An ADNOC trilogy (part 3): big gas ambitions

ADNOC’s gas self-sufficiency strategy relies on the development of ultra sour, unconventional, and gas cap resources – but the cost and complexity are impeding progress

8 minute read

Dalia Salem

Senior Research Analyst, Middle East Upstream

Dalia Salem

Senior Research Analyst, Middle East Upstream

Dalia is responsible for upstream research with a focus on UAE and Oman.

Latest articles by Dalia

-

Opinion

Can the Iraq-Turkey pipeline logjam be cleared?

-

Opinion

An ADNOC trilogy (part 3): big gas ambitions

-

Opinion

An ADNOC trilogy (part 2): building a gas nation

-

Opinion

An ADNOC trilogy: the tortuous path to gas self-sufficiency

-

Opinion

Drilling down into the UAE’s exploration renaissance

Alexandre Araman

Director, Middle East Upstream

Alexandre Araman

Director, Middle East Upstream

Alexandre has global experience in commercial research, upstream valuations and supply and demand analysis.

Latest articles by Alexandre

-

Opinion

Iraqi gas production increasing as flaring levels fall

-

Opinion

Can the Iraq-Turkey pipeline logjam be cleared?

-

Opinion

An ADNOC trilogy (part 3): big gas ambitions

-

Opinion

An ADNOC trilogy (part 2): building a gas nation

-

Opinion

An ADNOC trilogy: the tortuous path to gas self-sufficiency

-

Opinion

The Middle East steps on the gas

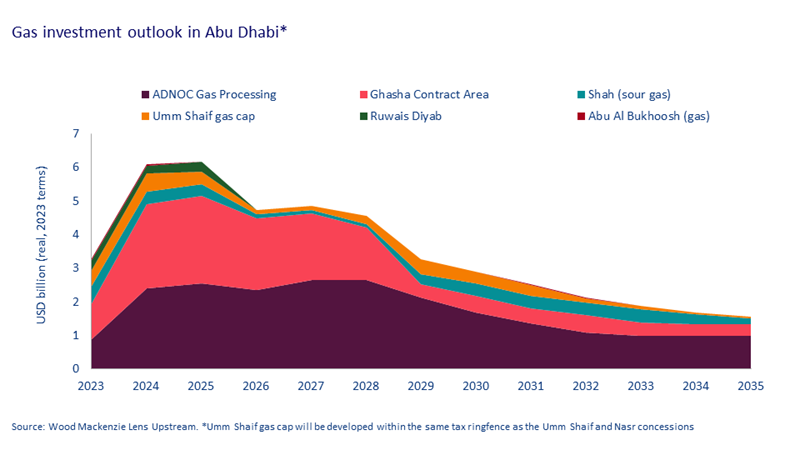

In the finale of our trilogy, we take an in-depth look at the future of the UAE’s gas industry and the main projects contributing to its growth. If all are approved for investment, and executed with no delays, only then can the UAE add 3 bcfd of gas before the expiration of the Dolphin contracts and achieve its gas self-sufficiency target.

UAE: abundant gas resources – but development is challenging.Following its radical transformation, Abu Dhabi National Oil Company (ADNOC) will need to consolidate and expand – because the reality is that the UAE needs more gas to become self-sufficient. The country has abundant gas resources, but their development will neither be easy nor cheap.

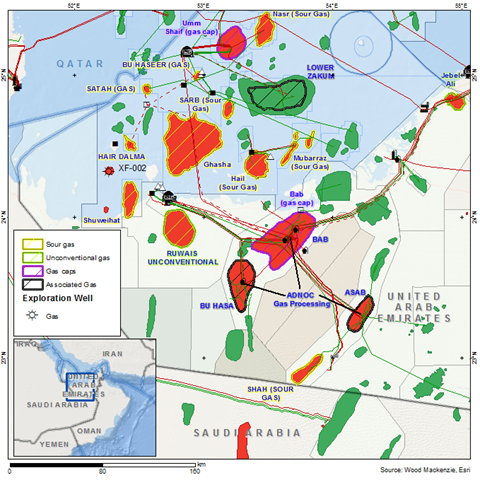

The commitment to self-sufficiency is driving ADNOC to examine all options in its push for more gas. Its growth strategy, approved by the Supreme Petroleum Council in 2018, relies on the development of ultra-sour gas, unconventional and gas cap resources. Associated gas expansion is also expected to contribute as well as exploration and new discoveries.

