Wind power to play a key role in achieving China's carbon neutral goal

China to account for more than two-thirds of global grid-connected capacity by 2030

1 minute read

Xiaoyang Li

Director, China Renewables Research

Xiaoyang Li

Director, China Renewables Research

Xiaoyang focuses on analysis of China’s renewables power market

Latest articles by Xiaoyang

-

Opinion

Steadying the grid: why grid forming BESS technology is crucial to future renewable energy supply

-

Opinion

China’s solar & storage exports achieve record growth with more than 40% surge

-

Opinion

Expansion opportunities beckon for China’s wind companies

-

Opinion

Wind power to play a key role in achieving China's carbon neutral goal

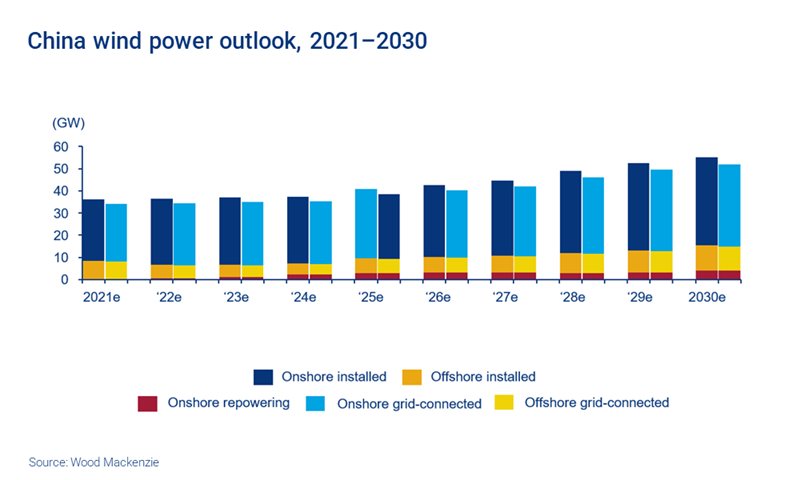

According to Wood Mackenzie’s new research China wind power outlook 2021-2030, China will reach a cumulative grid-connected wind capacity of 689 gigawatts (GW) by the end of 2030, accounting for 67% of global share.

Onshore wind maintains strong momentum

Stimulated by China’s target of 1,200 GW of wind and solar set for 2030, 408 GW of new capacity will be added from 2021 to 2030. Onshore wind comprises of 82% of the total during the outlook, with an average annual capacity of 33 GW.

Northern regions continue to dominate the onshore wind market due to favorable wind conditions and policies. In Inner Mongolia, Hebei and Shanxi provinces where newly-developed renewable energy bases are driving the high growth, state-owned developers sign GW-level development contracts directly with local governments.

Apart from the new projects, a substantial volume of ageing turbines with legacy technology installed in the last decades represents a good opportunity for repowering activities. Relevant policies to address the feasibility and profitability of repowering in China are needed to unleash the repowering market potential, which is expected to hit 24 GW capacity by 2030.

Favorable policies and healthy pipeline to support the outlook

A series of policies were released to support sustained wind market growth following China’s 2060 target announced in September 2020. These include the 2030 renewable capacity targets, annual renewable portfolio standard (RPS) targets, and benchmarked on-grid tariffs to stabilise onshore wind project profitability after subsidies ended in 2020.

There is a sufficient onshore wind project pipeline to support China’s 10-year outlook. The number of renewable bases more than tripled from 25 to 78 from H2 2020 to H2 2021, amounting to 260 GW of total capacity being planned and under construction across 14 provinces.

Established onshore wind supply chain and larger-scale wind turbine models will allow onshore wind power LCOE (levelised cost of electricity) to decrease by 46% from 2021 to 2030 and drop below coal power’s on-grid tariffs in 2022.

Intense competition in the carbon-neutral arena

Wind power is not the only winner under the national target but is challenged by lower-cost solar power in the post-subsidy era. The low initial investment for solar projects contributes to a low market-entry threshold and more diversified market players compared to wind projects, which are preferred by state-owned developers.

Hybrid projects are becoming more mainstream. The government is encouraging development of integrated wind-solar-storage-hydro-thermal projects to alleviate the pressure on the grid network and to support substantial renewable energy online.

Fill out the form at the top of the page to download an extract of the full report.