Big Oil is back buying upstream assets

Targets are gas and strengthening core positions

3 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

Unlocking the potential of white hydrogen

-

The Edge

Is it time for a global climate bank?

-

The Edge

Are voters turning their backs on the EU’s 2030 climate objectives?

-

The Edge

Artificial intelligence and the future of energy

-

The Edge

A window opens for OPEC+ oil

-

The Edge

Why higher tariffs on Chinese EVs are a double-edged sword

Greig Aitken

Director, Corporate Research

Greig Aitken

Director, Corporate Research

With over 12 years of experience, Greig brings a holistic view of corporate activity to the upstream M&A research team.

Latest articles by Greig

-

Featured

Upstream M&A 2024 outlook

-

Opinion

What does the Chevron-Hess deal mean for oil and gas?

-

The Edge

Big Oil: upstream M&A gets serious

-

The Edge

Big Oil is back buying upstream assets

-

Featured

Will we see an upstream M&A revival in 2023?

-

Opinion

Is private equity the buyer the upstream M&A market has been looking for?

Scott Walker

Senior Research Analyst, Corporate Research

Scott Walker

Senior Research Analyst, Corporate Research

Scott has nearly a decade of experience across M&A and corporate analysis in the upstream oil and gas sector.

Latest articles by Scott

-

Featured

Upstream M&A 2024 outlook

-

Opinion

Size matters: which International E&Ps are best positioned to ride out industry consolidation?

-

The Edge

Big Oil is back buying upstream assets

-

Opinion

Harbour and Talos in merger discussions – what are the drivers?

-

Featured

Will 2022 be a buoyant year for upstream M&A activity? | 2022 Outlook

Upstream M&A activity is inversely correlated to commodity price volatility. The extreme movements in gas and oil prices killed dealmaking last year, with buyers and sellers unable to align on price. This year, prices are more settled and M&A activity, while still at relatively modest levels, is picking up. Buyers have emerged, but they are choosy and on the lookout for good-quality assets.

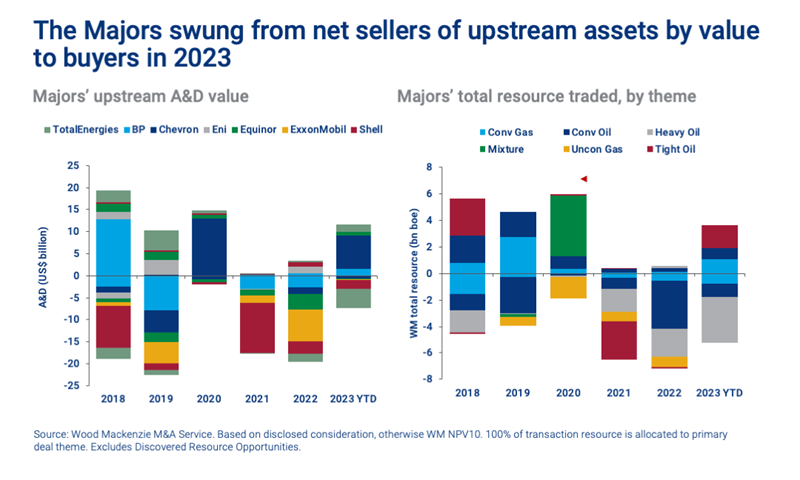

A big feature is the return of the Majors to the buy-side in 2023. The invasion of Ukraine has underlined the importance of energy security and the need to develop oil and gas supply for some years yet. The Majors have been active sellers of non-core assets to right-size portfolios over the last few years. But now political and investor sentiment has shifted, and they have been given some latitude to build again in upstream. Moreover, after a bonanza year or two, the companies are well-placed to do deals with cash or, in the case of US Majors, the optionality to use higher-rated equity.

The deals done so far by the Majors have been material in scale, but not transformational. Demonstrating value is key – capital discipline still rules, and no buyer wants to destroy hard-won, but still fragile, investor confidence. Deals must also make sense strategically. Gas, the more resilient fuel in most transition scenarios, has been a prominent target.

Greig Aitken and Scott Walker of our M&A team identified two themes driving deals so far in 2023.

Strengthening the core portfolio:

Chevron has acquired PDC for US$7.6 billion in an equity-financed deal, securing a big position in Colorado’s DJ Basin. It also complements the Major’s existing exposure of comparable size.

Chevron's rationale? Diversification – more gas for Chevron’s heavily oil-weighted global portfolio and US Lower 48 basin diversity. The deal dilutes its giant Permian position – PDC adds around 10% by value to Chevron’s core US Lower 48 NPV. It also brings economies of scale, including US$400 million in capex efficiencies, and leaves the Major less exposed to Permian cost inflation.

As important is the value opportunity. Chevron is buying a business on a much lower multiple than its own, despite PDC’s strong growth profile. As an indicator of its financial strength, Chevron’s share buyback programme will have repurchased all the shares issued for the deal within two quarters at the current run rate.

TotalEnergies acquired CEPSA’s upstream assets in UAE in March 2023, valued by WoodMac at US$1.68 billion. TotalEnergies' rationale? The deal bolsters the French Major’s position in Abu Dhabi, adding to its existing long tail of projects in the country. The deal also places advantaged low-cost, low-emissions Middle East oil barrels at the core of TotalEnergies’ strategy (adding close to 50,000 boe/d to its net oil production in the country) and strengthens its longstanding partnership with ADNOC.

Upstream transition deals:

Eni announced the acquisition of Neptune Energy (US$4.9 billion) on 23 June. Eni's rationale? Neptune’s gas-weighted portfolio fits with the Italian Major’s goal to replace its Russian gas imports by 2025, and lifts gas from below 50% of total production today to 60% by 2030. There’s a deal within a deal, with Neptune’s assets in Norway to be purchased by Eni’s 63%-owned Norwegian subsidiary, Var Energi. Neptune’s Indonesia, Australia, Egypt and Algeria assets complement Eni’s positions in those markets.

BP and ADNOC each acquired 25% of NewMed Energy in March 2023, with BP’s investment US$1.4 billion. BP's rationale? Increased exposure to East Mediterranean gas through NewMed’s giant Leviathan field (in production) offshore Israel and future projects, including Aphrodite in Cyprus. There’s the intriguing prospect of whether this rare IOC/NOC partnership leads to more deals in future.

Finally, what’s next?

The Majors will do more upstream M&A, with others also getting in on the action. Shell’s Capital Markets Day earlier this month signalled it still has an appetite in upstream, Chevron needs even more diversity in its portfolio in our view and Equinor may consider filling a gap in its project pipeline after the slippage of its big Canadian projects.

ExxonMobil, currently focused on organic investment in Guyana and the Permian, has one advantage over others it could bring to the M&A market – its premium-rated equity.