Drilling down into the UAE’s exploration renaissance

ADNOC has aggressive decarbonisation targets under a strategy that includes, somewhat counterintuitively, oil and gas growth and a renewed emphasis on licensing and exploration

4 minute read

Dalia Salem

Senior Research Analyst, Middle East Upstream

Dalia Salem

Senior Research Analyst, Middle East Upstream

Dalia is responsible for upstream research with a focus on UAE and Oman.

Latest articles by Dalia

-

Opinion

Can the Iraq-Turkey pipeline logjam be cleared?

-

Opinion

An ADNOC trilogy (part 3): big gas ambitions

-

Opinion

An ADNOC trilogy (part 2): building a gas nation

-

Opinion

An ADNOC trilogy: the tortuous path to gas self-sufficiency

-

Opinion

Drilling down into the UAE’s exploration renaissance

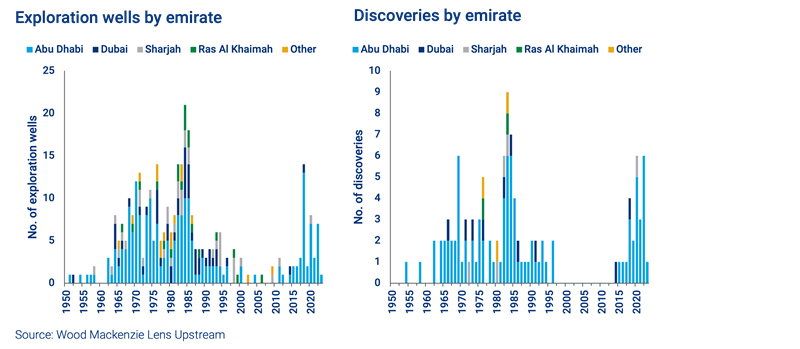

The United Arab Emirates ranks among the world’s top resource-rich nations. Oil and gas exploration began in the 1950s and led to a string of massive discoveries that continue to underpin the country’s hydrocarbon industry. By the mid-1980s, nearly 150 billion boe had been discovered. But as other economic priorities emerged, exploration took a back seat, with activity diminishing after 1985.

Today, the UAE is refocusing its strategy. National oil companies – such as the Abu Dhabi National Oil Company (ADNOC) – still lag the Majors on the decarbonisation journey and are under growing pressure to pick up the pace. Different NOCs are taking different approaches. ADNOC has aggressive plans to decarbonise its oil and gas operations, while also, somewhat counterintuitively, aiming to grow production and unlock the full potential of its resources.

ADNOC’s ambitious growth targets have sparked a renewed emphasis on licensing and exploration – including by foreign companies. The idea is that new discoveries could be more cost effective and less carbon intensive than existing resources, and better align with the emirate’s sustainable growth plans.

In a recent report we examined the UAE’s exploration renaissance, and its strategy going forward. Fill in the form to see a short film in which we use Lens Upstream to explore the findings. And read on for an introduction.

ADNOC’s grand plans

ADNOC’s production has risen significantly since its early exploration success. In 2019, the company produced a record 3.5 million b/d of crude oil and, for a brief period in April 2020, over 4 million b/d. Abu Dhabi has ambitious plans to ramp up crude oil production capacity to 5 million b/d. The target date was originally 2030, but this has been brought forward to 2027.

The UAE is also aiming for gas self-sufficiency by 2030, with ADNOC aggressively pursuing gas growth projects. The country currently depends on pipeline imports from Qatar to supplement domestic gas production. The start of power generation at Abu Dhabi’s Barakah nuclear plant and the ramp up of solar capacity is reducing domestic gas needs.

Nevertheless, ADNOC is pursuing ventures that will require more feedgas in the medium term, raising the bar for self-sufficiency. These include a new 9.6 mmtpa LNG export facility at Fujairah and a 1 mmtpa blue ammonia plant at Ruwais.

The return to exploration

ADNOC has the resources, finances, technical and operational capability, as well as a strong track record behind its ability to drive growth. It has top-tier international oil companies as partners, sharing expertise and costs across its different concessions. But despite these favourable conditions, achieving and sustaining its oil and gas production targets could be a stretch. Growth is expected to come from the large concessions, but this might not be sufficient. Marginal fields, unconventional resources and exploration will need to contribute.

Starting in 2018, ADNOC ramped up exploration activity again with the aim of unlocking the full potential of its resources. Its efforts extended to launching the world’s largest continuous seismic survey to cover the entire Abu Dhabi emirate, onshore and offshore, with high-resolution 3D images at ultra-deep locations.

How does exploration fit with ADNOC’s long-term strategy?

For ADNOC, exploration is a critical piece of its long-term growth story. It underpins the creation of supply options that could contribute to reserve replacement and help sustain production at the higher baseline level for longer. And as ADNOC’s remaining resources (specifically gas) are either unconventional or sour – exploration could potentially unlock low-cost, low-carbon molecules and reduce reliance on these less advantaged resources.

Open for exploratory business

In addition to pressing ahead with its own exploration activities, Abu Dhabi has opened up its exploration space to foreign entities. It launched its first-ever licensing bid round in 2018. Six exploration blocks were offered, with some containing discovered resource opportunities, as well as 110 prospects and leads. Five blocks were awarded to international oil and gas companies including Eni, Occidental, Inpex and others.

Following the success of the first round, ADNOC launched a second in 2019, offering five blocks that cover most of Abu Dhabi’s unlicensed acreage. Three of the blocks were awarded to incumbents. The fourth and final award went to a consortium led by Pakistan Petroleum Limited.

Despite Abu Dhabi’s tough fiscal terms resulting in tight margins for investors, the stable political environment, advantaged geology, and low-cost and low-carbon resources underpin the emirate’s attractiveness for companies looking to explore. Almost all oil and gas-bearing plays in the UAE have been identified in the Rub al Khali basin, one of the largest and most prolific basins in the world. It ranks as the world’s top basin by remaining resources with over 600 billion boe. It also aligns with our definition of an energy super basin, which in addition to having abundant resources, offers opportunities for clean energy and carbon capture, use and storage (CCUS) development. And with an extensive 3D seismic survey, and ample nearby infrastructure, risks are comparatively low.

See Lens Upstream in action

To learn more about this topic, fill in the form at the top of the page to access a short film that uses Lens Upstream to examine the recent surge in exploration activity and an overview of the recent discoveries.