ADNOC is moving swiftly to advance on all fronts via mega development projects, ambitious production targets and IOC partnerships. But the complex and expensive nature of these resources has derailed progress with escalating costs and final investment decision (FID) delays.

Sour gas

Ghasha contract area

The Ghasha development is a critical piece of the self-sufficiency puzzle, with a target to produce 1 bcfd of sales gas before 2030. The concession contains nine offshore fields not deemed commercial at the time of discovery due to the ultra-sour nature of the gas. Several of the reservoirs feature H2S concentrations of up to 30%, presenting a major technical challenge.

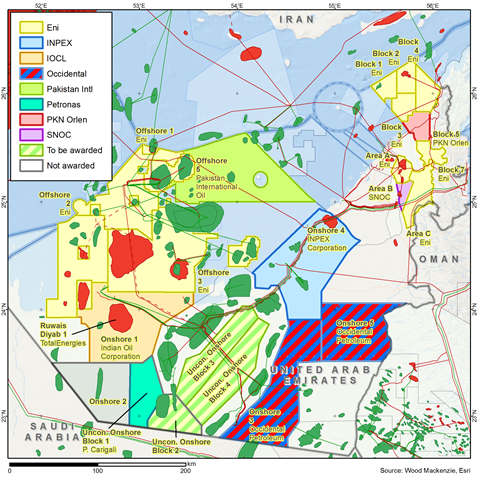

The IOC partners include Eni (25%), Wintershall (10%), OMV (5%) and Lukoil (5%), leaving ADNOC with 55% – instead of its usual 60%. The high costs associated with an offshore ultra-sour gas development, the sulphur handling requirements and the typically low domestic gas prices result in challenging economics with initial cost estimates of around US$20 billion.

The first phase (Dalma) is set to produce from three satellite fields. Two engineering, procurement, and construction (EPC) contracts were awarded in February 2020, only to be cancelled two months later due to the coronavirus pandemic and the subsequent oil price crash. In 2021, ADNOC re-awarded the main Dalma contracts, with development work expected to be complete in 2025, contributing around 250 mmcfd of sales gas at plateau.

The second largest phase (Hail and Ghasha) is expected to produce around 800 mmcfd of sales gas but is yet to reach FID. In a bid to optimise costs and increase efficiency, ADNOC initiated an updated front-end engineering and design (FEED) in 2021. This was followed by the award of two pre-construction service agreements, but these were cancelled in May 2023 as costs spiralled. With contracts unlikely to be awarded this year, the project’s timeline is now in doubt. We don’t expect it to start before 2028.

Shah expansion

The Shah Gas Development is operated by ADNOC Sour Gas, a joint venture between Occidental (40%) and ADNOC (60%). It is Abu Dhabi's largest operational sour gas project and provides around 15% of its sales gas production (excluding gas used for reinjection). The field is extremely challenging to develop and operate because of its ultra-sour nature. Wellhead gas includes around 23% H2S and 10% CO2, requiring high specification components and metal alloys due to corrosion.

Since the project was commissioned, capacity has been expanded by 20% to around 1.26 bcfd of raw gas, thanks to a low-cost debottlenecking programme. In 2021, another expansion phase was sanctioned to increase capacity to 1.45 bcfd. It was successfully completed in May 2023, resulting in record daily production rates.

ADNOC is now pushing a third expansion which would boost the plant’s total capacity to 1.85 bcfd. If approved, sales gas volumes could potentially increase from 740 to 940 mmcfd. The project is still being evaluated, but we understand a tender for the FEED contract covering surface facilities could be launched soon.

Unconventional gas

Ruwais Diyab

The emergence of massive discovered unconventional resources has prompted ADNOC to move away from its core conventional capabilities. But testing of the first wells at the Ruwais Diyab unconventional gas block revealed huge risks and cast doubt on ADNOC’s plan to produce 1 bcfd from the concession by 2030.

TotalEnergies was awarded a sub-area of the block (Area B), with a target to produce 300 mmcfd by 2027. A preliminary development plan involves leasing a 100 mmcfd processing facility and drilling up to 53 wells to evaluate the area before committing to full field development.

