Sign up today to get the best of our expert insight in your inbox.

How renewables are changing power markets

…and what it means for flexible power and energy storage

3 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

Unlocking the potential of white hydrogen

-

The Edge

Is it time for a global climate bank?

-

The Edge

Are voters turning their backs on the EU’s 2030 climate objectives?

-

The Edge

Artificial intelligence and the future of energy

-

The Edge

A window opens for OPEC+ oil

-

The Edge

Why higher tariffs on Chinese EVs are a double-edged sword

Low-carbon power supply is one of the great growth themes of the energy transition. But along with growth will come a profound change in the power mix. Variable renewables will become the dominant source of electricity, displacing the versatile and flexible fossil fuel-based generation most markets rely on today. Chris Seiple, our US-based Vice Chair Power and Renewables, visited clients in Europe last month and shared his thoughts with me on how the extraordinary events of 2022 will shape power markets for years to come.

First, 2022 was a shot in the arm for low-carbon power generation. Solar and onshore wind were already competitive on costs with other sources of generation and the scaling up of capacity was well underway. For the first time, investment in renewables exceeded upstream oil and gas in 2021. Then came Russia’s invasion of Ukraine, which quickly propelled energy security to the top of the agenda. Government policy hardened in support of domestic renewables and electrification as part of the longer-term solution. The ramp-up of capacity will now move into overdrive.

The policy targets are daunting. The European Union’s REPowerEU objectives require close to 70% of its power supply from renewables in 2030. Current annual capacity additions of wind and solar of 50 GW will have to rise to over 100 GW by the end of the decade to meet these targets, presenting an enormous investment opportunity. We project that Europe will only reach 65% – still a huge change on current levels of around 45%.

Growing appetite from companies for power purchase agreements (PPAs) will help finance the accelerated build-out. The universe of corporate buyers has moved beyond those just interested in decarbonising their businesses. Many companies now see renewables PPAs as a means of securing less volatile and competitive prices. Some have started to look at 24/7 PPAs with renewables twinned with energy storage.

Second, decarbonisation is changing the pricing dynamics of flexible power. Gas and coal-fired generators have traditionally competed on cost in the flexible market. At high gas prices, coal is more competitive and vice versa.

Irrespective of deferred retirals in 2022, the trend is for the continued closure of carbon-intensive coal plants in the US, Europe and elsewhere. And as more coal-fired capacity exits, the price elasticity of gas burn in power is disappearing. With no alternative flexible fuels, markets are forced to turn to gas plants for support, almost irrespective of price. The risk is that power markets become hostage to gas prices – whenever power producers move to buy gas in a tight gas market, severe electricity price volatility is inevitable.

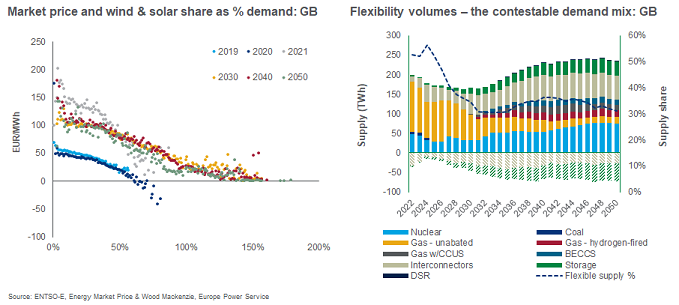

The rising share of variable renewables will make flexible power more valuable. Our modelling suggests that by 2030, power output from wind and solar in Great Britain will be 50% higher than demand in some hours; at other times, there will be too little. The very high prices during Europe’s 12-day wind drought in March 2021 were a window into the future value of flexibility, even in the daily to-and-fro of variability. Extreme weather events are also likely to be more frequent in future.

Power markets will need more investment in flexible power plant, energy storage and interconnections to balance the evolving mix. Increasing demand-side flexibility will play an import role, too. In Europe, insufficient attention is paid to bringing battery storage into the market. We expect that to change, led by government mandates to develop storage similar to those driving wind and solar capacity growth.

Third, policy to reduce reliance on China in the solar and energy storage supply chains is advancing rapidly. The US Inflation Reduction Act has already led module manufacturers to announce more than 50 GW of new manufacturing capacity. The EU’s response will come through its European Green Deal Industrial Plan and the implementation of the Carbon Border Adjustment Mechanism in October 2023.

Overcoming China’s cost competitiveness will be challenging – we estimate that Chinese-made panels are nearly 40% cheaper to produce than European ones. The coming policy changes in Europe will make management of the supply chain a factor of strategic importance for C-suite in renewable energy developers.

Finally, the market design that has governed deregulated electricity markets for nearly 30 years ago is under close scrutiny after consumer prices soared in 2022. The primary focus is on alternatives to the price-setting mechanism that rewards even lower cost supply from renewables with the wholesale price set by high fossil fuel prices.

Structural reform is on the table, with the UK’s ongoing Review of Electricity Market Arrangements and the EU’s more modest proposal of a more contract-driven market. If an investment shortfall in new plant is to be averted, clarity is essential – and soon.