Abundant, low-cost renewables will transform Nordic power markets

Nordic power markets have long been defined by their ample hydro resources, but the make-up of supply will evolve as new wind capacity serves a major expansion of demand.

3 minute read

Peter Osbaldstone

Research Director, Europe Power

Peter Osbaldstone

Research Director, Europe Power

Peter is a research director with more than a decade’s experience in European power and renewables markets.

Latest articles by Peter

-

Opinion

2025 global power market outlook: divergent paths in a transforming energy landscape

-

Opinion

Iberian blackout: let the finger pointing begin

-

Opinion

European power in 2025: the pace, opportunities and challenges of the transition

-

Opinion

European power and renewables: what to look for in 2025

-

Opinion

The outlook for European power and renewables

-

Opinion

Is European power rising to the challenge of decarbonisation?

Rishab Shrestha

Principal Analyst, Europe Power

Rishab Shrestha

Principal Analyst, Europe Power

Rishab is a principal analyst at Wood Mackenzie, focusing on European power and renewables markets.

Latest articles by Rishab

-

Opinion

Elevated subsidies enable offshore wind to end 2023 on a high note

-

Opinion

Abundant, low-cost renewables will transform Nordic power markets

-

Opinion

European power markets emerge from the energy crisis

-

Opinion

Renewable energy costs continue to fall across Europe

The Nordic power markets of Norway, Sweden, Denmark and Finland are set to play an increasingly important role in the European energy transition, exporting low-cost, flexible power to continental Europe in the longer term.

While a slow start for offshore wind expansion and electricity demand growth will tighten the Nordic supply balance in the late 2020s, wind projects will come online in droves thereafter, leading to excess supply and enabling the Nordic countries to maintain the lowest power prices in Europe.

This is a theme we covered in our recent Nordic Power Markets Outlook to 2050 report, and in our recent briefing in Copenhagen. Fill out the form on the top right of this page for a complimentary extract from our market commentary, or read on for a brief summary.

The situation in continental Europe

Power demand will continue to wane in the short term because of changes in consumer behaviour and higher prices. Longer term, however, demand growth will be substantial, particularly thanks to new electrification vectors, such as hydrogen, heat pumps and electric vehicles. These sources of increased demand and associated renewable supply growth will require significant grid investment.

We expect meaningful progress on renewable capacity targets across Europe, but investments in the grid and flexibility remain critical. To achieve headline policy objectives on decarbonisation, security, and affordability, faster change is needed. If this next-stage transformation is to be delivered, Europe must undergo fundamental shifts in market characteristics, technology delivery and costs, as well as regulatory and commercial arrangements.

The renewable sector faces multiple challenges, most notably permitting, grid bottlenecks, supply-chain constraints and cost inflation. However, the investment opportunity is huge as Europe pursues ambitious levels of decarbonisation by 2030 and net-zero by mid-century.

Instances of renewable surpluses will increase, creating negative prices across Europe. We have already seen them this year in the shoulder months between peak season and off-season, from Iberia to the Nordic countries. Less interconnected zones will be more prone to negative pricing.

The long-term Nordic power outlook

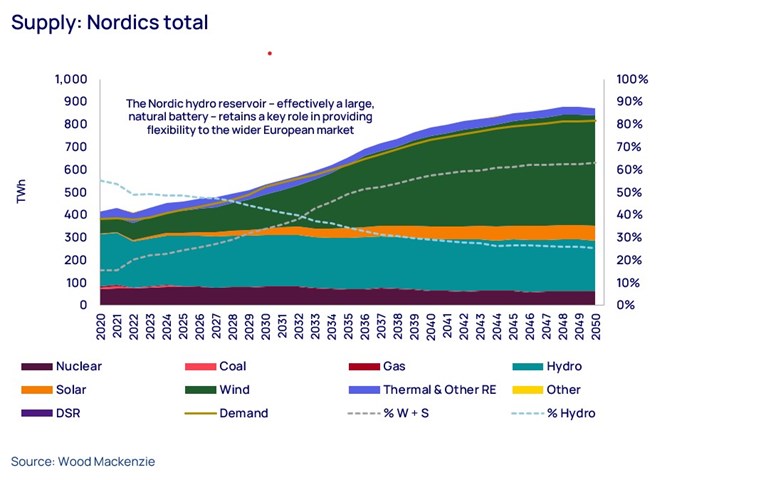

By 2050, we expect wind power to account for 56% of Nordic supply, while hydropower – for so long the defining feature of supply in the region – will halve to just 25%. But it is important to put this change in proper context, the power market will more than double in size over the same period and new wind supply will be key to serving those new volumes.

We also expect the Nordic markets to become frontrunners in utilising otherwise excess renewable volumes for hydrogen production.

Attractive power prices and the abundance of renewable supply provide one of the strongest foundations for hydrogen growth in Europe, and the sector is expected to account for over 20% of on-grid power demand in the long term. Against this background, offshore wind capacity will rise from 7 GW in 2030 to 65 GW in 2050.

The prospects for hydrogen production in the Nordics are further boosted by the European Union’s new rules on additionality and matching, which stipulate that zones with more than 90% renewables or an emissions intensity of less than 65 gCO2/kWh are free of any restrictions – all Nordic zones will produce green hydrogen.

Backing for nuclear power as part of the response to decarbonisation goals, and as additional support for energy security, has grown stronger in Finland and Sweden. In January 2023, the Swedish government proposed changes to the law to enable new nuclear plant builds, while Finland is amending legislation to facilitate the construction of small modular reactors. The combination of lifetime extensions and new builds sees 4.9 GW of Swedish nuclear power by 2050, higher than in our previous outlook.

Due to the lower market price background, the capture prices of renewable generators in the Nordic countries are less attractive than elsewhere in Europe, but strong capacity factors, favourable geography and growing opportunities to export electricity (either directly or via its by-products) provide support for a strong renewables project pipeline. In the longer term, Nordic offshore wind capture prices are highest in the southern Norwegian zone, where congestion is less pronounced and the influence of higher-cost interconnected markets is stronger.

Learn more

Fill out the form on the top right to download a complimentary extract of our Power Markets Outlook to 2050 report, which focuses on the Nordic markets, with individual country insights.