Get Ed Crooks' Energy Pulse in your inbox every week

The limits to resource nationalism for lithium

Chile’s president is moving to take greater control of the country’s lithium resources. It will still need to attract international companies

9 minute read

Ed Crooks

Vice-Chair, Americas

Ed Crooks

Vice-Chair, Americas

Ed examines the forces shaping the energy industry globally

Latest articles by Ed

-

Opinion

How global trade can help build the clean energy economy

-

Opinion

Biden exit shakes up US presidential race

-

The Edge

Is it time for a global climate bank?

-

Opinion

Are low profits to blame for the energy transition lagging?

-

Opinion

Day 3: How can we finance the energy transition? Discussions from the final day of the Reuters Global Energy Transition Conference 2024

-

Opinion

Day 2: The Energy Gang at The Reuters Global Energy Transition Conference 2024

Sustained upturns in demand often encourage resource nationalism. The long upswing in crude prices during the 2000s incentivised Vladimir Putin in Russia and Hugo Chavez in Venezuela to take greater control of their countries’ oil industries. More recently, the growth in demand for metals created by the transition to lower-carbon energy has encouraged governments in Indonesia and the Democratic Republic of Congo, among others, to impose export restrictions on materials used in lithium ion batteries.

Chile, the world’s second-largest lithium producer and largest holder of lithium resources, is the latest country where governments are seeking to benefit as demand for metals grows. Gabriel Boric, Chile’s left-leaning president who took office in March 2022, last month announced plans for a partial nationalisation of the country’s lithium industry. He described the country’s new National Lithium Strategy as a plan “to increase wealth for the country, developing a key industry as a fundamental step to link Chile’s economic development with the shift towards a global green economy.”

Under the plan, a new National Lithium Company would hold a controlling stake in all Chilean extraction projects, structured as public-private partnerships. The two companies now mining lithium in Chile, SQM and Albermarle, would be allowed to continue until their lease agreements expire, at the end of 2030 for SQM and the end of 2043 for Albermarle, but the Boric administration aims to renegotiate their terms in line with the new plan sooner than that.

It is not certain that the proposals will come into effect. Creating the new national lithium company requires legislation, and President Boric has faced significant opposition in Congress over his policy agenda. His authority was dealt a blow last weekend, when right-wing parties won most of the seats in the assembly that will draw up a new constitution for Chile.

Even if the nationalisation plan does go through, it will make little difference to the big picture in global lithium markets, Wood Mackenzie analysts believe, despite the significance of Chile as a producer and resource-holder. The bottom line from our recent Strategic Planning Outlook for lithium, covering the period out to 2050, is that we expect an overall surplus over the next decade, and then a broadly balanced market after that.

We are forecasting that the price of battery-grade lithium hydroxide will average about US$33,000 a ton, in 2023 dollars, over 2035-50. That compares to an average price last year of about US$51,000 a ton, again in 2023 dollars.

This is on the basis of rapidly growing demand, driven mostly by the rise of electric vehicles. We expect total lithium demand in 2050 to be about five times what it is this year. The idea, held by some in the oil industry, that lithium supply constraints will prevent sustained growth in EV sales seems not to be supported by the evidence.

In our base case forecast, we project battery electric vehicles and plug-in hybrids will rise from 14% of global passenger car sales last year to 69% in 2050. For commercial vehicles, we expect the BEV / PHEV market share to rise from 3% to 59% over the same period. There will be issues, such as the capacity and reliability of power grids in many countries, that could create obstacles to the rise of EVs. The long-term availability of lithium does not look likely to be among them.

“It’s not that there is any kind of shortage of lithium in the world,” says Suzanne Shaw, Wood Mackenzie’s head of energy transition and battery raw materials. “To the extent that shortages do occur, they are going to be about timing: the time it takes to bring new production on line.”

Elon Musk, chief executive of Tesla, made a similar point this week as the company broke ground on a new lithium refinery, the largest in North America. “Lithium is actually a very common element on earth,” he said. “It’s present basically in every country. So it’s not that there’s a shortage of lithium ore to mine.”

He went on to say that the real EV supply chain bottleneck was in lithium refining capacity. But there, too, Wood Mackenzie expects rapid growth. Global production of refined lithium chemicals will be about 1 million tons this year, with 65% of that coming from China. By 2050, we expect it to be about 3 million tons, with China’s share down to about 55%.

Lithium chemical prices soared in 2021-22, with battery grade hydroxide in the spot market rising more than ten-fold from about $6,700 a ton in the first quarter of 2021 to about $70,000 a ton in the fourth quarter of 2022. Contract prices, which are more important for most buyers, also jumped, rising about six-fold over the same period.

The result was an interruption in the downward trend in EV battery pack prices. The average price had dropped from US$334 per kilowatt hour in 2016 to US$139 / KWh in 2021, but then popped back up to US$150 / KWh in 2022.

This year lithium prices have been falling back, however, and we think the declining trend in battery prices will soon resume. We forecast that average battery prices will drop below US$100 / KWh before the end of the decade, helping to underpin the growing competitiveness of EV costs when compared to internal combustion engine vehicles.

One of the key factors driving that decline in lithium prices seems to be that there is now a wider appreciation that the long-term outlook does not really support expectations of sustained shortages of supply. Prices soared because of projections of sustained rapid demand growth for EVs. Those projections for demand have not faded away — if anything, they have strengthened — but it is more generally understood that supply will be available to meet it.

As Wood Mackenzie’s Suzanne Shaw puts it: “Lithium has been in a speculative bubble. And now it is deflating.”

