Get Ed Crooks' Energy Pulse in your inbox every week

1 minute read

Ed Crooks

Vice-Chair, Americas

Ed Crooks

Vice-Chair, Americas

Ed examines the forces shaping the energy industry globally

Latest articles by Ed

-

Opinion

How global trade can help build the clean energy economy

-

Opinion

Biden exit shakes up US presidential race

-

The Edge

Is it time for a global climate bank?

-

Opinion

Are low profits to blame for the energy transition lagging?

-

Opinion

Day 3: How can we finance the energy transition? Discussions from the final day of the Reuters Global Energy Transition Conference 2024

-

Opinion

Day 2: The Energy Gang at The Reuters Global Energy Transition Conference 2024

Coal power has been in steep decline in the US over the past decade, and Trump’s presidency has barely slowed that trend.

Ed Crooks

Vice-Chair, Americas

Ed examines the forces shaping the energy industry globally

Latest articles by Ed

-

Opinion

How global trade can help build the clean energy economy

-

Opinion

Biden exit shakes up US presidential race

-

The Edge

Is it time for a global climate bank?

-

Opinion

Are low profits to blame for the energy transition lagging?

-

Opinion

Day 3: How can we finance the energy transition? Discussions from the final day of the Reuters Global Energy Transition Conference 2024

-

Opinion

Day 2: The Energy Gang at The Reuters Global Energy Transition Conference 2024

The Navajo Nation in the southwestern US suffers from the same economic challenges as many other Native American communities. The unemployment rate in 2013-17 was 19%, and incomes per head were only about one-third of the US average. So the Navajo Generating Station, a 2.25 gigawatt coal-fired power plant on the nation’s land in Arizona, was an important employer and source of tax revenues for the tribe and their neighbours, the Hopi. The largest coal-fired generator west of the Mississippi, it supported about 500 jobs at the plant and about 350 more at its associated coal mine.

Built in the early 1970s and first brought on line in 1974, the Navajo Generating Station supplied power to the Central Arizona Project, which provides water for 80% of the state’s population, and to cities as far away as Los Angeles and Las Vegas. Competition from cheap gas and renewable energy had made it increasingly uneconomic, however, and on Monday afternoon, its last remaining unit was shut down for good.

As the closure loomed, both the Navajo and Hopi tribes pleaded with the Trump administration to save the plant, hoping that President Donald Trump’s vocal support for the US coal industry would prompt him to intervene. The story of the Navajo Generating Station, however, has been an object lesson on the limits of the US president’s power to influence the country’s energy system. The Trump administration did express support for the plant, and looked at various ways to rescue it, but in the end nothing that officials tried was effective.

Mike Hummel, general manager of Salt River Project, which operated the plant, described the closure as “a difficult but necessary decision based on the changing economics of the energy industry that has seen natural gas prices sink to record lows along with the growth of economical renewable resources”. Gas-fired plants are replacing most of the capacity lost by closing the Navajo Generating Station, although SRP is also investing in new solar plants and battery storage.

After Murray Energy, the largest privately-held US coal miner, filed for Chapter 11 bankruptcy protection late last month, the Navajo Generating Station is another landmark in the downfall of the US coal industry.

Coal power has been in steep decline in the US over the past decade, and Trump’s presidency has barely slowed that trend. Generation from US coal plants dropped 22% over 2013-16, and is on course to fall 19% over 2016-19. About 45 GW of coal-fired generation capacity was shut down over 2015-18, and WoodMac’s Robert Whaley projects that another 42 GW will close over 2019-23. In 2010, coal plants provided 46% of US electricity generation. This year it is down to 28%, and WoodMac expects it to drop to just 25% in the mid-2020s.

The Obama administration set a goal of reducing the carbon dioxide emissions from power generation by 32% from 2005 levels. That objective is likely to be achieved a decade early, even though the Clean Power Plan that was intended to deliver it never came into effect and was scrapped by Trump. The president has tried to help coal by cutting regulations, and the industry is still pushing for the Federal Energy Regulatory Commission to take action on the resilience of US grids in ways that could help coal-fired plants. But so far market forces – with some help from state clean energy mandates – have been difficult to resist.

