Discuss your challenges with our solutions experts

Is China edging closer to a national carbon market?

We assess an unofficial review of emissions allowances which offers a glimpse of the country’s carbon trading scheme.

1 minute read

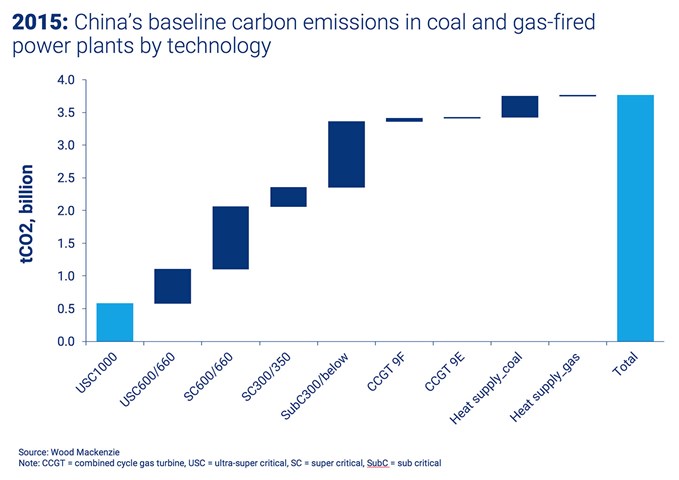

China is aiming to kick-off its nationwide carbon market in 2017, however, a recently disclosed document sheds some light on how carbon allowances will be allocated across its power, cement and aluminium industries. The draft lists accounting formulae and emission factors for eleven coal and gas-fired technologies.

The newly available information offers a tantalising hint at how a carbon trading scheme might function. However, agreeing an efficient, consistent methodology that can work across diverse provinces will be challenging and the deadline is beginning to look ambitious.

Using the emission factors and methodologies proposed in the revealed draft, we estimate the baseline emission in 2015 to be 3.76 billion tCO2 from fossil fuel generators. However, our in-house power model gives a base case view of around 3.86 billion tCO2, just 100 MtCO2 higher than the government-proposed baseline. The disparity suggests that fossil-fuel generators will not yet take the lead in carbon mitigation.

Several abatement technologies are available to China. Upgrading to high-efficiency, low-emission units would lower heat rate and reduce emissions – an ultra-super-critical 1,000 MW unit has a 13% lower emissions factor than a sub-critical 300 MW unit.

Increasing heat supply through co-generation would also cut the carbon emission factor by around 45% compared to thermally-generated electricity. More widespread centralised heating could help to phase out small, inefficient coal-fired boilers.

Above all, the government must secure consensus. But, with many different stakeholders, competitive interests at work and emergent technology underpinning it all, launching China's carbon market in the next eight months will spark an intense period of negotiation during which the following challenges should be considered:

- Standardising regulation: Authorities must unite current practices in the pilot provincial markets. Also, selection of the baseline year and the share of freely allocated allowances should be kept consistent.

- Sharing the allowances: The government is expected to adopt a 'common but differentiated responsibilities' approach to domestic carbon negotiations. This will enable less developed provinces to argue for reduced carbon mitigation allowances. However, developed coastal regions are unlikely shoulder a heavier burden willingly.

- Establishing best practice: Government and businesses must develop measuring, reporting, verifying and trading mechanisms for carbon emissions. The government also needs to build capacity, ensure transparency and manage enforcement.

Putting these steps in place will take time but the world will be watching with interest to see how, and when, China's government and industry respond.