How to tackle the upcycle’s big challenges

Cost inflation, supply chain disruption and ESG

1 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

Unlocking the potential of white hydrogen

-

The Edge

Is it time for a global climate bank?

-

The Edge

Are voters turning their backs on the EU’s 2030 climate objectives?

-

The Edge

Artificial intelligence and the future of energy

-

The Edge

A window opens for OPEC+ oil

-

The Edge

Why higher tariffs on Chinese EVs are a double-edged sword

It’s boom time again. Producers across energy and natural resources are reaping the benefits of the new upcycle. Rising commodity prices are the big driver, but the record earnings and free cash flow generation being delivered this results season have been hard-earned after companies made good use of the downturn to cut costs.

Will they last or could these margin-boosting gains shrink under the pressure of the extraordinary supply chain challenges unfolding in 2022? And what can companies do to ensure their supply chain meets the ESG requirements that stakeholders increasingly expect?

First, cost inflation and the risk of supply chain disruption.

Generally, costs fell sharply across energy and natural resources sectors over the last decade, albeit for different reasons. Technology advances and the scaling-up of renewables have led to a halving of solar and offshore wind costs.

In oil and gas, budgets shrunk after prices crashed in 2014. Suppliers cut capacity to stay alive and, in a buyers’ market, operators were able to drive a hard bargain. Some EPC contractors accepted more risk to win business, committing to deliver projects on budget and on schedule or suffer financial penalties. Upstream got lean and costs were pared back, unit development costs falling 66% from US$12/boe in 2015 to US$4/boe in 2020.

With demand picking up in the strong economic recovery, the tide is turning. Developers in oil and gas and renewables depend heavily on overseas manufacturers for everything from solar panels to steel pipes. They are exposed to rising costs, supply chain disruption and execution delay; and EPC contractors who are less willing to take on financial risk. All these factors threaten project economics.

The upstream oil and gas sector is already experiencing a squeeze in parts of the supply chain. Suppliers, still operating at reduced capacity, can’t readily respond to a pick-up in activity. The US Lower 48 is experiencing increased costs for tubulars (higher steel prices), workover rigs, pressure pumping and water, all of which are on the up. Labour shortages are also evident across much of the market. Workers lost in the downturn haven’t come back. Similar themes have begun to emerge in hot spots globally.

In renewables, the ongoing ramp-up in investment for a secular shift in the power energy mix is exacerbating cyclical cost pressures. For solar, costs are up across the supply chain – modules, trackers, cables, and construction and labour. For wind, it’s steel, logistics and freight.

The threat to already thin margins has been reflected in the stock market: shares of Jinko Solar (modules) and Array Technologies (trackers), both top three global solar manufacturers, fell by almost one-third in Q4 2021. Vestas, Europe’s biggest renewables manufacturer, has lost 39% in the past six months.

Second, meeting the challenge of ESG requirements in the supply chain.

ESG risks include water stress and deforestation as well as climate change (environmental); indigenous peoples’ rights and child labour (social); and democratic governance and corruption (governance). Scrutiny is intensifying across the energy and natural resources sectors. The shift to electrification and new low-carbon technologies over the next few decades will entail huge investment in mineral resources and manufacturing in countries with significant ESG risk.

Assurance around ESG measures is already critical for companies to access finance. Stakeholders essentially want to know about two things: greenhouse gas emissions through the value chain and the ethical sourcing of materials and components.

Third, protecting asset owners’ margins and reputations from the challenges of rising costs, supply chain disruption and ESG.

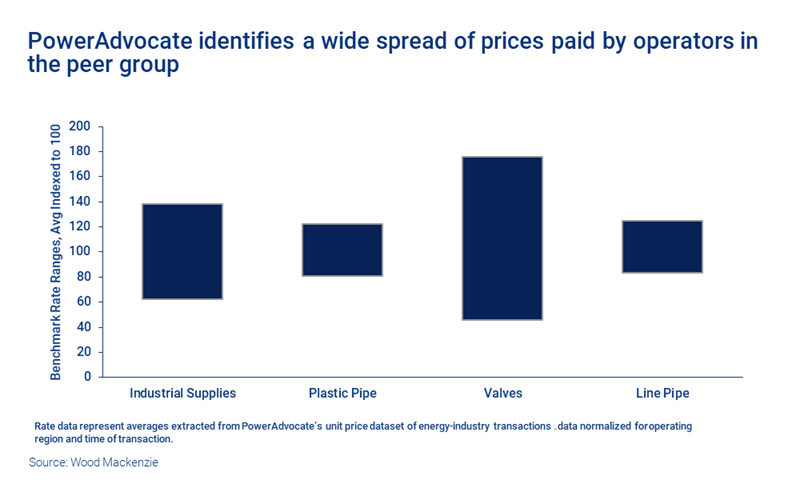

Shawn Curley, Vice President of Wood Mackenzie’s sister company, PowerAdvocate, thinks the starting point is access to reliable, actionable data to help companies understand and manage the impact of price inflation and supply chain disruption. In the past, benchmarking data has been hard to come by because so much data is proprietorial.

PowerAdvocate has a database built up over 20 years across oil and gas, power and renewables, and metals and mining supply chains. The data platform enables companies to track and mitigate cost inflation risk, compare their contract pricing and cost performance to peers in the market and identify ESG risk in their global supply chain.

Mitigating the cost and business continuity risk arising from supply chain disruption is a key application. Companies can also identify alternative suppliers with the lowest impact on cost and delivery times. That way, they can be sure they are getting the best possible deal with their suppliers at the lowest possible risk, not missing out on a potential source of competitive advantage.

This kind of data and insight hasn’t been available in the past. Combining data from PowerAdvocate and Wood Mackenzie opens a new window for companies to manage the evolving geopolitical risks in their supply chain. Companies need to maintain a laser focus on their cost and ESG performance as they negotiate this new commodity upcycle and the energy transition.