Discuss your challenges with our solutions experts

Expansion opportunities beckon for China’s wind companies

The winds of opportunity are blowing for Chinese onshore and offshore companies

4 minute read

Chenyuan Diao

Senior Analyst, Asia Pacific Renewables Research

Chenyuan Diao

Senior Analyst, Asia Pacific Renewables Research

Chenyuan is an expert in renewables covering Asia Pacific excluding China

Latest articles by Chenyuan

View Chenyuan Diao's full profileYuan Ren

Managing Consultant, China Wind Power Research

Yuan Ren

Managing Consultant, China Wind Power Research

Yuan provides analysis covering China’s wind market

Latest articles by Yuan

-

Opinion

New frontiers: order intake by Chinese wind turbine OEMs advanced beyond domestic dominance in H1 2024

-

Opinion

Expansion opportunities beckon for China’s wind companies

Xiaoyang Li

Director, China Renewables Research

Xiaoyang Li

Director, China Renewables Research

Xiaoyang focuses on analysis of China’s renewables power market

Latest articles by Xiaoyang

-

Opinion

China’s solar & storage exports achieve record growth with more than 40% surge

-

Opinion

Expansion opportunities beckon for China’s wind companies

-

Opinion

Wind power to play a key role in achieving China's carbon neutral goal

Yufan Wang

Senior Consultant, Global Offshore Wind Research

Yufan Wang

Senior Consultant, Global Offshore Wind Research

Yufan covers global offshore wind markets with a focus on China.

Latest articles by Yufan

View Yufan Wang's full profileLast year, as Western onshore wind markets grappled with a perfect storm of supply-chain challenges and capex increases, Chinese original equipment manufacturers (OEMs) were shielded by the country’s massive domestic market and localised supply chain. China’s onshore industry is now poised to capitalise on its low-cost position and economies of scale to expand into other territories.

In the offshore market, meanwhile, in 2022, Chinese suppliers exported their first jacket order and secured their first monopile order since 2008, as a healthy cost base, domestic oversupply and solid financials made them unprecedentedly competitive. Their continued expansion and strong competitive position, coupled with supply-chain hurdles in the Western world, offer Chinese suppliers a unique chance to pitch their offering elsewhere.

You can keep a step ahead of the competition by signing up for our Wind Supply Chain Service, your toolbox for understanding onshore and offshore supply side trends around the world. Read on for a taste of the insight and analysis you will receive to help you optimise your business strategy in the wind energy supply chain.

Onshore wind advantage: scale, cost and diversification

Chinese onshore wind companies are targeting overseas markets through multiple channels, from asset investment and engineering, procurement and construction (EPC) to equipment supply.

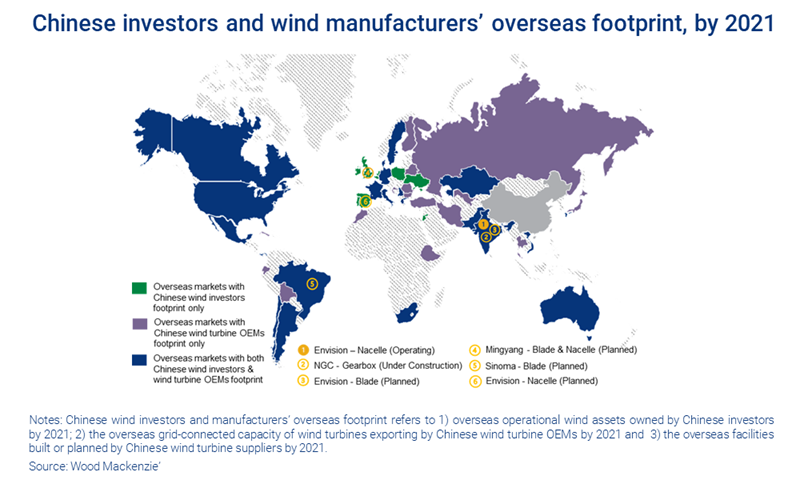

As of 2021, Chinese wind firms had an estimated global footprint of 45 countries, equivalent to 14 GW of capacity, spanning asset ownership, turbine supply, EPC contracts or a combination thereof.

China’s strength comes from its massive scale, lower cost and diversification. Its wind companies have enjoyed higher profitability than their Western peers thanks to the robust domestic market, a strong local supply chain and reduced exposure to logistics and commodity risks.