After that decline to the mid-2020s, WoodMac thinks coal generation in the US is likely to stabilise for a while as gas prices rise, making gas-fired plants less competitive. But as a price on carbon emissions starts to kick in, whether through taxation, a tougher cap-and-trade programme or a new wave of regulations, we would expect coal’s share of US power generation to dwindle further to just 9% by 2040 in our base case forecast.

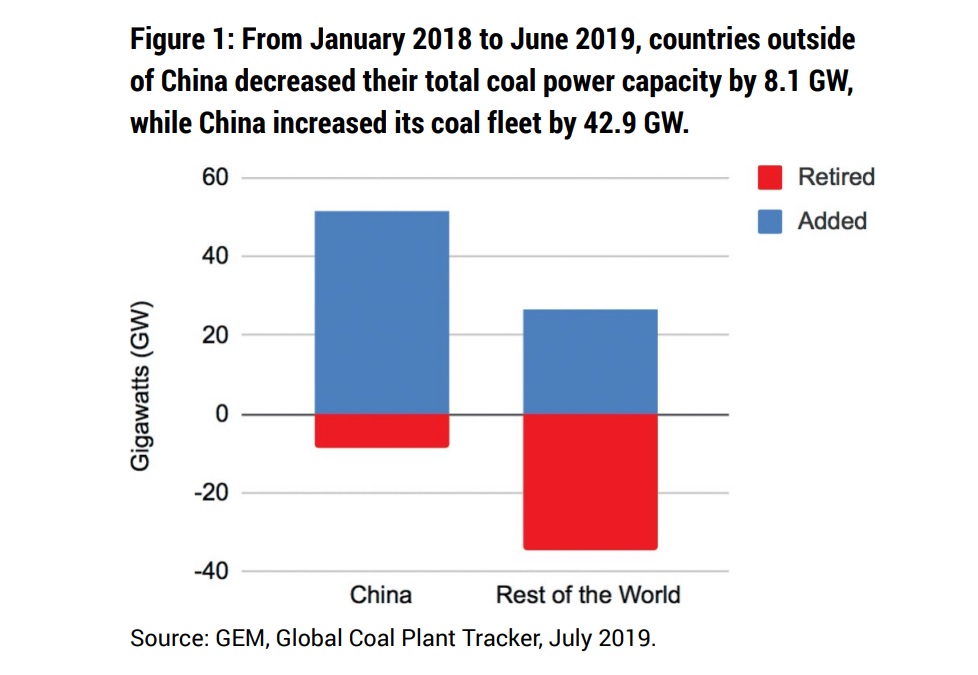

Coal power keeps growing in China

In China, meanwhile, coal-fired generation is still growing. China’s coal consumption peaked in 2013, and despite rising in 2017 and 2018 it was still about 9% lower than its peak. However, coal consumption and imports have been rising again this year, and there is still a lot of investment going into building new coal-fired power plants. In the 18 months to June 2019, China added a net 42.9 GW of coal-fired generation, the equivalent of a new 1.1 GW power plant every other week, according to a new report from Global Energy Monitor. That increase in China more than offset the aggregate decline in coal-fired capacity in the rest of the world, meaning that total world coal capacity rose by a net 34.9 GW.

As discussed in last week’s Energy Pulse, at a meeting of the National Energy Commission in Beijing last month, Premier Li Keqiang emphasised the importance of energy security for China, and said he wanted to promote the “clean and efficient development of coal-fired power”.

While the numbers for coal power in China are certainly eye-catching, it is important to remember that the recent pace of investment actually represents a marked slowdown in the pace of growth compared to five years ago. WoodMac data show that China added 34.3 GW of coal-fired generation capacity in 2018, compared to an average of 45.5 GW a year in 2013-17. China is also making massive investments in renewable energy, and WoodMac’s Frank Yu argues that in the 2020s, before energy storage is commercially cheap enough to deploy at scale, it will continue to add coal-fired plants to back up variable wind and solar power.

