Why the Permian is set for a shakeout

Motives for both the tight oil ‘haves’ and ‘have nots’

1 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

Unlocking the potential of white hydrogen

-

The Edge

Is it time for a global climate bank?

-

The Edge

Are voters turning their backs on the EU’s 2030 climate objectives?

-

The Edge

Artificial intelligence and the future of energy

-

The Edge

A window opens for OPEC+ oil

-

The Edge

Why higher tariffs on Chinese EVs are a double-edged sword

The best accessible upstream growth opportunity in fifty years? US tight oil. Correction: the Permian Basin. Second correction: the Wolfcamp formation spread across the Delaware and Midland sub-basins.

It’s this play that drives most of the growth in tight oil, from 5 million b/d today to the 10 million b/d we forecast in the middle of next decade. No surprise then, that those already big in the play want more of it.

But does Concho Resources’ acquisition of RSP Permian for US$9.5 billion – the biggest deal yet – signal the start of Permian consolidation? I caught up with Ben Shattuck, Research Director, US Lower 48.

Q. Ben, is Concho doubling up on what it does best?

That’s the obvious answer. Merging two Permian tight oil specialists brings scale (the largest rig program in the Basin) and synergies that Concho estimates at US$2 billion. That’s a very ambitious target in our view to be extracted from rationalising central costs, high grading drilling inventory and leveraging technical expertise, such as longer laterals from larger pads.

Q. I thought operators were focused on value, not volume?

It’s against the trend of capital discipline that has been driven by investors in the last year. But Concho has a history of deal-making and this is an all-share deal. By using its higher-rated equity to buy the lower-rated RSP, the deal is balance-sheet neutral for Concho and, in the company’s view, earnings accretive. Concho will argue the deal is about value and volume.

Q. What are the risks in scaling up?

The Permian’s on fire right now, and Concho reckons the deal enhances its three-year outlook for production growth. RSP brings elite exposure to Midland/Delaware sweet spots, so Concho’s growth through 2020 is likely more robust. Less certain is what lies beyond – how the Permian plays out into next decade.

We have already cut our medium-term forecasts for the more mature Eagle Ford and Bakken plays. Operators have found as they moved out of the sweet spots that the geology proved tougher than expected, with much higher well costs.

RSP’s implied top-end take-out price of US$75,000/acre reflects the quality of its ‘sweet spots’ and related inventory. A key risk for Concho in the medium term is that these run dry and the geology beyond is tougher. Growth becomes more expensive to achieve and the premium rating it has won unwinds. Any prospective Permian aggregator faces this risk.

Q. Are you suggesting tight oil acquisitions could be defensive?

It’ll be a factor as the basin matures. Operators by now have a fair bit of experience of the Permian sweet spots. Most have had some years of monitoring well performance and can extrapolate what their future inventory might deliver – their growth prospects and value proposition.

Some may already have question marks as to their hopper’s capacity to sustain organic growth beyond much more than a few years. That’s when an acquisition to create value through cost efficiency may be the answer.

Q. So we’ll see more consolidation?

Yes, and for the ‘haves’ there will be synergies whether the growth comes through or not.

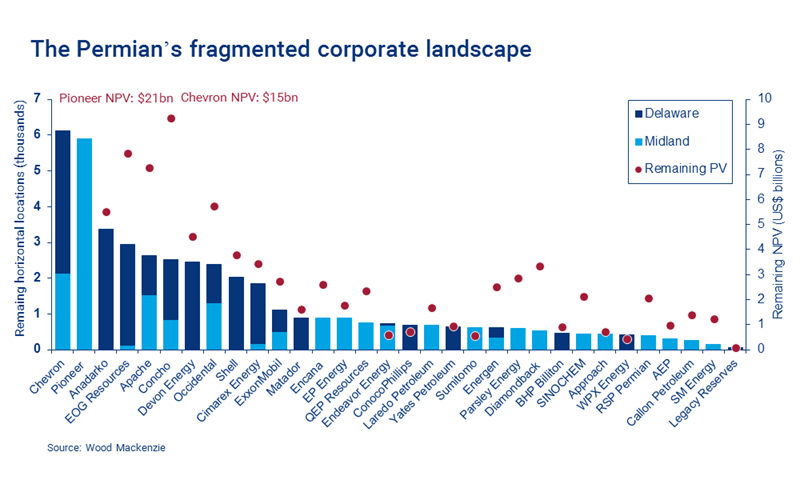

The Permian is still a fragmented market, with players large and small. We’re yet to see tight oil complete the transformation from its early days as a cottage industry to the full-scale industrialisation we ultimately expect.

Finance may be a restraining factor for some independents, which may not have the highly-rated equity Concho has to make the transaction arithmetic work.

Q. What about tight oil ‘have nots’ – will new entrants buy in?

Many big IOCs and NOCs that lack exposure to tight oil want in for portfolio diversification and to acquire the skill set. BHP Billiton’s portfolio is on the market and has Permian assets which would be a great starter pack.

Finance for new entrants isn’t the problem, but price is – how much to pay for the privilege when there may little or no synergies. Our analysis shows that it’s fiendishly difficult for a new entrant to an established unconventional play to create value.