Green steel: challenging the status quo

What are the big themes and challenges to look for as the iron and steel value chain decarbonises?

4 minute read

Isha Chaudhary

Global Head of Steel, Raw Materials and Alloys Markets

Isha Chaudhary

Global Head of Steel, Raw Materials and Alloys Markets

With 15 years of experience in metals and mining, Isha drives research and analytics for the ferrous space.

Latest articles by Isha

View Isha Chaudhary's full profileCharvi Trivedi

Senior Research Analyst, Steel and Raw Materials

Charvi Trivedi

Senior Research Analyst, Steel and Raw Materials

Charvi is responsible for analysing and tracking the steel industry performance and demand-supply forecasting.

Latest articles by Charvi

-

Opinion

Grey area: can steel really go green?

-

Opinion

How do Western sanctions on Russia impact the global metals, mining and coal markets?

-

Opinion

Green steel: challenging the status quo

-

Opinion

Steel: 5 things to look for in 2024

Priyanka Agrawal

Principal Analyst, Steel and Raw Materials Market

Priyanka Agrawal

Principal Analyst, Steel and Raw Materials Market

Priyanka has over a decade of experience in Steel and end-use sectors such as Infrastructure.

Latest articles by Priyanka

View Priyanka Agrawal's full profileLeading steelmakers in Europe first came together in 2016 to develop fossil-free iron and steelmaking technology. Fast-forward to April 2024, and the world has seen 200+ low-carbon steel projects announced across various shades of ‘green’ in the past few years.

As the decarbonisation saga for the steel sector evolves, we have seen corporates take some baby steps towards turning climate targets into climate actions as ESG pressures mount.

In a recent Wood Mackenzie report, we explore the steel industry's future across three climate scenarios – a base case view, a pledges scenario and a net zero scenario over the next three decades.

Drawing on proprietary data, insights from research analysts, and deep industry links, we look to better understand the steel sector and reveal its future.

Fill out the form at the top of the page to download an extract from the report, or read on for an introduction to the challenges and opportunities across the industry:

Decarbonisation to start with optimisation; change gears in 2030

Accounting for around 8% of global carbon emissions, iron and steel production sits squarely on the list of hard-to-abate sectors.

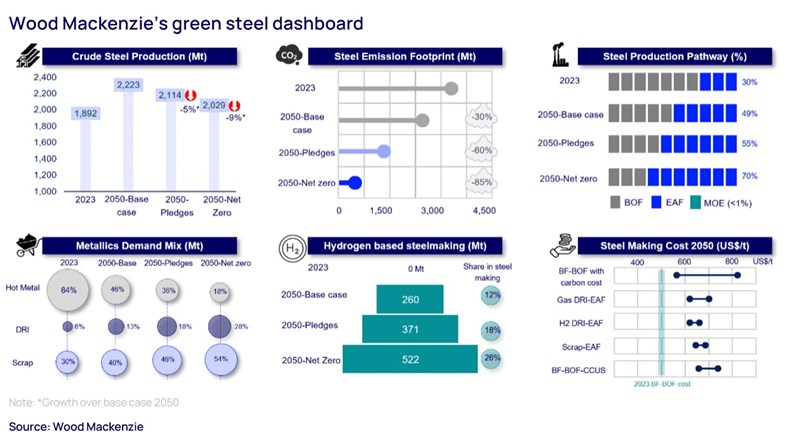

Our climate scenario analysis sees emissions from the steel sector declining 30% in the base case, 60% in pledges and 85% in net zero. Process and energy optimisation will help shave off 450 to 500 Mt (15%) carbon by 2050 across all scenarios.

However, the greater impact will come from the shift to greener metallics, DRI and scrap where the differential between scenarios is massive. For instance, it contributes to trimming 600 to 650 Mt of carbon in the base case and 2,200 to 2,500 Mt in net zero scenario.

Blast furnaces approaching mid-life crisis; opportunity at hand

EAF continues to be seen as a possible green pivot, especially as 60% of global blast furnace capacity would need to be overhauled by 2030 to sustain it till the 2040s.

At this juncture, discouraging overhauls and encouraging replacement with EAFs would be crucial to meeting net zero goals. Mid-life overhauling of the blast furnace will cost about one-third to half compared to the capital cost for setting up an EAF plant.

But smaller EAF units, typically less than 1 Mt, and the evolving metallics market would need to be figured out before making the leap.

Well-lived scrap and DRI hubs emerging as key protagonists

As the steel industry reduces its carbon emissions, direct reduced iron’s (DRI) share in metallics will double to 13% by 2050 in the base case and accelerate to 28% in net zero scenario. Supply shortage for high-grade iron ore for DRI is seen as less of an impediment, as a possible solution emerges in the form of electric smelting furnace (ESF) technology, where we have seen 10+ projects being announced in the past two years.

ESF might be new to steel, but similar technologies have been around in the base metals manufacturing process. Our decarbonisation tracker houses 90-100 Mt of DRI projects sequentially blending hydrogen at different rates. Nearly one-third of these projects are in pilot testing or ‘under-construction’ phase, and some have even signed offtake agreements with auto and appliance firms.

This gives us enough confidence to imagine that hydrogen steel will slowly become a reality as 12% of steel production by 2050, in our base case, will use hydrogen, with the share doubling to 26% in net zero.

The well-lived scrap has a unique story of its own. It will gradually increase its share from the current 30% to 40% by 2050 in the base case and 54% in net zero, but again, it’s a story that will unfold only after 2035.

A quick fact check tells us that 45% of China and India’s automotive steel demand (prime scrap) is less than five years old. Meanwhile, 55-60% of construction steel demand (obsolete scrap) in China and India is less than 10 years old.

The green drawdown will come at a cost

Cost parity for green steel with the conventional production route will translate into a premium of US$150/tonne of steel. The answer to “Who will foot the bill?” is still evolving, but at this point, the premium is expected to have a relatively limited impact of 1-3% on major end-use price tags.

Two worlds can emerge where on one side consolidated steel markets like Japan, South Korea and the US (with an average HHI* index of 2,400) will find it easier to pass on the prices, while China and India (HHI index of 100-750) will face a herculean task to charge premium. EU will find itself in the middle ground and will certainly need policy support.

*Herfindahl-Hirschman Index (HHI) is a common measure to determine market concentration and competitiveness. The lower the number, the higher the market fragmentation, and vice versa.

Corporate actions spread across hues of green initiatives

Of the 200 projects in our decarbonisation tracker, only 25-30% have near-zero carbon potential, and the rest have lighter shades of green.

The relatively weak financial profile of steel mills in China, JKT and the EU will need policy support to bring about solid actions. Only 1-2 key regions/countries have official net zero targets for the steel sector and only the EU and US have approved funds for decarb projects in steel.

Learn more

To view some of the charts and infographics from our recent report, and to learn more about the challenges and opportunities surrounding green steel, fill out the form at the top of the page.