A key issue is the subsurface. Drilling and hydraulic fracking require significant optimisation to improve flow rates and reduce costs. The lack of liquids to support the economics presents another challenge. Higher gas prices are required for the project to be commercial. Considerable de-risking and flow improvement are also needed, but, even then, the project’s operational performance and commercial viability remain uncertain.

Jebel Ali

Jebel Ali is a shallow biogenic gas play with no defined structure. The self-generated gas is believed to be adsorbed into the solid matrix or associated with the formation water. Just like coalbed methane, gas is produced from fractures and the amount of water coproduced is very high compared to conventional gas wells.

To produce the tight gas, multilateral horizontal wells and hydraulic fracturing are needed. Further analysis, including geomechanical studies, is required to better estimate the volume of gas ultimately recoverable. We understand appraisal wells have been drilled and there was a plan to have a small-scale pilot. But the implied cost of gas is very high, and we believe a commercial development in the foreseeable future is highly unlikely.

Gas caps

Umm Shaif gas cap

Significant resources are contained within the gas cap of the giant offshore Umm Shaif field. ADNOC has been investigating the simultaneous development of both oil and gas, which is inherently complicated, with potential pressure imbalances and loss of oil. Co-development is particularly challenging due to the presence of significant condensate volumes, requiring full gas recycling initially to accelerate condensate recovery.

TotalEnergies is leading the development of the Umm Shaif gas cap, which was envisioned to start production by 2025. The project nearly took FID in 2020 before being delayed because of the oil price crash. As of now, it is struggling to progress due to challenging economics and persistent inflation, and the start-up date remains very uncertain.

Bab gas cap

ADNOC is also evaluating the development of the Bab gas cap on a sole risk basis. BP – the asset lead for the Bab field – had previously conducted studies to produce 500 mmcfd from the gas cap. In its latest prospectus, ADNOC Gas announced plans to develop a 1.9 bcfd facility to process volumes from the Bab gas cap by 2027 at the earliest.

But even if the project’s potential has been revised, most of the gas will have to be reinjected. Sales gas volumes will be limited, at least throughout the first phase of the development. We understand the project is in the pre-FEED stage with major assessment work required before FID.

Associated gas

In addition to gas self-sufficiency, ADNOC is working to increase its oil production capacity to 5 million b/d by 2027. This expansion will bring additional volumes of associated gas from fields including ADNOC Onshore and Lower Zakum. Associated gas produced at ADNOC Onshore is processed at ADNOC Gas Processing, which is now part of ADNOC Gas. A FEED contract was recently awarded for the expansion of existing facilities to handle up to 1 bcfd of additional associated gas. We estimate a sales gas increment of between 250 and 500 mmcfd.

At Lower Zakum, oil production will increase to 520,000 b/d by 2027, leading to a boost in associated gas. In 2022, ADNOC awarded a US$548 million contract to build a new main gas line that will enable raw gas production to increase by an additional 300 mmcfd. A new offshore gas processing platform is also planned.

But while associated gas is cheaper to produce than other resource themes, its link to oil output can result in production limitations due to OPEC cuts. Last June, Abu Dhabi secured a 200,000 b/d increase to its OPEC+ production baseline which is now sitting at around 3.2 million b/d. It is likely to negotiate a further future increase given its massive investment to expand its oil capacity to 5 million b/d.

Exploration

ADNOC’s ambitious production targets have driven the NOC to revive exploration activities in Abu Dhabi. Two licensing rounds were launched in 2018 and 2019 and a total of nine blocks were awarded to IOCs. Gas exploration is especially important to find new advantaged resources that could potentially reduce the reliance on expensive gas projects.

Early results have been promising for Eni with a new gas discovery, XF-002, on its Offshore 2 block. Gas-in-place volumes are estimated between 2.5 and 3.5 tcf and testing indicated the gas is sweet, compared to neighbouring Hair Dalma and Ghasha. A fast-track development plan is under evaluation and could offer a valuable signpost of the commerciality of gas exploration in UAE from new blocks.

Accelerating the development of new gas resources will be essential to support ADNOC’s growth plans. The proximity of existing infrastructure offers tie-back options for some of the discoveries. But as production from nearby fields ramps up, spare processing capacity will be limited and new infrastructure could be required.