An ADNOC trilogy (part 2): building a gas nation

From pioneering beginnings to promising horizons: tracing the evolution of UAE's gas industry and ADNOC's future trajectory

8 minute read

Alexandre Araman

Director, Middle East Upstream

Alexandre Araman

Director, Middle East Upstream

Alexandre has global experience in commercial research, upstream valuations and supply and demand analysis.

Latest articles by Alexandre

-

Opinion

Iraqi gas production increasing as flaring levels fall

-

Opinion

Can the Iraq-Turkey pipeline logjam be cleared?

-

Opinion

An ADNOC trilogy (part 3): big gas ambitions

-

Opinion

An ADNOC trilogy (part 2): building a gas nation

-

Opinion

An ADNOC trilogy: the tortuous path to gas self-sufficiency

-

Opinion

The Middle East steps on the gas

Dalia Salem

Senior Research Analyst, Middle East Upstream

Dalia Salem

Senior Research Analyst, Middle East Upstream

Dalia is responsible for upstream research with a focus on UAE and Oman.

Latest articles by Dalia

-

Opinion

Can the Iraq-Turkey pipeline logjam be cleared?

-

Opinion

An ADNOC trilogy (part 3): big gas ambitions

-

Opinion

An ADNOC trilogy (part 2): building a gas nation

-

Opinion

An ADNOC trilogy: the tortuous path to gas self-sufficiency

-

Opinion

Drilling down into the UAE’s exploration renaissance

In this second part of our Abu Dhabi National Oil Company (ADNOC) trilogy, we take an in-depth look at the history of the UAE’s gas industry to understand the key events and trends that are shaping its future.

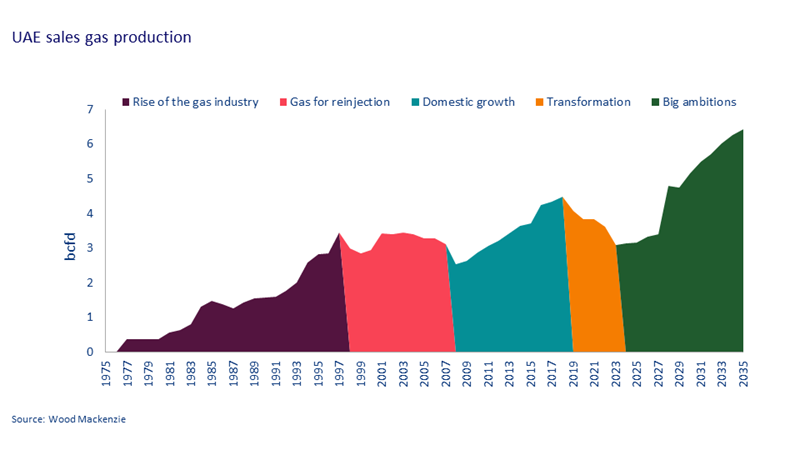

1977-1997: rise of the gas industry

Exploration in the UAE began in the 1950s and led to a string of massive oil discoveries in Abu Dhabi. Domestic gas demand was non-existent at the time and gas was considered an undesired by-product that was flared.

In the early 1970s, ADNOC boldly decided to build the region’s first LNG export terminal on Das Island, offshore Abu Dhabi. At a time when very few countries had commercial LNG plants, the move was driven by the late Sheikh Zayed’s directive to mitigate unnecessary flaring at oil fields. The ADGAS (now ADNOC LNG) liquefaction plant kick-started gas production and export in the country and turned Abu Dhabi into one of the pioneers of LNG.

Gas supply into the domestic market started in the early 1980s with the GASCO joint venture (JV) agreement. While the offshore associated gas fed the LNG plant, the onshore associated gas fed the domestic market through a separate gas infrastructure.

