How are diversified miners tackling scope 3 emissions?

Assessing corporate approaches to setting targets and addressing indirect emissions in the value chain

4 minute read

Islay McIsaac

Research Associate, Corporate Research

Islay McIsaac

Research Associate, Corporate Research

Islay has a specialism in the delivery of comprehensive analysis of companies' resilience and sustainability.

Latest articles by Islay

-

Opinion

The end of capital discipline in mining?

-

Opinion

PPAs: transforming miners’ decarbonisation strategies

-

Opinion

How are diversified miners tackling scope 3 emissions?

James Whiteside

Head of Corporate, Metals & Mining

James Whiteside

Head of Corporate, Metals & Mining

With 15 years of experience in the metals and mining industry, James leads our corperate coverage.

Latest articles by James

-

Opinion

The end of capital discipline in mining?

-

The Edge

Big Mining pivots to copper for growth

-

Featured

Metals & mining 2025 outlook

-

Opinion

Battery power play: countercyclical opportunities in raw materials

-

Opinion

Copper rush: A strategic analysis

-

Opinion

PPAs: transforming miners’ decarbonisation strategies

The first scope 3 indirect emissions target among diversified mining companies was set by Vale just six years ago, in the form of a modest 15% reduction by 2035. But with both stakeholder pressure and transition risk mounting, miners’ Scope 3 reduction strategies are starting to mature.

We have just published a report that uses our new Corporate Strategy & Analytics Service to benchmark diversified miners’ approaches to setting and meeting scope 3 emissions reduction targets. Fill out the form at the top of the page to download an extract from the report – or read on for some of the key takeaways.

Scope 3 emissions are a key issue for the mining sector

For mining companies aiming to reduce the risk to their business as the energy transition progresses, scope 3 emissions are a crucial factor (scope 3 emissions are all indirect emissions caused throughout the value chain other than purchased and consumed electricity, heat and steam). The report looks at the strategy of eight major mining companies with scope 3 emissions summing to 4% of global emissions. The burning of mined coal as a fuel and the production of steel from iron ore (which is processed using significant quantities of fossil fuels) are both areas where demand will be transformed by the transition to net-zero emissions.

Miners are working together to align their approaches

Mining firms are seeking to align their scope 3 approaches through industry associations such as the International Council on Mining and Metals (ICMM). Six of the eight diversified miners are members of the ICMM’s Climate Change Working Group, which developed the organisation’s scope 3 guidance and target recommendations. Under the guidance, companies are required to disclose scope 3 emissions annually to help identify ‘hot spots’ in the supply chain, with a ‘Diagnosis Pathway’ provided to find and prioritise routes to mitigation.

Mining companies’ Scope 3 targets vary significantly

While mining firms are collaborating on scope 3 emissions, so far, the focus is on agreeing common processes rather than imposing prescriptive timelines or levels for emissions reductions. Sector sustainability standards only moved to require scope 3 reporting in 2023, and there is still no requirement to set emissions reduction targets; these vary considerably among companies and seem unlikely to converge any time soon. There is some justification for the lack of alignment, as involvement with different end-use sectors carries widely varying implications for scope 3 emissions. Overall, while most firms have committed to net-zero operational (scope 1 and 2) emissions by 2050, only half have set scope 3 net-zero targets.

