Get Ed Crooks' Energy Pulse in your inbox every week

Oil producers cautious as recovery hopes rise

Good news on Covid-19 vaccines points to a rebound next year, but there are still some difficult months ahead

1 minute read

Ed Crooks

Vice-Chair, Americas

Ed Crooks

Vice-Chair, Americas

Ed examines the forces shaping the energy industry globally

Latest articles by Ed

-

Opinion

How global trade can help build the clean energy economy

-

Opinion

Biden exit shakes up US presidential race

-

The Edge

Is it time for a global climate bank?

-

Opinion

Are low profits to blame for the energy transition lagging?

-

Opinion

Day 3: How can we finance the energy transition? Discussions from the final day of the Reuters Global Energy Transition Conference 2024

-

Opinion

Day 2: The Energy Gang at The Reuters Global Energy Transition Conference 2024

On 10 November 1942, with Rommel’s army in full retreat across Egypt and French forces surrendering to the Americans and British in Morocco and Algeria, Winston Churchill gave a speech at Mansion House in London. “Now this is not the end. It is not even the beginning of the end,” he said. “But it is, perhaps, the end of the beginning.” That seems to be about where humanity is now in its battle against Covid-19.

The good news on vaccine test results from first Pfizer and then Moderna has raised hopes that effective prevention against Covid-19 can start to be rolled out worldwide next year. Prince Abdulaziz bin Salman, Saudi Arabia’s energy minister, said at the online meeting of the OPEC+ group’s Joint Ministerial Monitoring Committee this week that he could see “some glimmer of light at the end of the tunnel.” However, he warned: “There is still a way to go before we reach the other side of the long pandemic tunnel.”

The number of new coronavirus cases being reported worldwide is still rising, and the number of deaths each week is at a record high. Concern about the growing threat from the virus, and in some countries renewed lockdowns, have had an impact on economic activity. Global restaurant visits are running at about 60% of last year’s levels, the greatest shortfall since July, according to booking service OpenTable. The number of commercial flights worldwide grew steadily from April to July, but has since been on a plateau at about 40% below last year’s levels.

So while oil executives speaking at Wood Mackenzie’s online Americas Energy Summit this week were looking ahead to a better year in 2021, they were cautious about stepping up activity on hopes of a rebound in demand.

“We are taking a conservative approach to what we think prices will be,” said Vicki Hollub, chief executive of Occidental Petroleum. “I do believe that we’re going to see better prices towards the fourth quarter of next year… But for the near term, what we’re doing is we’ve capped our investment at $2.9 billion in 2021. That’s the maximum it would be, and if prices were for whatever reason to go lower than $40, we would probably adjust that.”

Matt Fox, chief operating officer of ConocoPhillips, had a similar message. “We’re quite cautious yet,” he said. “We’ll probably go into 2021 at a sustaining capital level, and see how the recovery progresses. It doesn’t make much sense to be putting new capital to work for short-cycle production into the current strip.” If prices do rebound and the company starts generating increased free cash flow, he added, “probably the first call on that will be to go back to shareholders”.

For the US tight oil industry in general, Fox said, he certainly did not expect a rapid reversal of the decline in production this year. “Despite most [US tight oil] companies saying that they are going to try to sustain production at end-2020 levels into 2021, I think that’s going to be a challenge for many,” he said.

The OPEC+ ministers debating production levels this week face the challenge of navigating through what are likely to be some turbulent conditions over the next few months before reaching the sunnier prospects becoming visible for 2021 and beyond. The ministerial committee’s official statement struck a downbeat tone, saying that the good news on vaccines had been “overshadowed by the resurgence of Covid-19 cases in major economies”, and warning that “the underlying risks and uncertainties remain high.”

When OPEC+ ministers hold their next full online meeting on 1 December, they will be under pressure to extend their current production curbs, set at 7.7 million barrels a day below baseline levels. Those limits are scheduled to be relaxed by 1.9 million b/d in January to 5.8 million b/d, but there is growing support in the group for a three or six month extension of the current 7.7 million b/d reduction, Reuters reported.

There have been signs of tension emerging, however, with Energy Intelligence reporting that some officials in the United Arab Emirates had “started privately to ask hard questions about whether OPEC membership remains in the country's longer-term interest”. The story suggests that one of the issues raised by some UAE officials was the concern that OPEC+ production curbs were helping US tight oil producers by supporting prices. However, the story also noted that “politically, the UAE has very good reasons to stay in OPEC.”

Later in the week Suhail Al Mazrouei, the UAE’s energy minister, tried to lower the temperature, Bloomberg reported, saying in a statement that his country had “always been open and transparent in all our decisions and strategies in support of OPEC.”

