EU wind pledges: a little overblown?

Lofty ambitions, particularly for onshore growth, face the reality of industry headwinds

3 minute read

Aaron Barr

Global Head, Onshore Wind Energy Research

Aaron Barr

Global Head, Onshore Wind Energy Research

Latest articles by Aaron

-

Opinion

Supply shortages and an inflexible market give rise to high power transformer lead times

-

Opinion

EU wind pledges: a little overblown?

-

Featured

Wind 2024 outlook

-

Opinion

Onshore wind energy: what to look for in 2024

-

Opinion

IRA set to increase cumulative US wind energy installations by over 50% in the next five years

-

Opinion

The Inflation Reduction Act and its impact so far

Zoe Grainge

Principal Analyst, Northern and Western European Wind

Zoe Grainge

Principal Analyst, Northern and Western European Wind

Latest articles by Zoe

-

Opinion

The outlook for European power and renewables

-

Opinion

Is European power rising to the challenge of decarbonisation?

-

Opinion

EU wind pledges: a little overblown?

The EU’s wind action plan requires member states to make voluntary, non-binding wind energy pledges for 2024-2026, to demonstrate commitment to ramping up deployment. But while near-term goal setting sends positive market signals, will the sector be able to meet ambitious promises for greater adoption?

Our EU wind analysts have evaluated the country-level pledges so far submitted against our own detailed forecasts for wind capacity growth in the bloc. Fill in the form to access the full insight, or read on for an overview.

In total, 21 of the 27 current member states of the EU have so far submitted at least pledges regarding additional wind capacity – Croatia, Hungary, Luxembourg, Malta, Slovenia and Sweden have yet to comply. We have compared these pledges against our own estimates for onshore and offshore capacity additions by country, calculated using our proprietary Lens Power platform.

Without urgent action, sector headwinds will lead the industry to miss aggressive pledges

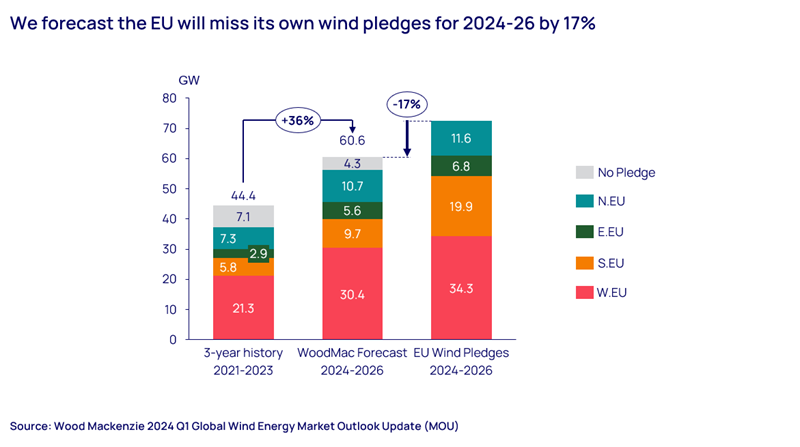

We forecast 36% overall capacity growth in the EU wind sector from 2024 to 2026 compared to the previous three-year period from 2021 to 2023. While that sounds healthy, it’s well below the 60% growth represented by the pledges submitted under the bloc’s wind action plan. As a result, the total of overall pledges would be missed by 17% (see chart below).

To make good progress towards countries’ frankly ambitious targets, particularly for onshore capacity growth, a series of headwinds must be addressed. These include permitting, transmission, supply chain and cost challenges.

Let’s explore in a little more detail why – as things stand - ambitious EU Wind Pledges may not be met:

Onshore: why ambitious near-term pledges are unlikely to be met

Many EU member states have pledged significant additions to their onshore wind capacity by 2026. These countries aim to ensure they can meet longer-term goals set under their individual 10-year national energy and climate plans (NECPs), which outline how EU member states intend to meet the bloc’s 2030 energy and climate targets. In total, announced pledges amount to 65.7 GW, comfortably exceeding the 58.2 GW needed to meet countries’ NECP pledges. Western and southern Europe lead the charge, making up almost 50 GW of the total.

Spain’s ambition stands out, with policymakers promising to double all-time annual onshore additions in the next two years. However, based on our analysis of the existing project pipeline, permitting constraints and transmission limitations, we expect only 43% of this pledge to be met.

Meanwhile, though still significant, Germany’s pledge actually represents a five-gigawatt (5 GW) downgrade from its original plan for the period of 28.6 GW. Despite this, we expect bureaucratic bottlenecks will mean Germany falls significantly short of its goal, which is 67% higher than our forecast for capacity additions in the country.

Some smaller member states have made aggressive pledges. For example, Estonia, Latvia and Romania have committed to 3.8 GW of additions by the end of 2026 – although this follows a three-year period when a mere 187 megawatts (MW) were installed.

In contrast, despite adding 2.6 GW over the past three years, the Netherlands has pledged just 400 MW of new onshore capacity to the end of 2026 – a total that we expect to be comfortably surpassed. Due to land constraints, Dutch policy makers are instead focusing on nearshore and offshore. Finland is also likely to significantly exceed its government’s (admittedly modest) pledges, thanks to a large pipeline of permitted projects and efficient grid connection procedures. Other countries that should make the grade are France, Greece and Ireland.

Offshore: pledges largely align with our forecasts for project completion

As well as the countries named above that have failed to submit any overall wind pledges, Germany, Italy and Lithuania have made no specific pledges for offshore. Meanwhile, a number of member states have made a ‘zero pledge’ for offshore, promising no capacity will be added at all. These include Belgium, Bulgaria, The Czech Republic, Estonia, Greece, Ireland, Latvia, Romania and Slovakia.

While our forecasts indicate that 18% of pledges for 2024 to 2026 won’t be connected in that period, pledges are largely aligned with the capacity of major projects we forecast for completion. Much of the discrepancy lies in the fact that 1.2 GW of offshore capacity was either already connected in 2023, or is unlikely to come online until after 2026 (you can access more detail on this aspect in the insight).

Learn more

Don’t forget to fill out the form at the top of the page to download your complimentary copy of the full insight, which includes a wide range of charts and supporting data examining the topic in more detail.