A solar breakthrough?

Concentrating solar power has very clearly lagged behind photovolataics in recent years, despite the suggestion in the movie Blade Runner 2049 that by mid-century it would be one of the principal energy sources for California. There have been signs that that could be changing, however: in June Greentech Media noted that the technology was “quietly becoming competitive” outside the US. And this week there has been an announcement of a “breakthrough” in concentrating solar technology by Heliogen, a company backed by Bill Gates.

The claimed breakthrough is one that might make it possible to use concentrated solar energy not just for power generation, but for industrial processes including the production of cement, steel and petrochemicals. Previous commercial concentrating solar technologies have typically been able to reach temperatures of up to 565 °C, Heliogen says. That is fine for power generation but too low for many industrial processes. The company announced this week that its system had shown it could reach temperatures of over 1,000 °C. Bill Gross, its founder and chief executive, said: “With low-cost, ultra-high temperature process heat, we have an opportunity to make meaningful contributions to solving the climate crisis.”

He is not wrong about the potential. Power generation looks like the easiest part of the energy system to decarbonise, because of the rise of solar and wind power. Industrial processes including cement and steel production are tougher nuts to crack. If Heliogen’s technology can be made to work at scale for the uses the company proposes, it could have a huge impact. But there is still a long way to go for it to realise its potential. Ravi Manghani, WoodMac’s head of solar, commented: “it will have to come down to economics, and it doesn’t seem like the markets are ready to invest in an expensive technology for decarbonizing heat.”

…and a battery breakthrough, too?

Another company claiming a technological success this week was Nikola, the Tesla rival that has been developing electric trucks with batteries and hydrogen fuel cells. The company announced it had discovered a revolutionary new battery technology with a much greater energy density than standard lithium ion cells, which would make it possible to double an electric car’s range from 300 miles to 600 miles. The technology is reported not to need cobalt or lithium, an attractive feature at a time when concerns about future supplies of battery raw materials are growing. Trevor Milton, Nikola’s chief executive, said the company was in discussions about an order that could make Nikola the largest truck manufacturer in the world.

The robustly skeptical responses have been understandable. Plenty of supposedly exciting battery breakthroughs have been touted, but none have yet surpassed the cost-effectiveness of lithium ion cells when produced in high volumes. We will have to wait a while longer to see whether Nikola can live up to the hype; the company plans to demonstrate the new battery at an event in the autumn of next year.

In brief

Saudi Arabia dropped plans for marketing Saudi Aramco’s shares formally in the US, Europe and Asia for its initial public offering, deciding instead to focus on local investors in the kingdom and in the Gulf region. The Saudi government is selling 1.5 per cent of the shares, which will be listed on the Tadawul exchange.

Andrew Cuomo, governor of New York, has set a deadline of November 26th for the utility National Grid to come up with a solution to their dispute over gas supplies in Long Island and New York. The company has been refusing to connect new gas customers while it waits for a decision on whether a pipeline to bring gas into the area will be allowed to go ahead. If the company does not present Cuomo with an acceptable plan, he may “decide to expel one of the world’s biggest utilities from the state’s most populous region”, Bloomberg reported. John Pettigrew, National Grid’s chief executive, told analysts on the company’s earnings call last week that it was “working through all the different engineering solutions” to avoid the need for a pipeline, including demand management and increased use of LNG.

US equipment manufacturers are facing a threat to their revenues from the slowdown in the onshore oil and gas industry, the WSJ reported.

Air pollution is killing thousands of people in the US each year, health researchers say.

If the UK’s Labour Party gets to form a government after the election on December 12th, one of the measures it will push for is a windfall tax on the oil industry to pay for investment in renewable energy.

If the world’s energy industries stay on the same track they are on now, by 2040 production of oil, gas and coal will be more than twice the level that would be needed to limit the increase in global temperatures to 2°C, according to a report from a group of organisations including the UN Environment Program.

