Beyond ESG: measuring corporate sustainability in an uncertain world

ESG may have lost its lustre, but the issues haven't gone away

3 minute read

Luke Parker

Vice President, Corporate Research

Luke Parker

Vice President, Corporate Research

Luke is Vice President of Corporate Research with a specific focus on the Supermajors.

Latest articles by Luke

-

The Edge

Majors' capital allocation in a stuttering energy transition

-

Opinion

Video | Shell and Equinor announce UK asset merger to create new JV

-

Opinion

Beyond ESG: measuring corporate sustainability in an uncertain world

-

The Edge

Big Oil: upstream M&A gets serious

-

Opinion

Are NOCs prepared for the energy transition?

-

The Edge

How NOCs compare with IOCs on energy transition strategy

Erik Mielke

Senior Vice President, Corporate Research

Erik Mielke

Senior Vice President, Corporate Research

Erik manages our corporate service, leading data-driven analysis and insight into strategies, performance and outlook.

Latest articles by Erik

View Erik Mielke's full profileEnvironmental, social and governance (ESG) investing and the ratings that underpin it have lost their lustre. That may be no bad thing for companies in the energy and natural resources sectors. When it comes to the big strategic questions they face around decarbonisation over the coming decades, ESG offers limited useful insight.

However, the fundamentals of climate change have not shifted, and its threats have not diminished. Now more than ever, companies and their stakeholders need to understand and evaluate how they are positioned to navigate the energy transition – both the risks and opportunities.

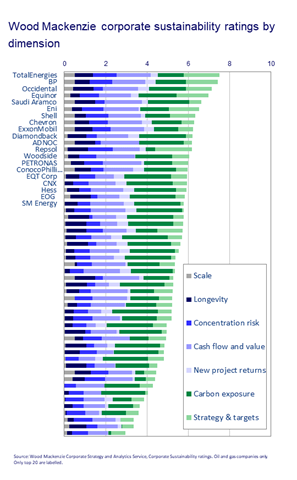

Wood Mackenzie’s Corporate Sustainability Index goes beyond ESG to provide a nuanced assessment of corporate positioning in the face of a changing world. It is more relevant to how companies in energy and mining manage their business and a more useful measure of how they stack up against one another.

We’ll be delving into our Corporate Sustainability Index in detail in a webinar on 26 March, entitled Beyond ESG: Measuring corporate sustainability in an uncertain world. Read on for an outline of why you should sign up and fill in the form to sign up.

ESG’s fundamental problem

The once seemingly inexorable rise of ESG investing has ground to a halt. The term itself – politicised and weaponised in some quarters – is fast disappearing from corporate messaging.

But the issues that ESG purported to address, and the need for companies and stakeholders to act on them, have not gone away. That’s especially true in oil and gas, power and renewables, and metals and mining – sectors in which the ‘E’ part of the equation concerns existential matters.

Now more than ever, companies and stakeholders in those sectors need to answer the question – How are we positioned to navigate decarbonisation and the energy transition – both risks and opportunities – over the coming decades?

A key challenge for ESG, particularly in energy and natural resources, is that ESG ratings do not answer that question. They are, by definition, too narrow in scope to fully assess the potential impacts of a changing world. And yet, even within that narrow scope, too broad, simplistic and confused to offer meaningful insight into company-specific risk.

ESG ratings have their place, of course. But on that fundamental question, they will only ever be a high-level starting point, at best.

What’s needed?

What’s needed to answer that question is a detailed, nuanced approach that presents a comprehensive picture. An approach which includes the salient aspects of ESG – carbon emissions in particular – but goes much deeper. Which ignores the parts of ESG that are less relevant – the ‘S’ part of the equation for example (important for stakeholder management, but not a material factor in transition and decarbonisation strategy). But incorporates the critically important element that ESG misses altogether – fundamental analysis of the businesses that will see companies through transition (or not).

That’s the approach taken by Wood Mackenzie’s Corporate Sustainability Index, which spans the most crucial aspects of corporate sustainability. Our index maps to three pillars: i) ‘transition’ assesses carbon exposure and transition strategy; ii) ‘portfolio’ assesses the quality, longevity, and resilience of underlying businesses; and iii) ‘platform’ assesses financial position.

Our Corporate Sustainability Index takes a very different approach to ESG ratings and presents a very different picture. Its central philosophy is that there are many routes to corporate sustainability; there is no one-size-fits-all approach. It rates all companies against all dimensions of sustainability, irrespective of portfolio and strategy, independent of scenarios. And, unlike ESG indices, the Corporate Sustainability Index is underpinned by measures of value, by proprietary, forward-looking commercial analysis, built from asset-level up.

Wood Mackenzie’s Corporate Sustainability Index brings clarity. It is a framework within which to understand and benchmark companies on a consistent basis across the key dimensions of sustainability. A tool to highlight strengths and weaknesses, to inform strategic planning, and to gauge the impact of corporate actions. A means to measure the progress of companies in strengthening sustainability in the face of an uncertain future.

No other index is comparable. None is as comprehensive in scope, as pointed in its focus on the crucial questions or as grounded in detailed analysis.

To learn more about our Corporate Sustainability Index, sign up for our webinar on 26 March.

Corporate Strategy & Analytics Service

Corporate-level strategic analysis and portfolio benchmarking of Oil & Gas, Power & Renewables and Metals & Mining sectors to underpin board-level decisions.

Explore CSAS