Its expansion will not be all plain sailing, however. Barriers include financing, increased technical market entry requirements, protectionist policies and growing geopolitical risk, which could impact the bankability of overseas projects. Entrenched competition from Western OEMs and investor caution are likely to deter Chinese entry into the US and Western European markets, for instance.

A proactive approach with a local presence is key to global success. Indeed, it is crucial if Chinese asset investors and EPC companies are to ensure that projects fit local market demand and counter protectionist opposition. Chinese OEMs and supply-chain manufacturers can benefit from Chinese asset investor globalisation, but must work directly with Western developers and OEMs to build a sustainable pipeline. They know this and are actively seeking to collaborate with Western firms.

Emerging markets and massive green hydrogen infrastructure projects present the most likely targets for Chinese onshore overseas expansion. Many Belt & Road Initiative countries offer an advantageous pathway for Chinese market entry, with companies effectively backed by the power of China’s government and doors opened by its emerging-markets climate diplomacy.

Green hydrogen projects in emerging markets in Africa, the Middle East, Latin America and Asia present significant opportunity for Chinese financing, particularly in markets with existing Belt & Road policies. Many Belt & Road countries require significant grid infrastructure investment to increase their renewable energy penetration, which could lead to synergistic investment.

Offshore wind expansion: growth amid myriad challenges

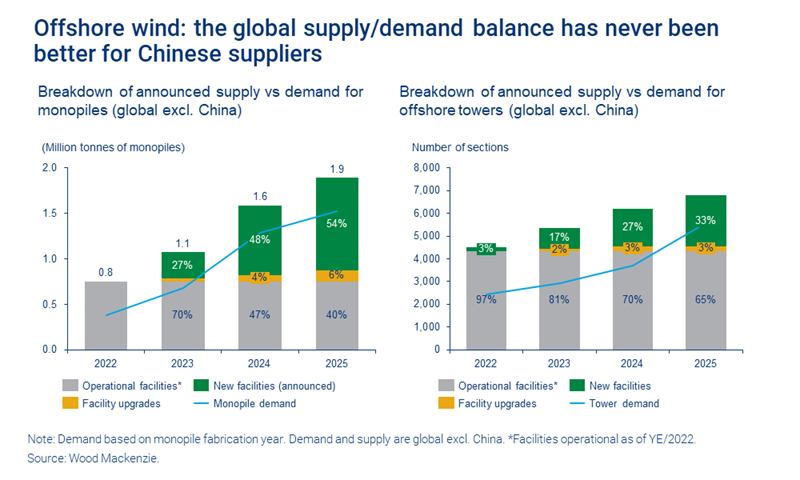

A massive expansion in offshore supply chain production has allowed Chinese manufacturers to reduce costs compared with their global competitors, despite the rising cost of raw materials. This cost competitiveness has seen many Western firms overcome their previous reluctance to sign up Chinese suppliers. In response, Chinese manufacturers are expanding and upgrading their production capacity to cater for growing global demand and next-generation technology.

Myriad challenges remain, however. Increasing transportation costs and regulatory uncertainty, for example, may offset the price advantage and test the ability of Chinese suppliers to make profits on overseas projects. Some countries and regions, such as the EU, have imposed anti-dumping duties on wind turbine components from Chinese suppliers. Complex grid connection requirements, intellectual property infringement concerns and strict health and safety standards may require product redesigns and impose significant added costs for exported turbines.

Still, the global supply-demand balance has never been better for Chinese offshore suppliers. The supply-demand outlook for offshore towers and monopiles suggests that delays or cancellations of Western facilities will create bottlenecks.

This could make it difficult for developers and policymakers to turn down Chinese suppliers.

Moreover, China’s installation boom in 2021 has resulted in near-term offshore oversupply that will forge opportunities for Chinese manufacturers to look overseas. Upgraded and new facilities will support sustained exports once a track record has been established.

Exports would also help Chinese suppliers to stabilise revenue. The phase-out of China’s offshore wind subsidies in 2022 took a significant toll, underscoring the risks for Chinese players for focusing solely on the domestic market.

The greater diversification of Chinese monopile suppliers means they boast more robust financials than their European counterparts. This will allow them to soak up higher costs and risks despite playing on a battlefield away from home.

Leading offshore Chinese turbine OEMs have taken the first steps and submarine cable suppliers are gradually making their mark. Chinese offshore wind tower and foundation suppliers have been dipping their toe in the European market by seeking out joint ventures and setting up local subsidiaries and facilities.

Watch this space.