Discuss your challenges with our solutions experts

Meeting gas demand in China - the role of LNG trucking

LNG trucking continues to play a major role in meeting demand in China

1 minute read

We're seeing phenomenal growth in China's LNG demand, driven by government-mandated coal-to-gas switching. Serious air pollution issues have led to new environmental policies prompting a reduction in coal in favour of cleaner fuels, including gas. How can China ensure local gas demand is met, without the price hikes seen last winter?

increase in China's gas demand

What's driving the demand?

China's gas demand has risen by more than 17% over the last year, with industrial coal-to-gas switching accounting for 40% of this growth. A further 30% of this came from new connections in the residential and commercial sectors.

This increase in gas usage has underpinned the surge in LNG demand, with LNG import growth increasing by 12.1 million tonnes (Mt) to 38.3 Mt in 2017. New challenges have surfaced with this increased demand. China's seasonal demand profile combined with its under-developed gas infrastructure, has led to a fragile supply-demand balance. Last winter the north saw gas shortages caused by higher seasonal demand and the lack of available regasification capacity.

By the end of 2017, China had 17 LNG receiving terminals in operation, but the issues faced last winter highlight the mismatch between LNG terminal distribution, mostly in the south, and the winter demand profile.

When peak utilisation in the northern and eastern regions reached 119% ad 159% respectively in the winter of 2017/2018, LNG trucking played a key role in meeting gas demand. With limited pipeline coverage and lack of storage facilities, LNG trucking provided a flexible, albeit relatively expensive, way to reach both on-grid and off-grid gas demand.

Delivering 12% of China's total gas demand, LNG trucking is a growing segment. Trucks are transporting both imported LNG and liquefied domestic production, delivering three-times the amount in 2012.

Trucking costs versus imported LNG

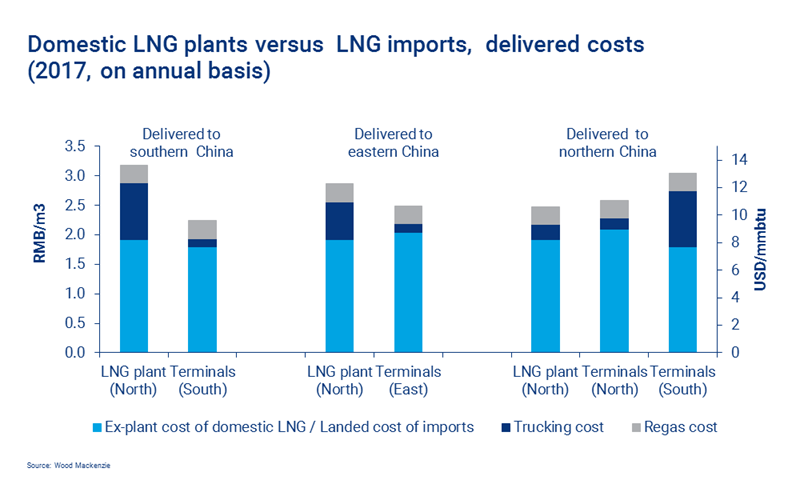

However, as the cost of imported LNG has declined, the cost of delivering LNG around China has become more complex. Sourcing LNG from the same region is the more economical solution, but last year LNG was trucked as far as 2,000 km from southern terminals to northern China to cope with shortages, that's more than double the normal distance. This led to a surge in LNG prices at the peak of last winter, with prices reaching US$30/mmbtu.

LNG trucking continues to be seen as a welcome solution for market participants in search of liquidity and flexibility. While gas demand is expected to remain healthy this year, the next winter gas shortage should not be as severe as the last.

LNG buyers are likely to have learned from past experience and will try to avoid being caught by price surges again.

Miaoru Huang

Research Director, Asia Pacific Gas and LNG

Miaoru leads our Northeast Asia gas research.

View Miaoru Huang's full profile