And finally: Live product demos are always heart-in-mouth experiences, and Tesla’s launch of its new electric Cybertruck on Thursday evening proved no exception. Elon Musk boasted about the strength of the truck’s supposedly impact-resistant glass. But the demonstration did not go the way he would have wanted.

Smart reads

Simon Flowers — The Edge: Asian NOCs, the energy transition and ESG

Amory Lovins— Does nuclear power slow or speed climate change?

Jules Kortenhorst — The energy transition: how fast?

Charles Koch talks about the environment, politics, business and more

Michael Hogan — A hearty bowl of Texas soup: How ERCOT keeps the lights on

Quote of the week

“Today’s technology of shale oil production and shale gas… without any doubt, they are barbaric. These technologies destroy the environment. And certain areas of shale oil production have a very precarious situation… In spite of all the economic benefits, we do not need it, and we will never do this.” President Vladimir Putin of Russia explained at the VTB Capital “Russia Calling” investment forum in Moscow why he opposed developing the country’s shale reserves.

Putin further argued that shale production in Russia was unnecessary because the country still had plenty of conventional reserves to develop, and anyway did not want to destabilise oil markets by increasing output. However, the Bazhenov formation in Siberia is one of the world’s largest shale oil and gas basins, and several companies have been working to assess its potential, although international groups have been shut out by European and US sanctions since 2014. A Gazprom Neft executive said in June that he expected costs in the Bazhenov to fall to the point where production could be commercially viable in 2022-23.

Chart of the week

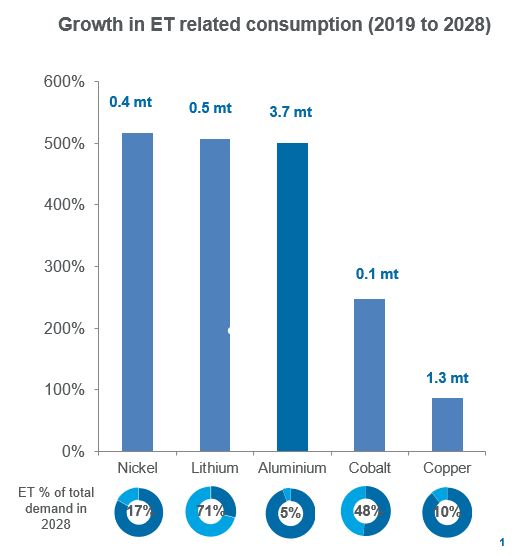

This comes from a presentation that Julian Kettle, our vice-chairman of metals and mining, used at the WoodMac 2019 North America Metals and Mining Forum in New York. It shows the huge increases in demand that are expected for some metals as the world shifts towards greater electrification and stronger curbs on greenhouse gas emissions. The percentages show the projected increases out to 202? in consumption of selected metals for energy transition-related uses: renewables, battery storage, EVs, and the grid. Bear in mind, too, that WoodMac is relatively conservative with its projections on the rise of EVs. Forecasters who expect faster growth in the EV market are by implication projecting even larger increases in demand for these metals.

Coming next

Energy Pulse will be taking next week off for the Thanksgiving holiday. The next big event in the world of energy is the meetings of OPEC ministers and their non-OPEC allies on December 5th and 6th in Vienna. Ann-Louise Hittle, our head of macros oils, will be previewing what we can expect from OPEC policy at the meeting and beyond, so watch out for that next week in The Edge. I will be back with another Energy Pulse on December 6th. See you then.

How to get Energy Pulse

Energy Pulse is Ed Crooks' weekly column, published by Wood Mackenzie every Friday. Here's how to get Energy Pulse:

- Follow us on social media @WoodMackenzie on Twitter or Wood Mackenzie on LinkedIn

- Fill in the form at the top of this page and we'll send you an email when the latest issue goes live

- Bookmark this page to have access to the full archive of Energy Pulse