Inflation Reduction Act propels the global wind outlook

The IRA and other global policy drivers yield a 25.6 GW quarter-on-quarter upgrade to the wind outlook – though Asia Pacific is bucking the trend

3 minute read

Luke Lewandowski

Vice President, Global Renewables Research

Luke Lewandowski

Vice President, Global Renewables Research

Luke heads our Global Renewables Research team, which includes wind, solar and energy storage.

Latest articles by Luke

-

Opinion

eBook | Navigate power market uncertainty with confidence: the essential guide to profitable energy investments

-

Opinion

New frontiers: order intake by Chinese wind turbine OEMs advanced beyond domestic dominance in H1 2024

-

Opinion

Distributed solar and storage: a beacon of security and hope

-

The Edge

COP28 key takeaways

-

Opinion

The power of the sun: supporting energy security in Puerto Rico

-

Opinion

Inflation Reduction Act propels the global wind outlook

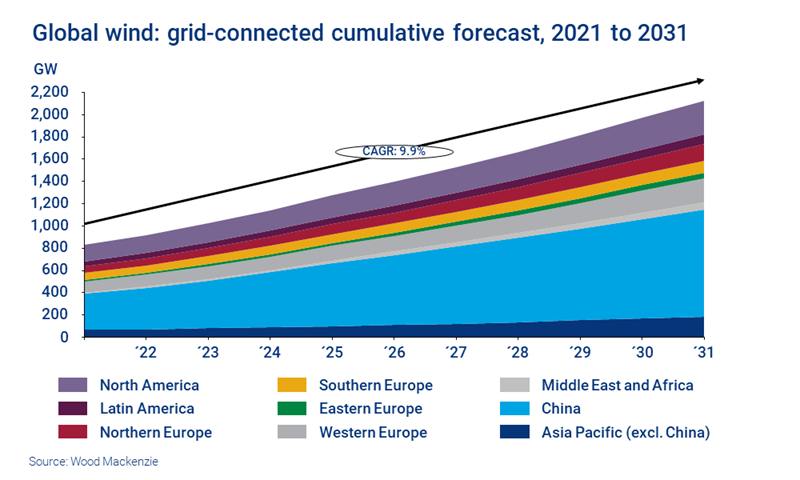

The global wind power outlook goes from strength to strength. Policy-driven adjustments – from the passage of the Inflation Reduction Act (IRA) in the US to Europe’s ongoing campaign for greater energy security – have led to a 1.9% upgrade in our latest quarterly outlook.

However, it’s not a universal trend. Asia Pacific (excluding China) stands as the only sub-region to receive a significant downgrade this quarter.

The Q3 outlook update from our Global Wind Markets Service explores the outlook by region in detail. Fill in the form for a complimentary extract, or read on for a brief introduction.

IRA delivers policy certainty in the US

The flagship IRA legislation is set to make climate history in the US – and has spurred the global outlook upgrade.

The IRA’s unprecedented support for decarbonisation initiatives signals long-term investment stability, and sparked headlines around the world. This adds to the positive momentum we’ve been seeing across many Western markets. Many are responding to calls for action on climate as concerns over energy security and the negative impact of increasingly destructive storm events rise, and pressure to meet targets increases. Adjustments across the Americas and Europe alone have resulted in a net upgrade of 21 GW this quarter.

Overall, North America has seen the largest sub-region uplift this quarter. The newfound policy certainty in the US is supported by aggressive utility-level targets in Canada. Procurement activity in Quebec and a robust pipeline in Alberta triggered a 2.5 GW upgrade and strengthened Canada’s position as a top 20 global market.

Europe’s campaign for energy security bolsters the global wind outlook

Energy security is firmly in the spotlight in Europe. The war in Ukraine has sparked the most significant shock to energy markets since the 1970s, and forced a rapid revaluation of Russia’s role as an energy supplier. Many countries in the region have accelerated plans to stimulate wind installations, providing a 10 GW capacity outlook upgrade this quarter.

New and strengthened policies in Germany, France and Greece have played a significant role. Germany’s Onshore Wind Energy Act, for example, will streamline permitting and help reduce the current lead times of 7-10 years. This has yielded a 5.5% quarter-on-quarter upgrade to the 10 year wind market outlook for Western Europe.

Meanwhile, project concessions and awards in Finland, Denmark and the UK further support the outlook. The UK, for instance, awarded about 8.5 GW of wind capacity in July – 7 GW offshore and 1.5 GW onshore – under round four of the Contracts for Difference (CfD) scheme.

All of this has led to upgrades to the outlook in each sub-region. The exception is Eastern Europe, where Russia’s war with Ukraine has negatively impacted its domestic market.

Build activity in China offsets wind outlook downgrades in the rest of Asia

It’s a mixed picture in Asia Pacific. The outlook for the region excluding China has been downgraded by 1.9 GW. This is due to slow market development in Japan, project adjustments in South Korea and – most notably – policy uncertainty in Vietnam. There, the state utility monopoly EVN is reluctant to add more renewables due to concerns over grid stability in major power demand areas. So far in 2022, no new wind capacity has been recognised in Vietnam.

In China, it’s been a tough year for offshore wind project installations, due to Covid lockdowns in coastal provinces and the impact of typhoons. However, China’s mid-term outlook is supported by ambitious renewables targets from the provincial governments in their 14th Five Year Plan, which require 60-70 GW of new wind capacity additions annually by 2025.

Overall, the forecast for Asia Pacific has increased by 2.9 GW from our Q2 outlook. Upgrades in China’s onshore and offshore sectors are proving more than enough to offset downgrades in the rest of the region.

Get a closer look at the global wind outlook

Our Global wind power market outlook update: Q3 2022 takes a region-by-region look at the latest forecast. To find out more, download the complimentary extract, which includes charts on the top 20 markets by region and new capacity, and more.