Horizons: From boom to Biden – a roundup of our insights from Q3 2021

A recap from the last three editions of Horizons, from the commodity price supercycle through to Joe Biden’s plan for net zero by 2050.

1 minute read

Horizons is a series of monthly thought-leadership articles designed to impart the insights of Wood Mackenzie research analysts around the world and inform discussion on key issues in the energy and commodity markets. In Q3, we ran the gamut, exploring the commodity price supercycle, the implications of carbon emission regulation for the oil and gas sector, and US President Joe Biden’s plan to achieve net zero emissions by 2050.

And we’ve collated a few highlights for you here.

July – Champagne supercycle: taking the fizz out of the commodities price boom

Another supercycle is coming. Anticipation of future demand growth has generated palpable excitement, driving commodity prices to post-pandemic highs.

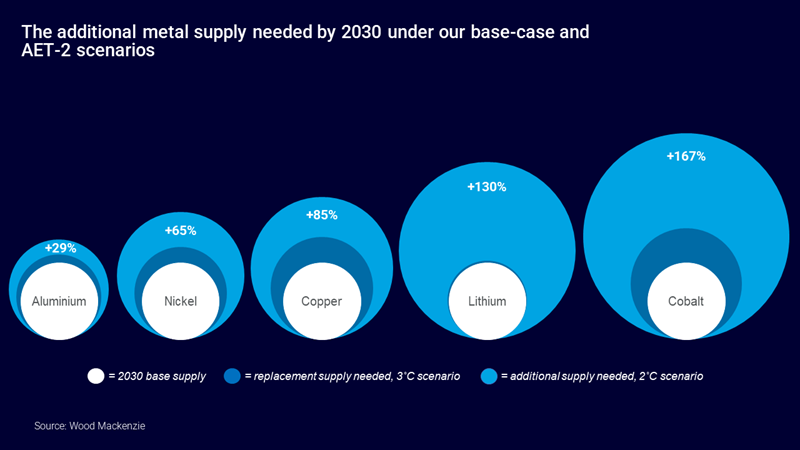

This time, however, it’s different. While previous cycles lavished windfalls on the entire natural resource sector, the forces shaping this nascent boom are unlike any other. For the first time, hydrocarbons will be bystanders, while those metals critical to the energy transition will take centre stage with a sustained period of extraordinary demand growth.

Three potential developments could challenge how this supercycle unfolds, however:

- The rise of ‘consumption consciousness’, undermining the long-term use of primary metal

- Systemic supply uncertainty, forcing commodities into obsolescence

- The narrowing control of metals’ supply chains, excluding many from the party.

Crucially, unlike previous cycles, this supercharged growth has been flagged well in advance. With such forewarning, the mining sector now has the opportunity to act pre-emptively to achieve a more sustainable long-run market dynamic. Not acting will leave the industry at risk of perpetuating the boom-bust cycles that have plagued the sector since time immemorial.

To learn more, click here to read Champagne supercycle: Taking the fizz out of the commodities price boom in full.

August – Commit and collaborate: squaring the carbon circle for oil and gas

The oil and gas sector is on notice. Stakeholders are demanding greater accountability for carbon emissions along the value chain. Net zero Scope 1 and 2 emissions by 2050 are now the industry standard. Scope 3 emission reductions are coming – with significant implications for corporate strategies and capital allocation.

The pressure is rising from stakeholders in large part because there is growing pressure on them to decarbonise their own portfolios. This is nothing new, but the momentum is inexorable, driven by the underlying facts of climate change. The sobering August Intergovernmental Panel on Climate Change report only adds to the sense of urgency.

Carbon-related investment standards will mature and converge – perhaps soon. The pool of investors that will agnostically invest in the oil and gas sector, indifferent to the energy transition, will continue to shrink. And ahead of COP26, governments are setting increasingly ambitious national emission reduction targets. Stricter, mandatory corporate climate reporting will follow.

It’s incredibly rare for an industry to get decades-long notice that its business is under threat – not least when a wall of cash is coming its way. Now is the time to reinvest cash flows from higher oil prices into building a sustainable business for future decades.

To read more, see CO₂mmit and CO₂llaborate: Squaring the carbon circle for oil and gas.

September – One giant leap: President Biden’s vision for repowering America

In 1962, President John F. Kennedy informed the American public that the United States would embark on a programme to put the first man on the moon, “not because it is easy, but because it is hard”. The space race spawned a technological revolution that shaped the world as we know it.

Almost 60 years on, US President Joe Biden has set an equally challenging, transformative goal of achieving net zero emissions in the US power sector by 2035 and the broader economy by 2050. The move comes on the heels of Europe’s highly ambitious net zero emission targets and ahead of COP26 in Glasgow, Scotland, in November. The targets are undoubtedly bold. Question is, can the US meet its new moonshot mandate?

After examining the proposals in detail, we believe the Biden administration will struggle to achieve its ambitious goals. Technological limitations, policy design, market structures and even the political and constitutional foundations of the United States create roadblocks that will impede the pace of progress. Even so, efforts to meet them will bring about major change in the US market that will help lower global carbon emissions.

To find out more, read One giant leap: President Biden’s vision for repowering America.

Horizons is a regular feature of The Inside Track, a weekly round-up of all the latest news and views from Wood Mackenzie's global experts. Fill in the form at the top of the page to sign up and make sure you don’t miss out on the next edition.