The OPEC+ meeting on 1 December will be one that the market watches very closely. Wood Mackenzie’s Macro Oils short-term forecast assumes OPEC+ keeps the production restraint at 7.7 million b/d for the first half of 2021, and then from 1 July eases the curbs to the previously planned 5.8 million b/d. If the group does not keep that restraint in the first half of next year, oil market fundamentals will be extremely weak.

General Motors accelerates its electric vehicle plans

General Motors on Thursday announced a big move in the electric vehicle market, stepping up its intended investment in EVs from its previous plans. By 2025, it will offer 30 all-electric models worldwide, with two-thirds of them available in North America. Before the pandemic, GM had intended to invest $20 billion in EVs and autonomous vehicles through to the end of 2025. It has now raised that planned commitment to $27 billion.

Mary Barra, GM’s chief executive, said in a statement: “Climate change is real, and we want to be part of the solution by putting everyone in an electric vehicle… We are transitioning to an all-electric portfolio from a position of strength and we’re focused on growth.”

GM said its new Ultium battery packs, produced in a joint venture with LG Chem, already cost nearly 40% less than the ones used in the Chevrolet Bolt EV, first sold in 2016. It is now projecting that the second-generation Ultium packs, to be available in the mid-2020s, will cost 60% less than the ones in use today. Batteries are a key component of the cost of an EV, and the plunge in costs will help bring them closer to parity with internal combustion engine vehicles, which are still significantly cheaper today.

GM also claims that its Ultium-based EVs, when produced, will have ranges of up to 450 miles on a full charge. That performance would address what customers say is the single most compelling reason for not buying an EV: range anxiety.

Wood Mackenzie analysts Ram Chandrasekaran and Prachi Mehta have built a total cost of ownership model, allowing people to compare the potential cost over ten years of owning an EV or an internal combustion engine vehicle. In most likely scenarios, EVs have the edge, with a lower all-in cost taking into account the purchase price, depreciation, fuel and power costs, maintenance, insurance and other fees. However, only about 10% of customers look at total cost of ownership when buying cars, so that advantage for EVs may not translate into a big sales boost. Unless gasoline prices surge higher, EVs will have to have “wider appeal... a higher penetration of public charging stations and a more accessible purchase price” to drive sales, Chandrasekaran and Mehta say.

A new industry group this week launched in Washington to campaign for an accelerated transition to EVs: the Zero Emissions Transportation Association, or Zeta. The group’s members include electricity providers such as Duke Energy, Southern Company, Enel X and PG&E, equipment suppliers such as Siemens and ABB, and EV manufacturers Tesla and Rivian. Its policy priorities include subsidies to bring down purchase prices, investments in charging infrastructure, and vehicle emissions and performance standards that would enable full electrification by 2030.

In brief

One of the most provocative sessions at the Wood Mackenzie energy summit on Tuesday featured an appearance by Mark Viviano, a managing partner of Kimmeridge, the investment firm. That morning, Kimmeridge had published a paper titled ‘Bringing Alignment and Accountability to the E&P Sector’, setting out a critique of governance in the industry. “The public E&P sector is broken,” the paper argues, adding: “Unless accountability and alignment are restored, the sector will struggle to attract capital and remain unprepared for the energy transition.” A previous Kimmeridge paper on US E&Ps in the energy transition is also well worth a look.

The UK government plans to ban sales of conventional gasoline and diesel cars by 2030, and of hybrids by 2035, as part of a “green industrial revolution” launched by Prime Minister Boris Johnson this week. The ten-point plan also includes funding and targets for low-carbon hydrogen, including a pilot “hydrogen village” by 2025; reaching 40 gigawatts of offshore wind capacity by 2030, including 1 GW of floating offshore wind; demonstration small modular and advanced modular reactors to be in service by the early 2030s, and a target to be capturing 10 million tonnes of carbon dioxide a year by 2030. One of the more controversial proposals has been the plan to ban gas boilers in new-build properties, which could take effect as soon as 2023.

General Electric is in talks about an investment that would show an early payoff from that strategy, the Financial Times reported. GE is said to be looking at setting up a factory on the east coast of northern England or Scotland to make wind turbines for use offshore, creating at least 3,000 jobs.

The US Bureau of Ocean Energy Management held another lease sale for the Gulf of Mexico, with modest results. The high bid amount increased by 30% compared to the previous sale, in March, but the amount paid per acre was about the same. There was a low level of competition, with only 9% of the blocks that were bid on receiving multiple bids. It was an undramatic event considering that it could be the last such lease sale for a few years, or possibly ever: Joe Biden has pledged to put an end to new oil and gas leasing on federal lands and waters. The next sale is scheduled for March 2021, making it an early test case for the new administration.

Meanwhile, the Trump administration is pressing ahead with plans to open up for oil development a section of the Arctic National Wildlife Refuge. The Department of the Interior this week issued a Call for Nominations and Comments, asking companies to suggest and comment on which tracts they might be interested in bidding on. Legal and reputational risk, and the prospect of the area being immediately closed off again by the Biden administration, are expected to limit the level of interest from the industry.

