An ADNOC trilogy: the tortuous path to gas self-sufficiency

Expanding horizons: ADNOC's recent gas industry ventures and global ambitions

6 minute read

Dalia Salem

Senior Research Analyst, Middle East Upstream

Dalia Salem

Senior Research Analyst, Middle East Upstream

Dalia is responsible for upstream research with a focus on UAE and Oman.

Latest articles by Dalia

-

Opinion

Can the Iraq-Turkey pipeline logjam be cleared?

-

Opinion

An ADNOC trilogy (part 3): big gas ambitions

-

Opinion

An ADNOC trilogy (part 2): building a gas nation

-

Opinion

An ADNOC trilogy: the tortuous path to gas self-sufficiency

-

Opinion

Drilling down into the UAE’s exploration renaissance

Alexandre Araman

Director, Middle East Upstream

Alexandre Araman

Director, Middle East Upstream

Alexandre has global experience in commercial research, upstream valuations and supply and demand analysis.

Latest articles by Alexandre

-

Opinion

Iraqi gas production increasing as flaring levels fall

-

Opinion

Can the Iraq-Turkey pipeline logjam be cleared?

-

Opinion

An ADNOC trilogy (part 3): big gas ambitions

-

Opinion

An ADNOC trilogy (part 2): building a gas nation

-

Opinion

An ADNOC trilogy: the tortuous path to gas self-sufficiency

-

Opinion

The Middle East steps on the gas

Abu Dhabi National Oil Company (ADNOC) has embarked on a long transformation journey to become a self-sufficient, international gas player. Three significant moves in the last few months illustrate this evolution:

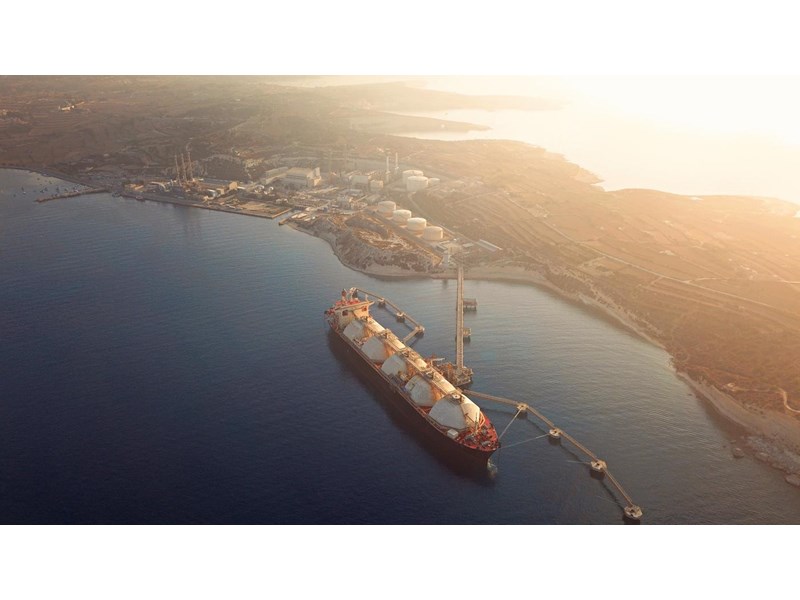

- The plan to construct two new LNG trains in Ruwais and triple its export capacity.

- The establishment and partial floating of ADNOC gas.

- The non-binding offer to take East Mediterranean-focused NewMed Energy private with BP.

In the first part of this trilogy of insights, we have created three gas supply scenarios for the United Arab Emirates (UAE) to assess the likelihood of achieving self-sufficiency in gas supply. In the second part, we delve into ADNOC’s past to understand how the company’s gas strategy has evolved throughout the years. In the third part, we conduct an in-depth study of the new gas projects. Read on for an introduction to the first insight, The tortuous path to gas self-sufficiency.

A radical transformation

At the heart of the UAE’s energy strategy is the target to become gas self-sufficient by 2030, a couple of years before the Dolphin contracts expire. The country has been dependent on its smaller neighbour since 2008, with around 1.9 bcfd of gas imports flowing though the 48-inch, 364-kilometre dolphin pipeline to fulfil the needs of its rapidly growing population. Dubai also imports LNG periodically to satisfy its peak demand, especially during the hot summer months.

With the dolphin contracts set to expire in less than a decade, the country has made significant strides in harnessing its resources to grow production. But the remaining resources are neither easy nor cheap to develop. The commitment to self-sufficiency is driving ADNOC to examine all options which include more costly and complex ultra-sour gas, unconventional shale gas and gas cap developments.

As part of its Energy Strategy 2050, the UAE has also plans to reduce its dependency on gas for power and diversify its energy mix. Gas demand for power generation is already decreasing as the combined nuclear and solar shares are increasing. In 2024, the total nuclear capacity will increase to 5.6 GW, displacing the equivalent of 1 bcfd of gas. We thus expect the domestic gas demand to remain flat in the short to medium term.