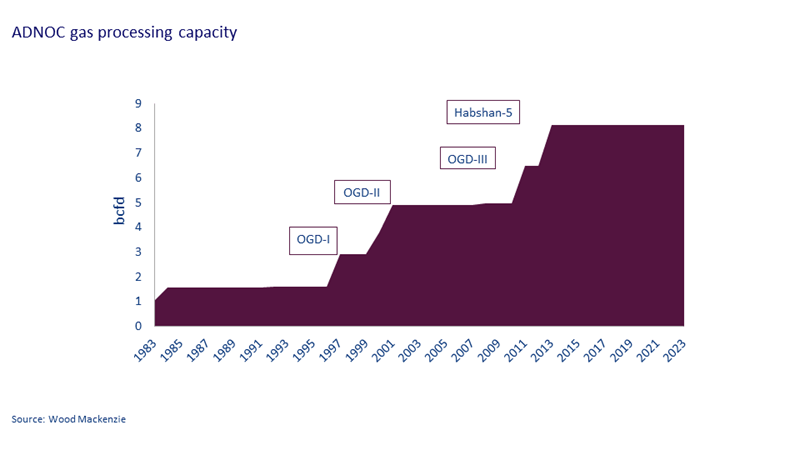

Demand for gas continued to rise, both for domestic use and LNG export. ADNOC responded by ramping up gas development and production. In 1991, ADNOC launched the Onshore Gas Development (OGD) programme and executed it in phases to develop more non-associated gas resources from the Bab field.

1998-2006: gas injection

In 2001, Atheer's assets were merged into GASCO. The merger more than doubled the size of GASCO, which continued to expand its facilities. OGD-2, the second phase of the OGD commissioned in 2001, transformed Habshan into one of the world’s largest gas processing plants at the time, with a total capacity of around 3 bcfd.

Abu Dhabi’s gas reinjection needs were also expanding along with oil production growth. A considerable portion of GASCO’s gas was used for reinjection at ADNOC Onshore’s fields. Dry gas reinjection is vital in pressure support to maximise oil and condensate recovery. It is also essential in balancing the UAE’s gas market with ADNOC having the flexibility to increase or reduce volumes in response to variabilities in domestic demand.

2007-2018: domestic growth

Since its foundation in 1971, the UAE’s population swelled steadily at 5% to 7% per year for more than three decades. But in 2006, the population exploded at three times that rate. In 2007 and 2008, population growth reached almost 20% for two consecutive years, driven by an influx of new residents in Dubai and strong gains in the construction sector. Demand for gas surged with the population increase. Gas for power generation was vital for cooling the expanding cities of Dubai and Abu Dhabi, especially during the hot summer months.

Gas imports from Qatar via the Dolphin pipeline started in 2007 to meet the fast-growing demand. Qatar developed a dedicated sector of the North Field to export 1.9 bcfd to the UAE via a 600-kilometre subsea pipeline.

Starting in 2010, on top of the piped volumes from Qatar, the UAE also imported LNG. Dubai LNG imports peaked at 3 mmtpa in 2016. Abu Dhabi also started to buy LNG that year, but volumes were minimal and inconsistent.

Even with imports from Dolphin and LNG, local gas production was still insufficient to meet the strong demand growth. In 2008, GASCO renewed its agreement for another 20 years, and in 2013, a new plant, Habshan 5, was commissioned.

ADNOC also started to develop its expensive sour gas resources. In 2011, Occidental entered the Shah Gas Development project with a 40% stake. Shah began producing in 2015 and was the region’s first ultra-sour gas development.

2019-2023: transformation

ADNOC's 2030 strategy released in 2016, a year after the Paris Agreement, doubled down on oil growth, but also marked the start of a transformational journey to become a competitive international gas player and a growing developer of renewables and low carbon power.

Shift towards renewables

Starting 2019, the growing share of solar and nuclear energy helped to reduce the reliance on gas for power generation. With falling domestic demand and no additional capacity to export gas, sales volumes started to decrease. The first reactor of the Barakah nuclear power plant came onstream in August 2020. Two additional reactors have since commissioned and demand is now expected to drop further as the fourth reactor starts commercial operation in 2023. Total nuclear capacity will increase to 5.6 GW, displacing the equivalent of 1 bcfd of gas.

In 2020, the European Majors announced decarbonisation targets and plans to become net zero by 2050. ADNOC joined its European partners and started embracing the energy transition. It added sustainability goals to its 2030 strategy, including a commitment to reduce carbon emissions intensity by 25% by 2030 and a net zero target by 2050.

In 2021, ADNOC and TAQA formed a green energy venture aiming for at least 30 GW of renewable energy capacity by 2030. ADNOC also signed an agreement with Emirates Water and Electricity Company (EWEC) to have its grid power solely supplied by nuclear and solar sources. In 2022, ADNOC became the first major oil and gas company to fully decarbonise its onshore grid power and position itself among the world’s lowest Scope 1 and 2 carbon emitters.

