Get Ed Crooks' Energy Pulse in your inbox every week

Nord Stream 2 and the battle for gas market share in Europe

The US administration and Congress are trying to prevent the completion of the new gas pipeline from Russia to Germany

1 minute read

Ed Crooks

Vice-Chair, Americas

Ed Crooks

Vice-Chair, Americas

Ed examines the forces shaping the energy industry globally

Latest articles by Ed

-

Opinion

How global trade can help build the clean energy economy

-

Opinion

Biden exit shakes up US presidential race

-

The Edge

Is it time for a global climate bank?

-

Opinion

Are low profits to blame for the energy transition lagging?

-

Opinion

Day 3: How can we finance the energy transition? Discussions from the final day of the Reuters Global Energy Transition Conference 2024

-

Opinion

Day 2: The Energy Gang at The Reuters Global Energy Transition Conference 2024

The US government was initially slow to act against Nord Stream 2. Joe Biden, then vice-president, said in August 2016 that the project, an expansion to the Nord Stream system that transports gas from Russia to Germany, was a “fundamentally bad deal for Europe”. Rex Tillerson, President Donald Trump’s first secretary of state, raised similar concerns, warning that the pipeline would undermine Europe’s energy security. But the US position lacked teeth. Legislation passed in 2017 authorised the administration to impose sanctions on anyone investing in or providing goods and services for “Russian energy export pipelines”, but until now it has declined to use those powers.

Instead, US Congress has done all the running on trying to stop Nord Stream 2. At the end of last year, legislation was passed mandating sanctions on anyone involved in providing vessels to lay the subsea pipeline.

Last month, a new round of sanctions was proposed in Congress, with bipartisan support including senators Ted Cruz, a Republican from Texas, and Jeanne Shaheen, a Democrat from New Hampshire. The new law would widen the scope of the sanctions to target not just the pipe-laying vessels, but also anyone who insures those vessels or provides port facilities for them.

This week, a version of that legislation was approved in the House of Representatives, as an amendment to the latest bill authorising spending on the US military, which gives it a good chance of becoming law.

Meanwhile, the Trump administration has also been stepping up the pressure. Last week the state department indicated it could start using the sanctions powers that it was given in 2017. New public guidance on implementing the 2017 law warned that the administration “may impose sanctions” on anyone investing in or working on the construction or maintenance of Nord Stream 2 in future.

Michael Pompeo, the US secretary of state, also raised the issue this week on a visit to Denmark. Of the pipeline’s 764-mile length, about 100 miles remain to be completed, and that stretch lies in Danish waters.

Pompeo has reiterated the long-running theme of US policy in referring to Nord Stream 2 as one of “Russia’s malign influence projects”. But alongside US concerns about the project’s supposed implications for Europe’s energy security, there are also significant economic factors at play, as a recent report by Wood Mackenzie’s Massimo Di Odoardo, Eugene Kim and Murray Douglas points out.

Russian gas delivered through Nord Stream 2 represents direct competition for US LNG, holding down European prices as demand recovers. If Nord Stream 2 remains unfinished, European benchmark TTF gas is expected to average about $4 per million British Thermal Units next year. But if the project can be completed as its backers hope early in 2021, then the average TTF price that year could drop to about $3, we estimate.

That would be good news for European gas consumers, obviously, but less welcome for companies seeking to export LNG from the US. Without Nord Stream 2, Russian gas exports to Europe are expected to be about 176 billion cubic metres next year, up from 168 bmc this year. With Nord Stream 2, Russia’s exports next year could be about 27 bcm higher at 203 bcm. Lower prices would mean higher gas consumption in Europe, in part because of coal to gas switching for power generation. But some of the increase in imports from Russia would come at the expense of US LNG.

US LNG export capacity will be equivalent to about 10% of total US gas supply next year, and if sales to Europe are constrained again, as they have been this year, that will put downward pressure on Henry Hub prices. The net impact of that in terms of lost revenues for upstream US gas producers could be significant.

The Nord Stream 2 company rejects the charge that it is undermining a common European approach to energy security, arguing that the gas delivered through the pipeline can flow anywhere in the region. But setting all security-related issues aside, US gas producers still have a compelling economic motivation for hoping that the project can be blocked.

Tesla picks Texas

The time was when you could barely find a Tesla in Texas. When TNT rebooted the TV series Dallas in 2012, one of the younger Ewings drove a Tesla Roadster, as a sign of his forward-thinking environmentally responsible credentials. But the producer could not find a single one available in the Dallas area, so he had to have his own car shipped over from California to use in the show.

