Deepwater decommissioning: three key things to know

Faced with a significant decommissioning bill over the next ten years, operators are likely to seek alternatives

2 minute read

Luiz Hayum

Upstream Research Principal Analyst, Latin America

Luiz Hayum

Upstream Research Principal Analyst, Latin America

Luiz's expertise lies in valuing upstream assets in Latin America.

Latest articles by Luiz

-

The Edge

Delaying deepwater decommissioning

-

Opinion

Deepwater decommissioning: three key things to know

-

Opinion

Latin America upstream: opportunities and challenges

-

Opinion

Can Brazil’s mature pre-salt oil fields continue stellar performances?

-

Opinion

Deepwater's Latin America comeback

Amanda Bandeira

Research Analyst, Latin America Upstream

Amanda Bandeira

Research Analyst, Latin America Upstream

Amanda is an expert in valuing individual upstream onshore and offshore assets in the Latin America region.

Latest articles by Amanda

-

The Edge

Delaying deepwater decommissioning

-

Opinion

Deepwater decommissioning: three key things to know

-

Opinion

Petrobras kicks off Marlim revitalisation project in Brazil

Deepwater production took off in the late 1990s. With platforms designed for an average service life of around 25-30 years, large pioneering fields are therefore reaching a decision point for either investing in service life extension or planning decommissioning.

Our report Unwanted spend: how big is the deepwater decommissioning bill? assesses the potential cost of decommissioning these mature fields – and considers the measures operators may take to avoid it. Fill in the form to download an extract from the full report or read on for a quick overview.

Deep impact in the Golden Triangle

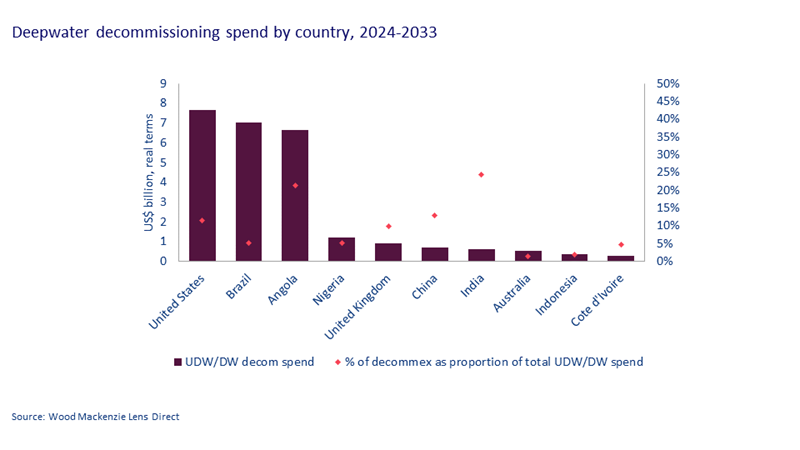

Mature deepwater provinces have the highest decommissioning liabilities over the next ten years. The so-called Deepwater Golden Triangle of Brazil, the US Gulf of Mexico and Angola will account for 60% of global deepwater production in 2024 but will bear 80% of the US$27 billion forecast to be spent on deepwater decommissioning over the next decade (see chart below). Angola faces a particularly hefty decommissioning bill as a proportion of total deepwater spend.

Breathing new life into old fields

In theory, the average number of wells ceasing production will jump from 150 per year in the 2020s to 220 per year in the 2030s. However, operators will do all they can to focus capital allocation on development spend and minimise their decommissioning liabilities. With regulators’ consent, operators will seek to postpone plug and abandonment operations. More productively, they will seek to generate ongoing value from mature fields where possible, through tiebacks, infrastructure sharing and facility upgrades.

Demand for redeployed floating production, storage and offloading facilities (FPSOs) is on the rise, with several shipyards and contractors specialising in FPSO refurbishment and service life extension. This offers an opportunity to install newer topside technology such as more efficient power generation systems to mitigate emissions, a critical concern in mature assets.

We estimate that 80% of deepwater fields either already in production or approved for development have undeveloped prospects within 30 kilometres. This creates strong opportunities for tiebacks to existing infrastructure to extend the productive life of existing infrastructure. On average, a 50-million-barrel oil tieback would yield a 22% internal rate of return in the fiscal regimes for the top ten deepwater countries by decommissioning liability.

New decommissioning capabilities will be needed

Platforms have high operating costs even after production ceases, which should incentivise faster end-of-life decommissioning. However, deepwater decommissioning have different challenges than the existing process for shallow water facilities. This will create a need for new, specialised equipment to access deep wells, lift subsea equipment and safely dismantle floating platforms weighing many thousands of tonnes.

At the same time, with up to five production platforms set to be removed each year, the potential level of well plug and abandonment work threatens to put severe pressure on an already tight deepwater rig market. Fortunately, intervention vessels are proving to be a feasible alternative to rigs for this purpose.