It is an important point for President Boric, as he works on Chile’s lithium strategy. Private sector involvement is crucial to his plan, he says, to “contribute capital, technological innovation and networks in the market.” In a global market with potentially commercial resources distributed widely around the world, mining companies will have options as to where they can invest. Chile will need to keep its new contract terms reasonable if it wants to attract the international capital that its strategy requires.

In brief

The US Environmental Protection Agency has published its proposed new regulations to limit carbon emissions from fossil fuel power plants. It said the proposed limits and guidelines were “based on proven and cost-effective control technologies that can be applied directly to power plants”, and allowed generators “ample lead time” and substantial flexibility in compliance. The new regulations, which would apply to both new and existing coal and gas-fired plants in varying ways, follow a series of legal battles over earlier rules proposed by the Obama and Trump administrations.

The approach taken by the EPA attempts to work within limits set by the US Supreme Court, which ruled last June that the agency did not have the power to compel emissions reductions across the entire industry, but only at individual power plants. Patrick Morrisey, the attorney-general of West Virginia, who was one of the leaders in the successful legal action against the EPA, said he expected to prevail in court again “against this out-of-control agency.” He added: “Based upon what we currently know about this proposal, it is not going to be upheld, and it just seems designed to scare more coal-fired power plants into retirement—the goal of the Biden administration.”

As the US nears its debt ceiling, threatening a financial crisis, Republicans in Congress have voted for a package of spending cuts including abolishing the extensive tax credits for low-carbon energy that were included in the Inflation Reduction Act last year. President Joe Biden is in negotiations with Republican leaders to find a compromise, but is reported to have ruled out repeal of the IRA as part of any deal.

Former president Donald Trump touched on energy policy when he spoke at a CNN event on Wednesday. Asked about how he would bring down the cost of living and ease strains on consumers, he answered: “Drill, baby, drill.”

Saudi Aramco has set out its views on investment in blue hydrogen as it reported earnings for the first quarter of 2023. It estimates that the cost of blue hydrogen — produced from natural gas with carbon capture — delivered into end-markets is about US$250 per barrel of oil equivalent. Buyers in Europe, Japan and Korea do not currently want to sign deals at those prices, and without firm offtake agreements Aramco will not commit to large-scale investment in blue hydrogen production. Aramco also announced a plan for a new additional performance-linked dividend.

Worley has won the engineering, procurement and construction contract for the first phase of Venture Global’s CP2 LNG project in Louisiana. The project is intended to start operating in 2026.

The US now has an offshore wind development pipeline totaling 51.4 gigawatts of capacity, according to the industry group the American Clean Power Association. Just 42 megawatts of offshore wind capacity is currently on line in the US.

New York state has passed legislation that will allow the New York Power Authority, the largest publicly owned power provider in the US, to develop renewable energy projects to meet the state’s goals for decarbonisation.

Grid congestion is delaying tens of billions of pounds in renewable energy investments in the UK, BBC News has found. There are £200bn worth of projects currently waiting in connection queues, with about 40% of those facing a wait of a year or more. Zoisa North-Bond, chief executive of Octopus Energy Generation, said the UK had one of the longest grid connection queues in Europe.

Other views

Katherine Blunt — The most valuable US power company is making a huge bet on hydrogen

Dylan Matthews — The nationalist dark side of Joe Biden’s climate policies

Kate Aronoff — The IRA is an invitation to organizers

Amy Westervelt — The “electrify everything” movement’s consumption problem

Quote of the week

“I'm not that worried about the very short term, I think we can manage balancing the supply with demand. I'm more worried about the level of investment required for years to come.” — Suhail Al Mazrouei, energy minister of the United Arab Emirates, gave his thoughts on the OPEC+ group’s strategy after the latest round of production cuts. Crude prices have dropped back after an initial jump when the cuts were announced in early April. The risk of underinvestment in oil and gas leading to supply shortages in the future has been a frequent theme in comments from energy ministers and executives from the UAE and Saudi Arabia in recent years.

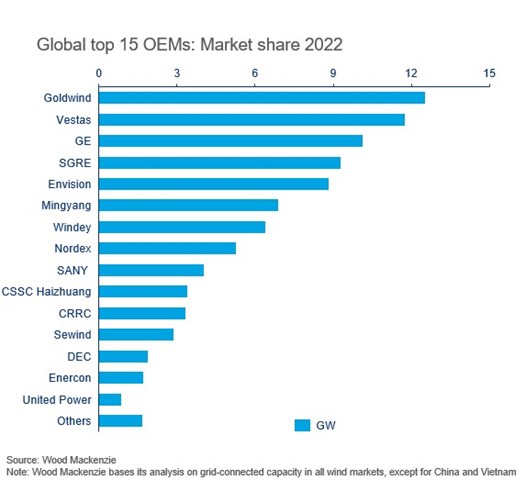

Chart of the week

This comes from a new report on wind turbine manufacturing in 2022, written by Endri Lico, Wood Mackenzie’s senior analyst for the global wind supply chain and technology. The chart shows the global top 15 turbine manufacturers, ranked by order of new installations in 2022. You can see that Goldwind was market leader, by a narrow margin, marking the first time that a Chinese company has topped the rankings. Vestas, which had had the largest market share every year since 2015, was in second place, followed by General Electric, Siemens Gamesa and Envision. Western original equipment manufacturers, including Vestas and GE, dominate markets outside China, accounting for 92% of new installations last year. But China is a huge market, accounting for 54% of installations worldwide last year, despite a slowdown caused by measures to slow the spread of Covid-19. There is a lot more interesting detail available if you download the free extract available through this link.