Although the company ran a sustained lobbying campaign, you still cannot buy a car from a Tesla dealership in Texas, although you can take a look and take test drives from its “galleries”.

So it was a genuinely historic moment when Tesla announced this week that it plans to invest $1.1 billion to build the factory for its new electric “cybertruck” near Austin, Texas. The factory is expected to create at least 5,000 new jobs. Governor Greg Abbott of Texas welcomed the decision, describing Tesla as “one of the most exciting and innovative companies in the world”.

From the governor of the largest oil-producing state in the largest oil-producing country in the world, that was a noteworthy tribute.

Ohio nuclear bailout leads to arrests

When the state of Ohio passed the legislation known as HB 6 last year, it was described as “the worst energy policy in the country”. The law introduced new subsidies to prop up struggling nuclear and coal-fired power plants, while weakening regulations supporting renewables and energy efficiency. It stirred up an unusual coalition of renewable energy and natural gas advocates to oppose it, and was widely condemned as a plan for looking after well-connected utilities including FirstEnergy Solutions, at the expense of consumers.

So there was a lot of interest in the energy industry when Larry Householder, the speaker of the Ohio House of Representatives was arrested by federal agents along with four others on charges of taking millions of dollars in bribes to support HB 6. The Department of Justice alleges that Householder and the others were part of a conspiracy involving payments of about $60 million to help pass and then defend a bailout that could be worth $1.6 billion.

The full 82-page affidavit from the FBI detailing the allegations is well worth reading to understand how the policy was put in place. It notes that there was a media campaign urging Ohioans to back HB 6 “to save jobs in Ohio and protect their communities from ‘big oil’.”

It looks as though the arrests will have a material impact on energy policy in Ohio. Governor Mike DeWine had defended the bailout earlier in the week, but on Thursday he changed his position, acknowledging that although he still thought it was good policy, “the process by which it was created stinks”. He added that HB 6 should be “repealed and replaced through an open process.”

Chevron leads M&A activity, but others may not follow

Chevron has agreed a deal to buy Noble Energy for $13 billion including debt, in the first large acquisition of the latest oil industry downturn. Noble has US assets, mainly in the Permian and DJ basins, and a mature position in Equatorial Guinea, but its “crown jewel” is its position in Israel, where it holds positions in the Leviathan and Tamar gas fields. Those assets account for almost half of its oil equivalent reserves.

Chevron was also the big winner in Egypt’s latest licensing round earlier this year, as Wood Mackenzie’s Simon Flowers pointed out recently. Having a US oil major take a significant position in the two countries could help support future co-operation on gas between Israel and Egypt in the long term.

The deal inevitably sparked a round of speculation about whether Noble might be the first domino to fall in a cascade of M&A activity, and which E&Ps might be bought out next. The market reaction was generally quite muted, though. In part this was a response to the modest takeover premium of about 8% agreed by Chevron and Noble, which does not give much support to the theory that E&P companies are greatly undervalued at present.

Wood Mackenzie analysts argued that the oil Majors’ ambitions to grow through acquisition had been tempered by their more downbeat views of longer-term commodity prices, and for the European companies by their plans to develop low-carbon energy operations.

In brief

Gas flaring jumped by 3% last year to levels not seen for a decade, according to the World Bank. One of the sharpest increases was in the US, where flaring rose by 23%, and there was also a significant rise in Venezuela and in Russia. Worldwide about 150 billion cubic metres of gas was flared off in 2019, equivalent to the entire consumption of sub-Saharan Africa. The four top countries for flaring — Russia, Iraq, the US and Iran — account for about 45% of the global total. The World Bank calculates the figures using satellite observations matched with country-level data.

The Payne Institute at the Colorado School of Mines, which works on the World Banks flaring estimates, is also part of a new project launched with the Oil and Gas Climate Initiative, the industry group working on ways to cut greenhouse gas emissions. The institute and the OGCI are collaborating on a new web platform to support “real-time mapping and tracking” of global gas flaring data. The idea is to make it easier to see how much gas is being flared around the world at any given time, and how efforts to reduce flaring are succeeding, or failing.

EU leaders have backed a €750 billion stimulus plan to support the region’s economic recovery, with focus on greener growth. About 30% of the EU’s spending, from the stimulus package and from its regular budget, is intended to go towards tackling the threat of climate change.

A group of 32 large companies including Pepsico, McDonald’s, Dell, Unilever, and Levi Strauss has urged leaders in the US Congress to “double down on clean energy infrastructure to put Americans back to work and come back stronger and cleaner than before this pandemic-driven recession.”