To adapt to the changing political, energetical and environmental landscape, ADNOC has also embarked on a transformation journey to become a competitive and international player across the gas value chain. It established ADNOC Gas in December 2022 to consolidate its gas processing and LNG businesses under one business unit. It then listed a 5% stake in ADNOC Gas in March 2023 and raised US$2.5 billion.

In April 2023, ADNOC and BP made a US$2 billion non-binding offer to take East Mediterranean-focused NewMed Energy private. This is ADNOC’s first international upstream deal and positions the company as a global gas player with access to the East Mediterranean gas market. A deeper analysis of ADNOC’s gas history and transformation will be covered in the second part of the trilogy.

In 2028, the gas output will spike at the expense of reinjected volumes as the new LNG facility in Ruwais is set to become operational. The planned 9.6 mmtpa LNG facility will require an additional 1.5 bcfd of feedgas. The country could then face gas shortages if no new project comes on stream by the end of the decade and the Dolphin contracts are not renewed.

So how can ADNOC continue to fulfil domestic demand, triple its LNG export capacity and halt gas imports from Qatar in nine years?

Diverse but expensive growth projects

The straightforward answer lies in new gas developments. Most of these growth projects are still in the planning and design stage and final investment decisions (FIDs) must be awarded imminently to avoid delays. The current high-cost environment has introduced new challenges, casting doubts on the size of the projects and the planned start-up dates.

High costs are indeed behind the recent cancellation of the pre-construction service agreements for Hail and Ghasha. The project is a critical piece of the gas self-sufficiency puzzle as ADNOC is targeting 1 bcfd of sales gas from these ultra-sour offshore fields.

The Abu Dhabi giant is also betting big on its gigantic unconventional resources with a mandate to produce 1 bcfd from Ruwais Unconventional by 2030. Well results haven’t been very encouraging so far.

The gas caps of the giant Umm Shaif and Bab fields also contain significant resources. ADNOC began investigating the feasibility of codeveloping the gas caps on top of the oil rings. But the simultaneous development of both oil and gas is inherently complicated and could lead to pressure imbalances and the potential loss of oil production.

These new sources of non-associated gas (NAG) are all expensive, leading to significantly higher costs of feed gas for the new LNG plant. For Ruwais LNG to be competitive, controlling the upstream and plant costs is essential. Securing attractive prices from contractors under a high inflationary environment and a stretched supply chain is challenging. That led ADNOC to abandon the idea of Fujairah for the location of its new plant and stick to Ruwais. Ruwais has an established infrastructure and is close to the gas fields and the nuclear power plant.

Apart from the expensive and technically complicated NAG projects, a boost in associated gas is expected as part of ADNOC’s plan to increase oil production capacity to 5 million b/d by 2027 (project 5). But volumes available for the market will depend on the reinjection needs to maintain pressure in the oil reservoirs. ADNOC has been exploring CO2 injection which could reduce the reliance on dry gas for injection and free up more volumes for the domestic market.

ADNOC has also an active exploration programme. Several blocks that were awarded in the 2018 and 2019 licensing rounds. Early results are promising, and Eni has already announced a new gas discovery, XF‑002, in the Offshore 2 block. The Italian Major estimates gas-in-place volumes between 2.5 to 3.5 trillion cubic feet (tcf) and is currently evaluating fast-track development options.

What could the future look like?

We have considered all the growth projects discussed in the previous section and created three supply scenarios based on the likelihood of these projects moving forward, starting up on a specific date and producing at a certain level.

In our base case scenario, the UAE gas market remain well-balanced until July 2032, when the Dolphin contracts expire and piped imports cease to flow. The country then faces a subsequent supply gap. Gas imports for few additional years are required to supply the domestic market and continue LNG exports.

In our worst case scenario, gas shortages start as early as 2027, long before the Dolphin contracts expire. Major growth projects face important delays due to the high-cost environment and supply chain pressures. Gas shortages push ADNOC to choose between its 5 million b/d oil target, its gas self-sufficiency goal and its LNG ambitions.

If all the stars align, the country achieves its gas self-sufficiency target. In our best case scenario, ADNOC starts the post-dolphin era with important gas oversupply. This excess gas could even justify further LNG expansions. This scenario, however, requires mega investments across all growth projects, fast-tracked execution, and strong operational performances.

Look out for the next part of this trilogy, coming soon.

The supply scenarios with data, charts, and quantitative analysis, are available to the subscribers of our Middle East coverage.

Lens Gas & LNG

Our powerful data analytics solution for exploring industry data alongside leading expertise, analyses, and modelling insights to enable faster, more accurate operational and strategic planning and portfolio management decisions.

Learn More