offs depressed 2019 whereas 2020 demand will be boosted by marine diesel in China and NGLs for new US petrochemical capacity. Any repeat of demand disappointment will add to the pressure OPEC+ is under to balance a fundamentally oversupplied market.

Sector credibility

The industry has done a dismal job in convincing equity markets and the wider public of its role as the energy transition plays out. The global economy needs oil and gas for some decades yet. It’s up to oil and gas companies in 2020 to present themselves in a better light – as part of the solution rather than the problem. What’s needed? A plan to maximise cash value for shareholders from the core oil and gas value chain. A plan to measure, reduce and eliminate Scope 1, 2 and even Scope 3 emissions. A plan to adapt to an energy market that’s decarbonising. That will be a start. Repsol, aiming for net-carbon neutrality by 2050, has set a bold example. Other IOCs – and NOCs – need to follow.

Gas – financing a key transition fuel

Gas, with its low-carbon intensity on burning compared to other fossil fuels, has a critical role to play in balancing the intermittency of solar and wind power through the transition. Global gas demand looks resilient for the next two decades and beyond, and the industry is onto it – planned LNG projects are at record highs. But policy makers and capital markets are moving fast – will finance be available for the huge investment needed? The European Investment Bank is the latest to withdraw from the sector, and will cease funding coal, oil or gas projects after 2021. The industry needs to work harder in 2020 to demonstrate the benefits of gas and its environmental credentials – in tandem with carbon capture and storage – to ensure that finance for much-needed gas projects doesn’t dry up.