Carbon capture and storage: how far can costs fall?

The current average cost of CCS is higher than today’s carbon pricing levels

2 minute read

Mhairidh Evans

VP, Global Head of CCUS Research

Mhairidh Evans

VP, Global Head of CCUS Research

Mhairidh leads our global research on carbon capture, utilisation and storage (CCUS).

Latest articles by Mhairidh

-

Opinion

Can CCUS help achieve Net Zero?

-

Opinion

Can CCUS momentum overcome headwinds to the industry?

-

Opinion

Carbon management frequently asked questions part 3: CCUS

-

Opinion

The challenges and opportunities in Europe’s oil & gas, CCUS and hydrogen sectors

-

Opinion

Our top five takeaway messages from the CCUS conference 2023

-

Opinion

The UK’s journey to net zero: an uncertain path ahead

The costs of carbon capture and storage (CCS) technology are still stubbornly high. Why is it so expensive? And what will be the catalyst that makes costs fall?

We tackled these questions and more in our first proprietary report on CCS costs, covering the levelised cost of CCS across power, natural gas processing and hydrogen production. Fill in the form for complimentary access to short video presentation exploring the report in more detail – and read on for an introduction.

CCS is costly but necessary to meet net zero commitments

As our recent Horizons article detailed, finding ways to remove CO₂ is essential if we’re to limit global warming to 1.5 °C, in line with the most ambitious goals of the Paris Agreement.

Industry must cut the equivalent of around 1.8 billion tonnes of carbon dioxide (BtCO2e) each year over the next three decades. Reducing fossil fuels in favour of renewables just won’t be enough.

For now, CCS still comes at a significant cost. Our modelling shows the average cost of CCS is higher than today’s carbon pricing levels – and will be for some time to come.

However, the number of CCS projects is increasing, with North America the most active. As the industry scales up and technology improves, we forecast cost reductions of around 20% by 2050.

Fill in the form to access more detail on further potential cost reductions.

Costs will go up before they go down

Current global CCS capacity is around 60 Mtpa and could rise to 400 Mtpa by 2030. We estimate this will need to rise by as much as 10-15 times that number to meet our Accelerated Energy Transition scenarios.

One thing that companies and governments will have to consider as they scale up and increase investment, is that the next phase of CCS projects are likely to cost more.

That’s because what’s already in place, or in the pipeline, is really the low-hanging fruit. For example, natural-gas processing costs less, as CO₂ removal is already built into the process. Addressing emissions in the fossil-power sector and other post-combustion industries is more complex and will be more expensive.

The full report includes the modelled cost of CCS at planned capture projects in power, natural gas processing and hydrogen sectors. Fill in the form at the top of the page to get a more detailed introduction.

Why CCS hubs will make a difference

The solution for many CCS projects could be to collaborate.

Multi-industry hubs take CO₂ from sources including power generation, chemical production and oil refining. They can help the companies involved avoid the expensive upfront development work associated with creating standalone CO₂ transport and storage.

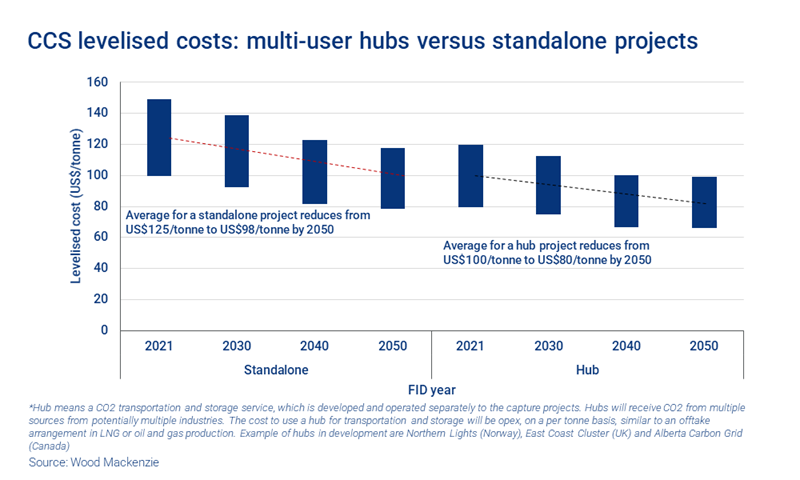

So, should projects join forces or go it alone? Hubs have lower investment and lifetime costs and could ultimately lower CCS breakevens by a further 20-25%, on top of technology cost reductions.

On the other hand, hubs take longer to plan, fund and develop – and need significant public funding. But while not suitable for all CO₂ emitters, for smaller point sources they are critical to making CCS economically viable.

Every CCS project is unique

One of the most complex aspects of CCS is the bespoke nature of projects. No two developments are alike.

We believe the range of costs is much wider than is regularly reported. We’ve modelled the effect of many different scope levers, such as load factor (which has the biggest impact on power) and location (which affects the energy prices and the cost of labour and materials). With these major differences, projects can vary by as much as +/- 100% from a reference cost.

Such a discrepancy makes it difficult for industry players and investors to benchmark and plan their projects with a high degree of accuracy. It’s another barrier to entry in what is already a technically complex area. Any technology or business model that can standardise and modularise would be welcomed by industry.

The full report delves into more detail on:

- The CCS capacity pipeline

- The future of policy support and how that will influence investment

- CCS in Asia’s power markets – its potential as a low carbon, highly flexible dispatchable power resource for the region’s fossil power plants

- Natural gas processing – the biggest CCS growth market in the near term

- The role of hydrogen production.

Fill in the form at the top of this page for complimentary access to a video presentation exploring the report in more depth.