Trade actions and supply chain challenges steal spotlight from strong US solar deployments

Solar prices increase across every market segment for the first time in at least seven years

1 minute read

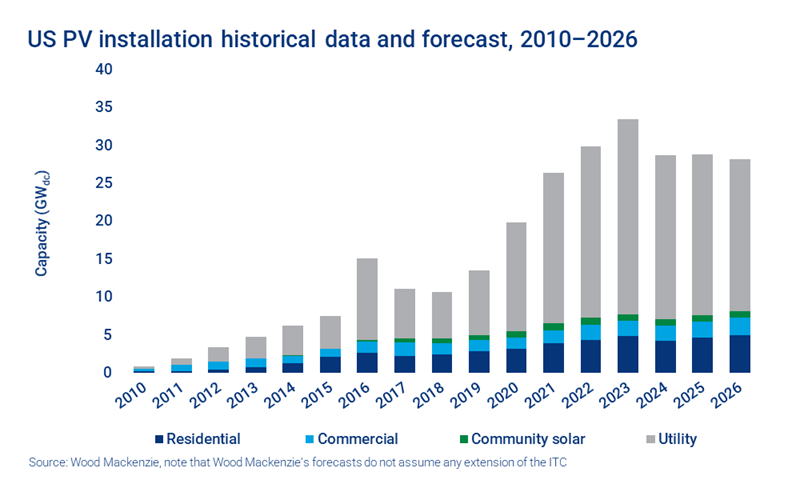

Another quarter of record solar deployments is in the books. Deployments reached 5.7 gigawatts (GWdc) of installed capacity across all market segments in Q2 2021 – the largest Q2 on record. Installations in Q2 brought the 2021 total to nearly 11 GWdc through the first half of the year. But this hardly tells the full story. In Q2, it became more apparent how continued supply chain constraints and trade action headwinds are negatively impacting the US solar industry.

A full analysis of each market segment, including our five-year outlooks, can be found in our US Solar Market Insight Q3 2021 report, created in collaboration with the Solar Energy Industries Association (SEIA). Complete the form for a complimentary copy of the 18-page executive summary. Or read on for the key highlights.

Amidst a growing market, the industry is experiencing increased prices from supply chain challenges

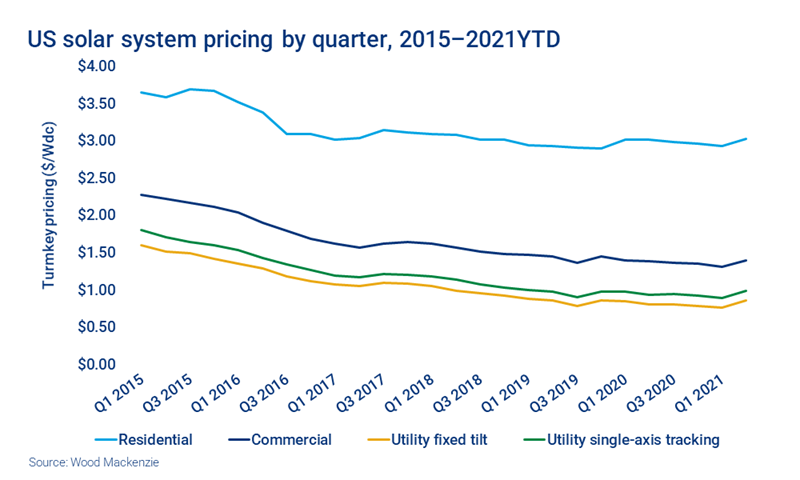

Our solar team has documented procurement delays and price increases for components and raw materials in past quarters. These issues persist and have finally led to quarter-over-quarter and year-over-year system price increases across all market segments in Q2 2021 – the first time such a trend has occurred in at least seven years.