Saudi Arabia’s sovereign wealth fund, the Public Investment Fund, has raised its stake in ACWA Power, the electricity generation and water desalination company, from 33.4% to 50%. The fund said the investment was part of its strategy “to support the development of the renewable energy sector within Saudi Arabia and to support the growth of national champions”.

Royal Dutch Shell has signed off on its first commercial hydrogen project in China.

Meanwhile Saudi Arabia, the world’s biggest oil exporter, has set its sights on becoming the world’s number one hydrogen exporter. What will be the world’s largest plant for producing “green” hydrogen, made by electrolysing water, is under development by Air Products in Saudi Arabia. However, Wood Mackenzie analysts have forecast that “grey” hydrogen, produced from natural gas, will continue to be the country’s cheapest source until around 2040.

The Biden administration could be good news for nuclear power in the US. A Democratic administration, working with a Senate where Republicans are in control or centrist Democrats hold the balance of power, will have to look to make progress with energy technologies that have bipartisan support, and nuclear power is one of them.

Arizona has shown another example of bipartisan co-operation on climate and energy policy. Its regulator has approved a rule requiring that the state’s utilities must generate all their power from carbon-free sources by 2050. The initiative was led and supported by Republican commissioners on the Arizona Corporation Commission.

And finally: For everyone staying in and looking for home entertainment, an energy-related movie recommendation. Last year Nikola Tesla was fictionalised in a so-so film about Thomas Edison and George Westinghouse, called The Current War. Now, recently arrived for home viewing, there is new film about him called Tesla, starring Ethan Hawke as the eponymous hero. The trailer makes it look a lot of fun. Still, it is hard to imagine anyone topping David Bowie’s imagined version of Tesla in Christopher Nolan’s brilliant The Prestige.

Other views

Gavin Thompson — What is carbon-neutral LNG?

Guy Bailey and Ashish Chitalia — Can chemical recycling make plastic more sustainable?

Luke Parker and Greig Aitken — E&Ps through the energy transition

Camilla Cavendish — Climate diplomacy is winning its fight against a zero-sum mindset

Clyde Russell — Australia shows reality of renewables beating the hopes of gas

Quote of the week

“This is an industry that’s not in favour with shareholders. And it wasn’t in favour before Covid, primarily because returns to shareholders have been poor. The industry has not been a good steward of capital over the past decade, and we’ve got to improve returns. Covid has only deepened our commitment… [At the same time] we have to recognise, and we fully embrace the fact, that the world is looking for a lower-carbon energy system in the future. And if you want to be successful in the energy system longer term, you need to be part of a lower-carbon energy future.” — Mike Wirth, chief executive of Chevron, in an interview at Wood Mackenzie’s online energy summit explained his four-word summary of the group’s strategy: “Higher returns, lower carbon”.

Chart of the week

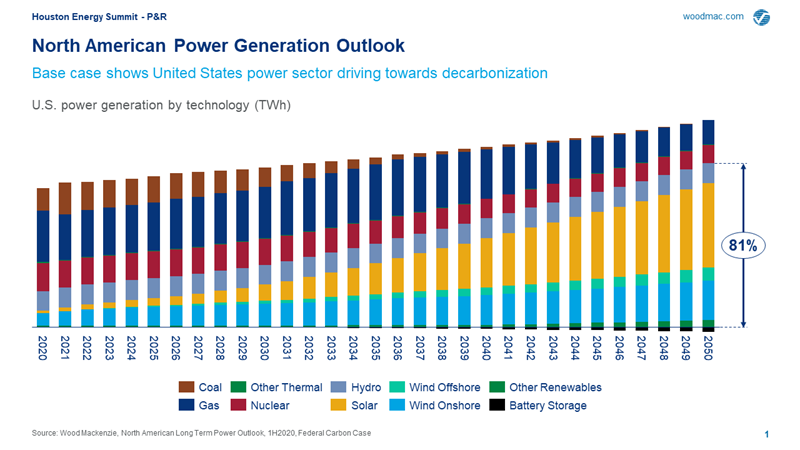

This is taken from a slide that I presented this week, provided by Dan Shreve from Wood Mackenzie’s power and renewables team. It shows our projection for the fuel mix in US power generation over the next 30 years, in our base case forecast. You can see how additions of new wind and solar capacity are expected to dominate investment in power generation, and how coal-fired power is set to dwindle away to almost nothing in the 2030s. The 81% on the right is the proportion of US electricity that we expect to be generated from renewable sources in 2050.

The projections are particularly striking because this is our base case, not reflecting the additional push from policy needed to meet the goal of the Paris climate agreement to limit global warming to “well below” 2°C. If the US did implement those policies, the growth of renewables and the decline of coal would be even faster.