PPAs: transforming miners’ decarbonisation strategies

Securing power purchase agreements (PPAs) has become the latest trend among mining companies looking to hit emission reduction targets

3 minute read

James Whiteside

Head of Corporate, Metals & Mining

James Whiteside

Head of Corporate, Metals & Mining

With 15 years of experience in the metals and mining industry, James leads our corperate coverage.

Latest articles by James

-

Opinion

The end of capital discipline in mining?

-

The Edge

Big Mining pivots to copper for growth

-

Featured

Metals & mining 2025 outlook

-

Opinion

Battery power play: countercyclical opportunities in raw materials

-

Opinion

Copper rush: A strategic analysis

-

Opinion

PPAs: transforming miners’ decarbonisation strategies

Islay McIsaac

Research Associate, Corporate Research

Islay McIsaac

Research Associate, Corporate Research

Islay has a specialism in the delivery of comprehensive analysis of companies' resilience and sustainability.

Latest articles by Islay

-

Opinion

The end of capital discipline in mining?

-

Opinion

PPAs: transforming miners’ decarbonisation strategies

-

Opinion

How are diversified miners tackling scope 3 emissions?

Companies have been switching to renewables to reduce scope 2 emissions. However, some countries’ electricity grids do not have the requisite renewable mix, so the most effective way of meeting this rapid increase in demand for renewable power is through corporate PPAs.

Wood Mackenzie recently issued a report entitled PPAs and their transformative role in miners’ decarbonisation strategies. It is based on data from our Metals and Mining Corporate Strategy & Analytics Service (CSAS) and our Global Renewable Energy Offtake Tracker, both of which are updated on a rolling basis, including projects that are both operational and under development. The metals and mining CSAS database tracks two coverage peer groups – diversified miners and pure play copper miners.

Miners have been reducing market-based emissions by purchasing renewable energy that has a lower associated carbon intensity. From the start of 2020 to the end of 2024, the number of corporate PPA deals announced each year in the sector doubled from 7 to 14.

Fill in the form for a complimentary extract from the report and read on for a brief outline.

Diversified miners lead the PPA drive

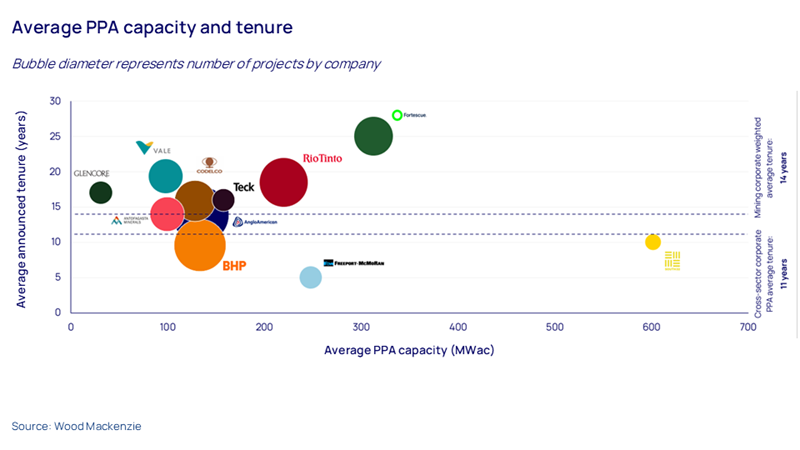

The diversified miners have led the surge in PPAs. Fortescue, Rio Tinto, Anglo American and BHP have been the most consistent in signing new deals over the last five years. During the energy crisis, the escalating cost of power deterred some firms from entering into long-term agreements. Since the energy crisis, however, the volatility of power prices has prompted some companies to sign long-term PPA contracts that will reduce price risk and hedge costs.

The tenure of corporate mining PPAs is also becoming longer as lenders become educated about their risks and benefits, now averaging 14 years. This is around three years longer than other industries to accommodate the mining industry’s longer business cycle.

Fortescue leads the pack with the longest average tenure, at 25 years. Copper companies, in contrast, favour short-term deals, averaging between five and ten years. Typically, short-term PPAs have lower credit requirements, but a higher PPA price. Long-term tenures provide stability for both the offtaker and the supplier. For companies with decarbonisation targets to meet, a long-term PPA provides assurance and maintains transparency for investors.

PPAs have become more standardised as investors have become more educated on the risk profile of PPAs, in turn reducing costs. This has created the opportunity for players to opt for rolling PPAs. However, some companies are holding out before signing long-term PPAs as they expect power prices and equipment prices to continue to fall in the near term.

Renewable procurement capacity is increasing

Average capacity is also growing, as both renewable developers and miners better understand pricing risks. Long-term PPAs provide companies with stability and the assurance of reaching their emission reduction targets. Antofagasta and Vale are good examples of companies that have almost zeroed their market-based scope 2 emissions through renewable procurement for their assets.

Solar PPAs have been a favourite among miners because they have short lead times and lower infrastructure costs than hydro or wind projects. Jurisdictions such as Chile have ample renewable sources, providing better opportunity for offtakers to negotiate reliable PPA deals. Integrating and relying on renewable power options remains difficult for countries such as South Africa, where storage solutions are not sufficient – an extra hurdle for Anglo American and South32 when reducing emissions.

Beyond 2024, we expect a continued ramp-up in PPA uptake and larger capacity. Some 4,300 MW is signed for operation in 2026 compared with 1,000 MW in 2024. Codelco, BHP, and Rio Tinto have significant contracted capacity expected to come online in 2026.

Get further insight

Download your complimentary copy of an extract on ‘PPAs and their transformative role in miners’ decarbonisation strategies’ by filling out the form. This extract includes data from our Metals and Mining Corporate PPA Database and the Global Renewable Energy Offtake Tracker.