Lower 48: How low can costs go?

One of the few remaining levers tight oil players can pull as they fight to survive

1 minute read

With analysis from Ryan Duman, Scott Forbes, Nathan Nemeth and Andrew Thorburn

Tight oil is in turmoil.

The sector was already under pressure before the coronavirus crisis knocked the bottom out of oil demand. Ever nimble, operators moved quickly, revising down CAPEX and production guidance. But the WTI crude futures benchmark plunging below zero for the first time in history this April is a sign of just how much pressure US producers are under.

Now, more than ever, players in the Lower 48 need to focus on what they can control. And managing unit costs is one of the few remaining survival levers available. But just how low can costs go? Pricing for key components had already fallen by double-digit percentages last year.

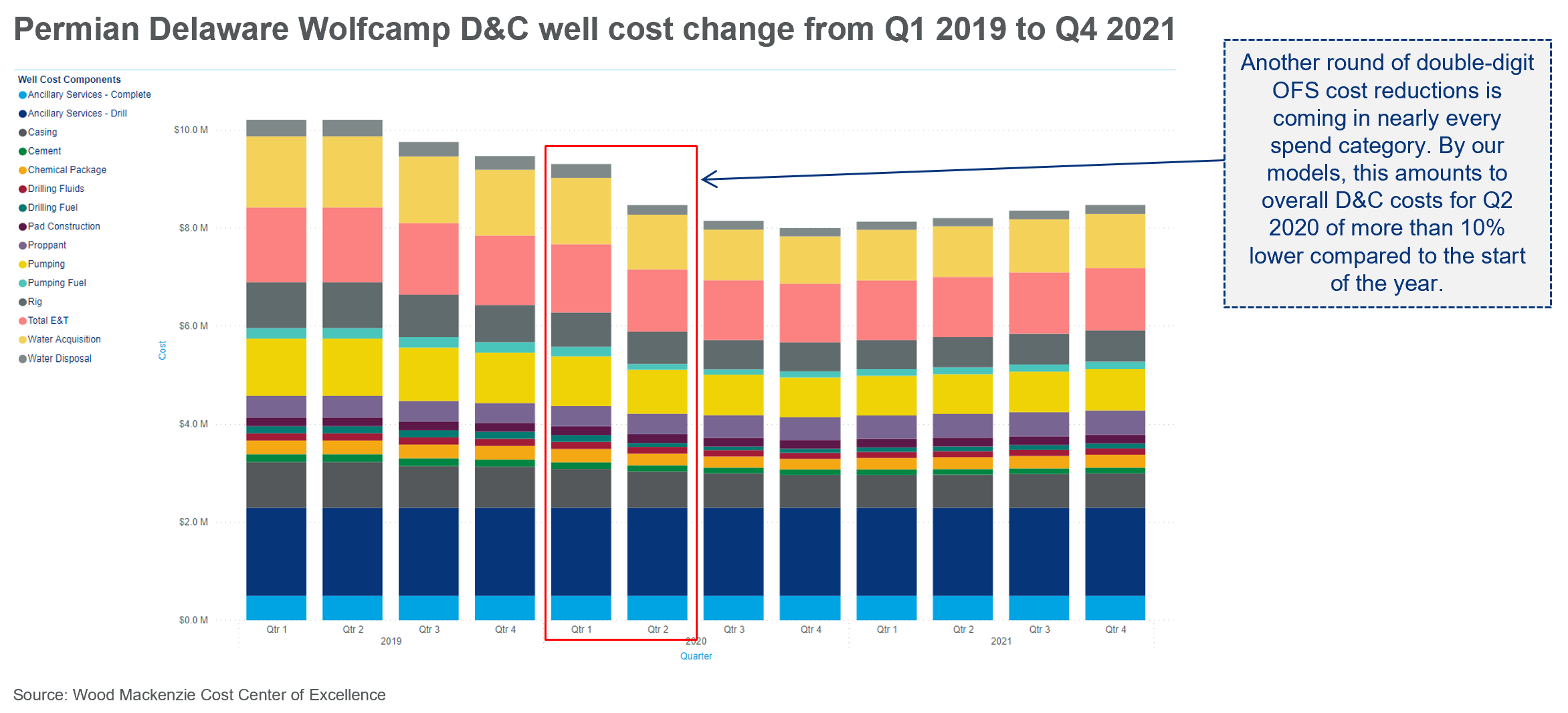

Deflationary pressure will continue for as long as the Oilfield Service (OFS) sector remains oversupplied. With the price collapse in March, E&Ps slashed 2020 spending, and demand for services cratered. Costs are once again falling for all major components.

Fill out the form on this page to tune into the webinar and hear our Lower 48 team discuss how tight oil operators can position themselves to survive the downturn. Or scroll down to catch up with the highlights.

Investors’ call for tight oil players to exercise capital discipline took center stage in 2019.

Ryan Duman

Director, Americas Upstream

Ryan specialises in supply forecasting, basin characterisation, upstream decarbonisation and economic modeling.

Latest articles by Ryan

-

Opinion

Gas prices enter a bearish spring amid crude market volatility

-

The Edge

Three factors driving US liquids production to new heights

-

Opinion

A new tight oil powerhouse: Permian Resources and Earthstone create a new large-cap US E&P

Can costs drop much lower?

Last year, Lower 48 operators doubled down on capital discipline. The rig count fell by roughly 25%. And pricing for key components dropped to some of the lowest levels ever. Rig day rates, pressure pumping and casings saw the biggest reductions.

Why?

Producers were aggressively adjusting their business models to prove they could generate cash flow. That meant fewer wells, so cost categories most directly related to new pads fell hard and fast. Now, there is even more pressure on spending. Rig counts have fallen faster than any period in 2019. Meanwhile, E&Ps are pressuring OFS providers for even more cost concessions. And with far too many OFS companies vying for a small amount of remaining work, E&Ps have all the leverage. There needs to be structural change in OFS as the current perspective is unsustainable for most service companies.

Every dollar that an oil company spends is under more scrutiny than ever before.

Scott Forbes, Vice President, Cost Center of Excellence

Expect even more cost deflation for the rest of 2020

We thought costs would hit bottom earlier this year.

But another round of double-digit cost reduction is coming in nearly every spend category. Overall drilling and completion costs for the second quarter were more than 10% lower when compared to the start of 2020. Expect another double-digit reduction before bottoming out in Q4 this year. While activity will start to pick up again in 2021, it’s unlikely that costs will recover to today’s levels.

The cost savings operators achieve will help well economics. But don’t expect large portions of tight oil inventory to be suddenly back in the money.

Ryan Duman

Director, Americas Upstream

Ryan specialises in supply forecasting, basin characterisation, upstream decarbonisation and economic modeling.

Latest articles by Ryan

-

Opinion

Gas prices enter a bearish spring amid crude market volatility

-

The Edge

Three factors driving US liquids production to new heights

-

Opinion

A new tight oil powerhouse: Permian Resources and Earthstone create a new large-cap US E&P

Will costs fall low enough to make a difference?

Cost savings will offer E&Ps an opportunity to cut spending further. That could help companies to realize CAPEX savings and improve cash flow. But costs that are 10-15% lower won’t fix tight oil economics. On average, half-cycle breakevens improve by roughly 8-12% with this level of saving. And with WTI prices so low, new drilling opportunities won’t be making money.

To find out more on this topic and receive a complimentary copy of the webinar slides and recording, fill out the form on this page.