The utility-scale segment has experienced the greatest system price increases. Fixed-tilt system pricing increased 12.5% quarter-over-quarter, while single-axis system pricing increased 11.6% over the same time period. Utility-scale projects are more exposed to cost increases for equipment (namely, modules), raw material inputs, and freight costs.

Distributed solar projects also saw increased system prices, but equipment represents a smaller portion of the overall cost stack for residential and commercial projects. These projects also source a higher share of equipment domestically compared to utility-scale projects, so they are better insulated from freight cost increases.

Note that pricing has increased in past quarters (in Q3 2017 thanks to module price increases from limited global tier 1 module capacity available to the US market, and in Q4 2019 and Q1 2020 as more developers began utilizing more expensive mono PERC modules), but total system pricing has never increased both QoQ and YoY across all market segments before Q2 2021.

The response to system price increases varies by developer and market segment

Some developers are renegotiating PPAs, while others are keeping existing contracts in place and taking a hit to project margins. Customers currently attempting to contract for new projects are facing higher prices. This is forcing developers to cut costs where possible. Some have added contract language to hedge for future equipment price increases.

Equipment delays are causing headaches across all segments. Some commercial and utility-scale projects will see completion dates get pushed from 2021 into 2022. Residential installers report multi-week procurement delays, or they end up procuring different module brands and models than they were originally planning. Despite this, labor shortages and permitting issues remain the primary bottlenecks for the residential segment.

Recent trade actions could exacerbate supply chain constraints

The Withhold Release Order (WRO) on metallurgical-grade silicon (MGS) and proposed anti-dumping and countervailing duties (AD/CVD) introduce uncertainty and complexity to the already-struggling solar supply chain. Both of these issues present downside risk to our outlook for solar deployments.

In August, US Customs and Border Protections (CBP) began enforcing the WRO – which covers MGS sourced from certain companies that operate in China’s Xinjiang region – by detaining about 100 MW of equipment from a major module vendor. CBP requires a high burden of proof for vendors to show that they are not sourcing MGS from listed companies. While the first detainment impacted a relatively small amount of equipment, the situation is quickly evolving. We will be closely tracking how the scope of the WRO and the level of CBP’s enforcement changes in the coming weeks and months.

On top of the WRO, unnamed companies have petitioned the US International Trade Commission to impose AD/CVD rules on certain companies that use Chinese wafers for cell production in Malaysia, Thailand, and Vietnam. Currently, AD/CVD apply to Chinese crystalline silicon cells and modules. This new petition would greatly expand the application of AD/CVD. The exact impacts remain to be seen, but the petition certainly throws another curveball to the industry.

Federal policy action remains the key focus but outcomes are not set in stone

US Congress continues to consider two sweeping pieces of legislation – the bipartisan infrastructure bill and the budget reconciliation package. At this point, aside from investments in transmission buildout that the Senate passed in the infrastructure bill, most of the clean energy provisions have been moved to budget reconciliation which requires a simple majority in the Senate to pass.

The specific policies included in budget reconciliation are currently under development but could include an ITC and PTC extension, the creation of a standalone storage ITC, clean energy requirements for utilities, and direct pay provisions for the ITC and PTC. These policies, if enacted, would be some of the biggest market catalysts that the industry has ever seen and present tremendous upside to our forecast. Obstacles remain, however, and the scope of the bill partly depends on moderate Democrats’ appetite for spending.

Despite challenges, we maintain an optimistic outlook for US solar

As demand for solar remains strong across all market segments, Wood Mackenzie is forecasting greater than 30 percent year-over-year growth for the industry. Headwinds may delay projects or create challenges in the near-term, but we do not yet see any of the issues mentioned in this article resulting in significant demand destruction. Between supply chain challenges, trade actions, and federal policy efforts, the landscape is ever-changing. The US solar industry will be an eventful space to watch for the rest of 2021 and beyond.

The full report explores the US solar market in more detail. Fill in the form at the top of the page for a complimentary copy of the 18-page executive summary.