Qatar diplomatic crisis

The Qatar diplomatic crisis began in June 2017 when the UAE, Saudi Arabia, Egypt and Bahrain unexpectedly severed diplomatic relations with Qatar and imposed a blockade on the peninsula. The repercussions of this crisis on ADNOC’s gas strategy started to be visible a year or two later. Although Dolphin’s imports were never affected, the crisis highlighted the UAE’s energy dependence on its smaller neighbour. ADNOC has always been aware of the Dolphin supply contract’s end date in 2032 and the need to renegotiate at much higher prices or to walk away and rely on other energy sources.

With the diplomatic crisis, it became politically and strategically more important for the UAE to have domestic alternatives, even if more expensive ones. In November 2019, the Supreme Petroleum Council (SPC) announced the goal of gas self-sufficiency by 2030.

Coronavirus pandemic

The coronavirus pandemic and lockdown plunged the global economy into deep contraction. The massive destruction of oil demand worldwide and the subsequent oil price crash in March 2020 showed how important it was for the country to partially diversify its revenues away from oil. For ADNOC, this meant becoming a more prominent LNG exporter and a more significant player in downstream, chemicals and new energies.

In 2021, ADNOC LNG initiated pre-FEED for a new 9.6 mmtpa LNG export terminal to boost its LNG capacity to 15.2 mmtpa. After evaluating several options, Ruwais was finally chosen as the optimal location for the new trains, mainly because of its proximity to existing gas pipelines, infrastructure and future gas growth projects. The proximity to the Barakah nuclear power plant and the Al Dhafra solar plant is another advantage, particularly as the new LNG plant is designed with electric-powered facilities that will run on nuclear and solar power.

Russia/Ukraine conflict

The Russian invasion of Ukraine in February 2022 drastically reduced the Russian gas supply to Europe. In May 2022, ADNOC decided to move ahead to the design stage for a new 9.6 mmtpa LNG export facility at a critical time of market upheaval and rising demand, as Europe was looking to replace Russian gas volumes. ADNOC should triple its LNG exports once this new LNG plant comes on stream, which we assume will be in 2028, and we expect additional long-term agreements to be signed with European buyers.

The last critical step of ADNOC’s new gas strategy was the establishment of ADNOC Gas in December 2022 to consolidate the gas processing and LNG businesses under one business unit. ADNOC Gas has access to over 10 bcfd of gas processing capacity, roughly 700 kboe/d of liquids processing capacity and 5.8 mmtpa of LNG export capacity. The new LNG facility in Ruwais is currently outside ADNOC Gas’s scope. However, ADNOC Gas expects to be allowed to acquire the project before starting commercial production.

Abraham accords

The Abraham Accords – a series of joint normalisation statements initially between Israel, the UAE and Bahrain – radically changed the political landscape of the Middle East. The establishment of diplomatic relations between Israel and the UAE marked the first instance of Arab–Israeli normalisation since 1994.

In April 2023, ADNOC and BP offered to buy 50% of Israel's NewMed Energy for US$ 2billion. . If approved, this would be the largest-ever deal signed between Israel and the UAE, resulting in ADNOC and BP owning 50% of NewMed Energy. The offer enabled by the Abraham Accords is ADNOC’s first international upstream deal and positions the company as a global gas player with access to the East Mediterranean gas market. Few months later, in August, ADNOC announced the acquisition of 30% equity stake in the Absheron gas field in Azerbaijan from TotalEnergies and SOCAR. We were expecting ADNOC to enter a new gas play. The Absheron deal is a confirmation and continuation of ADNOC's evolution.

2024 -2035: big ambitions

Following its radical transformation, ADNOC will need to consolidate and expand because the reality is that the UAE needs more gas. The country has abundant gas resources, but their development will neither be easy nor cheap. The commitment to gas self-sufficiency is driving ADNOC to examine all available options to push for more gas: exploration, ultra-sour gas projects, gas caps, unconventional resources or even reducing gas re-injections.

The full story with data, charts, and quantitative analysis, is available to the subscribers of our Middle East coverage.

In the third and final part of the trilogy explores a technical and commercial look at ADNOC’s new gas growth projects to assess their strengths and weaknesses and evaluate the threats and opportunities. This insight will be available soon.