In the EU-27 countries, renewable generation exceeded fossil fuel generation for the first time ever in the first half of 2020, according to Ember, a climate think-tank. Renewable generation rose by 11%, while gas-fired generation fell by 6% and coal generation fell by 32%.

The world’s second-cheapest solar power project, contracted to sell electricity for 1.45 US cents per kilowatt hour, has secured financing from two Japanese banks.

Meanwhile Total has secured $14.9 billion in debt financing for its Mozambique LNG project.

Chevron is using solar power to cut the cost of oil production.

General Electric and Uniper have launched an initiative to collaborate on exploring, assessing and developing technologies for the decarbonisation of gas-fired power generation. The initiative, which is GE’s first such fleet-wide programme signed with a major power producer, will explore the greater use of hydrogen in gas turbines and other equipment.

A group of 11 large EU gas infrastructure companies has set out a plan for a “European hydrogen backbone”.

And finally: the energy transition as popular entertainment. The actor Zac Efron has a new series for Netflix called Down to Earth, in which he “explores healthy, sustainable ways to live”, as the promo blurb puts it. That means diet and nutrition advice, as well as looking at hydro power and geothermal energy in Iceland and solar power in Puerto Rico.

The show has some respectable reviews from viewers, but has also drawn some sharp criticism. Jonathan Jarry of McGill University described the nutrition advice as “insidious nonsense” and “pseudoscience”. Eve Andrews of Grist argued that it was “disingenuous bordering on grotesque” for the show to suggest that tackling climate change would create wonderful new lives for everybody, while ignoring the “corruption and structural inequalities” that mean a healthy, environmentally sustainable lifestyle is “available to some and not others”.

Other views

Simon Flowers — Are exploration’s days numbered?

Xiaojing Sun — Why US solar tariffs (almost) worked, and why they don’t now

Muhammad Tabish Parray — Is Covid-19 an opportunity to clean up India’s coal power plants faster?

Anjli Raval — The last frontier: the oil industry scales back exploration

Alex Trembath — Alternatives to climate alarmism

Quote of the week

“We believe that North America production is likely to remain structurally lower in the foreseeable future and have slower growth going forward.” — Jeff Miller, chief executive of Halliburton, explained why he saw greater potential in the company’s international operations. He was speaking as he presented Halliburton’s second quarter results, showing a net loss of $1.7 billion for the three months to June. Revenues in North America were down 57% from the first quarter. Free cash flow of $456 million was stronger than expected, however.

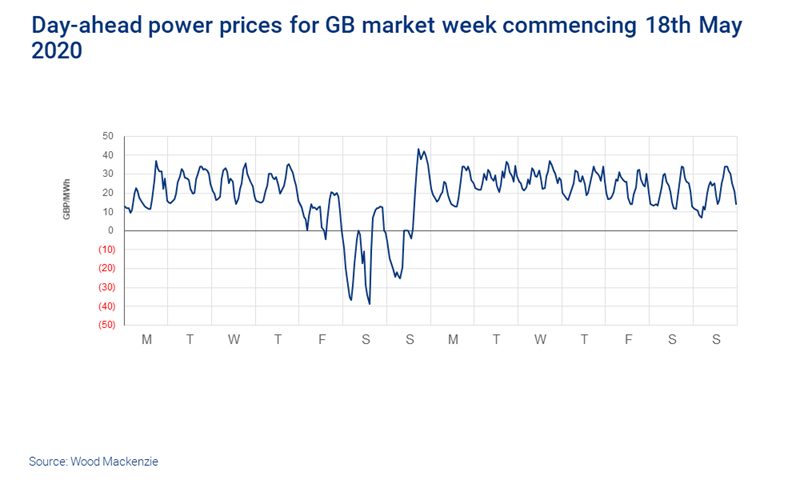

Chart of the week

This comes from a fascinating note by Rory McCarthy and Victor Laurent of Wood Mackenzie Genscape. It has long been clear in principle that increasing the proportion of wind and solar power on the grid creates challenges for balancing, but now there are some examples emerging of it being a significant issue in practice. This chart shows day-ahead power prices in the market for Great Britain, starting on May 18 of this year. You can see that on the weekend of 23-24 May, with a holiday on Monday, the country in lockdown and abundant wind and solar generation, prices were negative for a while. In fact, it was the first average negative day-ahead price on record; a clear sign that there is not enough flexibility in the system. The cost of balancing the grid also shot up over that weekend. The ideal solution would be to use periods of excess supply to charge up storage, so the power can be used later. But McCarthy and Laurent ask whether “European power markets need a complete rehaul in order to deliver this new breed of system flexibility”.