Grey area: can steel really go green?

A range of technologies are aimed at decarbonising the sector – we assess their real-world potential

3 minute read

Sushmita Vazirani

Principal Analyst, Bulk Commodities

Sushmita Vazirani

Principal Analyst, Bulk Commodities

Sushmita covers cost assessment of steel and iron ore assets, with special focus on DRI costs and breakeven analysis.

Latest articles by Sushmita

View Sushmita Vazirani's full profileMiller Wang

Principal Consultant Steel Decarbonisation

Miller Wang

Principal Consultant Steel Decarbonisation

Miller leads on WMC analysis on steel decarbonisation, focusing on the benchmark of emerging green steelmaking.

Latest articles by Miller

View Miller Wang's full profileCharvi Trivedi

Senior Research Analyst, Steel and Raw Materials

Charvi Trivedi

Senior Research Analyst, Steel and Raw Materials

Charvi is responsible for analysing and tracking the steel industry performance and demand-supply forecasting.

Latest articles by Charvi

-

Opinion

Grey area: can steel really go green?

-

Opinion

How do Western sanctions on Russia impact the global metals, mining and coal markets?

-

Opinion

Green steel: challenging the status quo

-

Opinion

Steel: 5 things to look for in 2024

Priyanka Agrawal

Principal Analyst, Steel and Raw Materials Market

Priyanka Agrawal

Principal Analyst, Steel and Raw Materials Market

Priyanka has over a decade of experience in Steel and end-use sectors such as Infrastructure.

Latest articles by Priyanka

View Priyanka Agrawal's full profileDaniel Carvalho

Director, Metals & Mining Consulting

Daniel Carvalho

Director, Metals & Mining Consulting

Daniel brings over 18 years of experience as a global operations, process and technology leader.

Latest articles by Daniel

-

Featured

Metals & mining 2025 outlook

-

Opinion

Four key takeaways from LME 2024

-

Opinion

Grey area: can steel really go green?

-

Opinion

How do Western sanctions on Russia impact the global metals, mining and coal markets?

-

Opinion

What’s next for green steel technologies?

-

Featured

Metals and mining 2024 outlook

As a major contributor to overall global emissions, steelmaking must significantly lower its carbon footprint to make the transition to a net-zero world possible. But can such a hard-to-abate sector really go green – and if so, how?

Our experts recently presented their assessments of the potential of the key decarbonisation options being pursued by the steel industry globally. Fill out the form at the top of the page to download the presentation slides, or read on for a brief review of the key technologies.

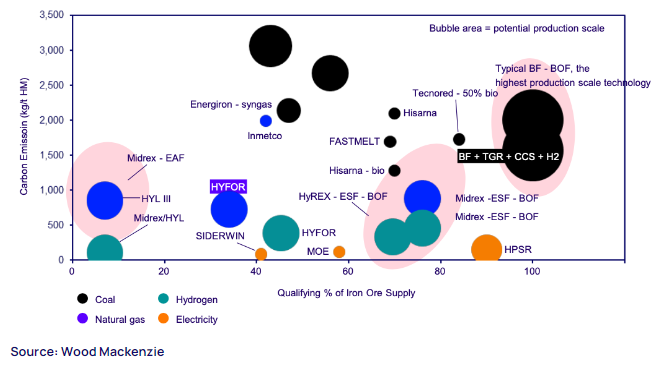

A range of alternative steelmaking approaches could help reduce emissions, primarily by using alternative feedstocks to traditional coal. The chart below maps out these options in terms of their potential production scale, relative levels of carbon emissions and the percentage of overall iron ore supply they are able to use.

Various technologies could reduce steelmaking emissions, mainly through alternative feedstocks

Blast furnace optimisation

The route with the greatest potential is the transformation and optimisation of the well-established blast furnace process which creates the iron from which steel is made. Blast furnaces are efficient, reliable, large in scale and can work with a wide variety of iron ores. This makes the combination of blast furnaces with basic oxygen furnaces (BOF) for steelmaking by far the most popular existing technology, accounting for around 70% of steel worldwide.

Blast furnaces traditionally use coal, which is highly polluting. Initial improvements will rely on replacing part of the coal with natural gas to reduce emissions, as it is relatively cheap and abundant. However, gas still creates carbon emissions, and our modelling shows that by 2050, carbon prices could meaningfully impact producers using natural gas in both the European Union and the US. The use of hydrogen will gradually increase as it becomes more widely available, and most facilities will be adapted ready to operate with both gases. Blast furnace emissions could also be reduced through the use of carbon capture, utilisation and storage (CCUS).

Electric arc furnace (EAF)

Current green steelmaking technologies are based on the electric arc furnace (EAF), which is usually fed by iron created by the direct reduction process. Combining direct reduced iron (DRI) with EAF offers the lowest emissions of any current OBM steelmaking technology. In the European Union, it could also have the lowest cost position after 2027, thanks to carbon pricing due to be introduced in 2025.

Unfortunately, EAF has some major limitations. Most significantly, it requires either high-grade iron ore, which currently makes up only 8% of global iron ore supply, or scrap.

Electric smelter furnace (ESF)

The Electric Smelter Furnace (ESF) is emerging as a potential compromise to bridge the green technology gap. ESFs convert direct reduced iron into liquid hot metal that can then be used in the well-established BOF process. That makes ESFs compatible with 76% of global iron ore supply.

The combination of ESF with BOF provides some of the quality parameters of BF-BOF with much lower emissions intensity. Meanwhile, although it is less efficient in terms of emissions than the combination of direct reduced iron with EAF (DRI-EAF), it can be used with low and medium-grade iron ores.

Employing ESF technology allows producers to gradually replace their blast furnaces while commissioning facilities for new hydrogen ironmaking. It also means they can continue to use existing BOF steelmaking shops, reducing capex, operational complexity, and project execution time. As a result, an increasing number of traditional producers are investing in ESF projects. These include Thyssenkrupp, Voestalpine, ArcelorMittal and Tata Steel in Europe, Posco, Ansteel, BlueScope and Rio Tinto in APAC, and Emirates Steel and others in the MENA region.

The bottom line: cost is king

ESF technology offers steelmakers a much less emissions intensive process than traditional BF-BOF while providing much greater flexibility than DRI-EAF. Ultimately, however, cost competitiveness will decide whether ESF and other alternative technologies can drive significant greening of steelmaking globally. This largely depends on how carbon pricing structures evolve, as without rigorous carbon pricing, BF-BOF is likely to remain the lowest-cost route for steel production across most regions.

Learn more

Remember to fill in the form at the top of the page to access your complimentary copy of the full presentation, which explores this topic in detail and includes a range of charts and data.