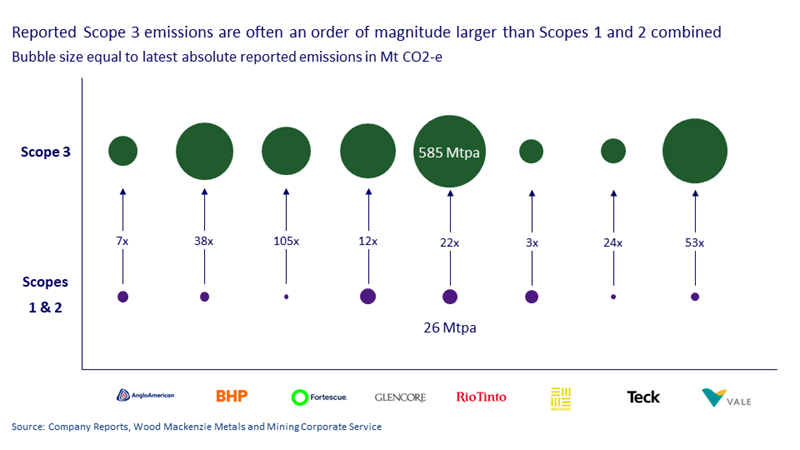

The scale of scope 3 isn’t constraining target setting for mining firms

Even for the firms with the lowest ratio of scope 3 to operational emissions, scope 3 emissions are often still an order of magnitude larger than scope 1 and 2 emissions combined. For Fortescue, which has lower than average site emissions but is heavily involved in iron ore production for emissions intensive steelmaking, the ratio is over 100x.

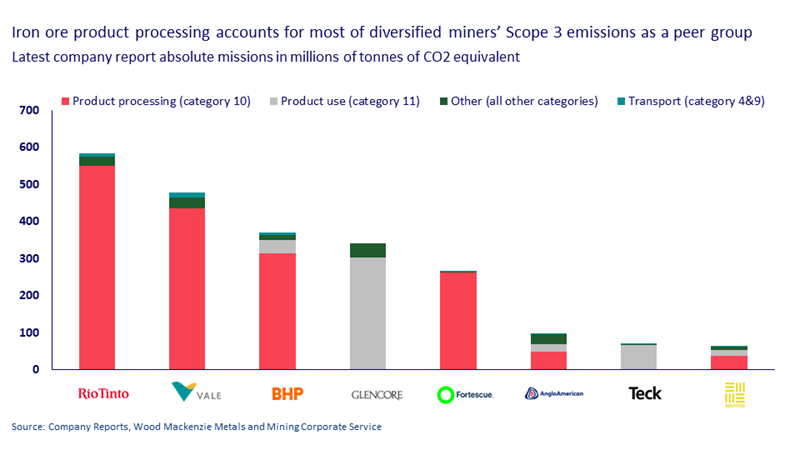

Mining companies have strong ambitions where scope 3 is concentrated

Product processing, particularly of iron ore, is responsible for the majority of scope 3 emissions in diversified mining, as well as for the lion’s share of most miners’ individual emissions (see chart below). The exceptions are Glencore and Teck, whose scope 3 emissions are heavily concentrated towards product use from their coal-weighted portfolios.

Despite the size of the challenge for particular companies, some miners with the highest scope 3 emissions are also those with the most ambitious reductions targets. These tend to have their scope 3 impact concentrated in a single industry such as power generation or steelmaking.

Miners’ strategic positioning focuses on key risks

Companies are developing ambitious targets to deal with key risks rather than meet arbitrary targets. For example, both Vale and Rio Tinto have committed to a broad set of decarbonisation strategies despite not having net-zero targets. In contrast, Glencore has deprioritised scope 3 mitigation as it plans to address scope 3 risk by spinning off or closing coal assets.

Portfolio pivots have so far had the greatest impact on scope 3 emissions

Diversified miners are broadly adopting four key strategies to tackle scope 3 emissions: technology development; supply chain optimisation; in-house offsets; and transition focused pivots. Of these, pivoting away from fossil fuels has so far been the primary and most successful lever for most firms. For example, Anglo American has cut its emissions by 26 million tonnes of CO2 equivalent from 2018 levels thanks to its gradual exit from coal. Meanwhile, for the iron ore majors, the focus is on developing green steelmaking processes to address the otherwise existential threat scope 3 emissions place on their core business.

Don’t forget to fill out the form to download your complimentary extract from the report, which includes a range of charts and data covering the approaches of individual firms in more detail. You can also learn more about how our Corporate Strategy & Analytics Service can help your business on our website.