Coronavirus and China’s jittery commodity markets

Slaying the ‘demon’ now Beijing’s top priority

1 minute read

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin oversees our Europe, Middle East and Africa research.

Latest articles by Gavin

-

The Edge

A world first: shipping carbon exports for storage

-

The Edge

WoodMac’s Gas, LNG and the Future of Energy conference: five key themes

-

The Edge

Nigeria’s bold strategy to double oil production

-

The Edge

US tariffs – unpredictability is the strategic planners’ nightmare

-

The Edge

Upside pressure mounts on US gas prices

-

The Edge

The coming geothermal age

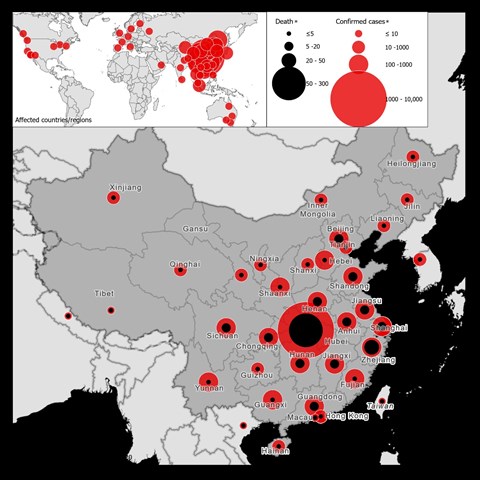

The WHO has announced that the novel coronavirus (2019-nCoV), first detected in Wuhan, is now a ‘Public Health Emergency of International Concern’. As of February 4, there are over 20,000 cases of 2019-nCoV confirmed globally, the vast majority within China.

There are reasons to remain positive, in no small part due to the Chinese government’s highly proactive response. China quickly identified the virus and shared its sequence, allowing other countries to diagnose potential cases and introduce public health measures to prevent its spread.

We are also now seeing unprecedented containment measures. The lunar new year holiday has been extended and many businesses have halted or reduced operations in China. Domestic travel is severely curtailed. Internationally, visa and border entry restrictions on travellers departing or transiting through China are blunt but effective tools.

Just what the global economy didn’t need

Estimating how much economic damage 2019-nCoV will inflict is difficult and will ultimately depend on the duration and severity of the outbreak.

Again, I think we can be cautiously optimistic. Despite a shaky start, the global containment of SARS took about three months. The far more rapid and robust response to 2019-nCoV raises hopes this can be bettered.

If so then we could see a modest impact on China’s economy. But even factoring in relatively quick containment, we expect slower Q1 growth at 5.8% yoy before a notable rebound to 6% in Q2 and then a return to our previous slowing trajectory. In effect, our forecast for China's GDP growth in 2020 is unchanged at 5.8%.

This is bullish, and there are of course far more pessimistic forecasts. The China Academy of Social Sciences, which advises the State Council, has publicly discussed the potential for growth falling below 5% in Q1. This is a worst-case scenario and would be more damaging to the global economy.

Assessing the impact on commodities

At the end of 2019, I raised my concerns that uncertainty over the Chinese economy would lead to increased commodity price volatility in 2020. Unsurprisingly, I’m sticking with this as even a short-lived 2019-nCoV outbreak inevitably impacts energy demand and prices.

Transportation grounded

It’s kind of obvious but as containment is focused principally on restricting air travel and using public passenger transport, jet fuel, and to a lesser degree diesel and gasoline, are hit hardest.

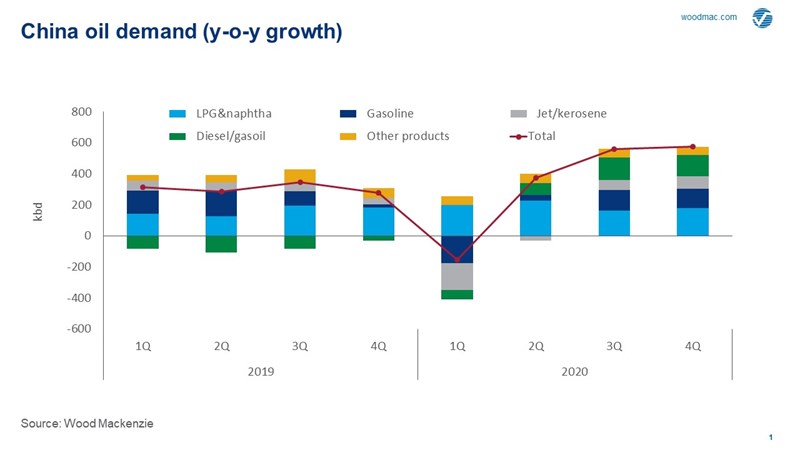

For Q1 2020, our Oils team expects China’s demand to decline by over 450,000 b/d versus 4Q 2019 (a 3.5% drop). February demand really suffers, but if containment starts to work by early Q2 then a strong rebound in demand is likely through early summer, as we saw post-SARS in 2003. Even with this, China’s overall annual oil demand growth for 2020 has been revised downward by over 200,000 b/d from our early January outlook.

There’s a lot of panic in the market right now, reflected in Brent’s double-digit percentage drop through January. But I think things may not be as bad as some suggest. Talk of something like a 20% drop in Chinese oil demand is alarmist and risks skewing oil prices to the downside. Even if Chinese jet fuel demand were to drop to zero – which it won’t – then this still only represents some 7% of the country’s total oil demand.

Read more: The impact of Wuhan coronavirus on oil demand

Industrial output and consumption

As noted, an immediate impact of the 2019-nCoV outbreak has been workers not returning to their jobs. In Hubei province, factories and construction sites are dormant, while much of the rest of the country is only slowly returning to work.

Electricity demand, already weakening through 2019, is on the ropes. Industry accounts for almost 70% of total power demand in China so closed factories will hit demand hard. By the end of January, peak power load in Hubei province dropped to 22.5 GW, some 21% lower than planned.

Weaker power demand and industrial activity inevitably impact both domestic production and consumption of thermal coal. Imports are also expected to slow, with reports of Indonesian producers already being asked to delay loadings. The effect on prices though is likely to be muted; prices fell so much through 2019 that globally many producers are already operating at negative margins.

Even prior to the outbreak, the pace of China’s gas demand growth was tumbling. Much of this was due to the slowing economy. Given that 60% of Chinese gas demand comes from power and industry, 2019-nCoV is impacting the gas market at a time of underlying weakness.

Media reports suggest China’s LNG buyers could declare force majeure on contracted cargoes. This is possible as contracts often include epidemics as a trigger and the government has reportedly offered companies FM certificates. LNG demand has fallen off a cliff since January (an LNG trader just told me Chinese demand has ‘disappeared’) and buyers will be looking at all options. Force majeure could provide relief for Chinese buyers but should always be considered an option of last resort.

The importance of staying positive

Analysts are scrambling to understand the impact of 2019-nCoV, with all sorts of outcomes being considered. The next few weeks will be crucial in determining whether the outbreak can be controlled. But containment is achievable and with continued efforts, should limit the worst of the impact. Let’s stay positive.

Best wishes to all those affected and to those working to contain and prevent the spread of the virus.

More on our analysis of the Wuhan virus:

APAC Energy Buzz is a blog by Wood Mackenzie Asia Pacific Vice Chair, Gavin Thompson. In his blog, Gavin shares the sights and sounds of what’s trending in the region and what’s weighing on business leaders’ minds.