Get in touch

-

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency -

Sonia KerrSonia.kerr@woodmac.com

+44 330 174 7267

Australia sees record volume of upstream M&A deals, despite regulatory turmoil

Australia upstream and LNG M&A transactions exceed US$7bn in 2023, yet risk index ticks upwards with unstable legal and fiscal landscape

3 minute read

LONDON/HOUSTON/SYDNEY, 9 November 2023 – The Australian market remains a top destination for global investors with a record volume of upstream and LNG merger and acquisition (M&A) deals in 2023, despite the last 12 months having been the most unstable legal and fiscal landscape seen in Australia for over a decade, according to Wood Mackenzie.

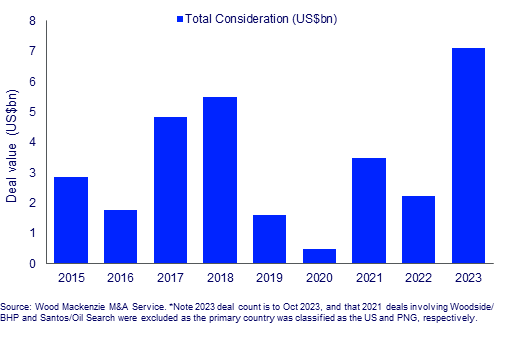

Angus Rodger, Vice President, SME Upstream APAC & Middle East said, “By October this year, we have seen more than US$7 billion spent on upstream transactions. It is particularly interesting that such a strong vote of confidence in the upstream sector be delivered against a backdrop of the most unstable legal, regulatory and fiscal landscape seen in Australia for over a decade.”

Upstream/LNG M&A activity in Australia, by year/announced deal consideration*

Recent M&A deals in Australia

Recent M&A deals in Australia include EIG and Brookfield's acquisition of Origin Energy, a bidding war in Perth for Warrego Energy, won by mining giant Hancock Energy, and Taiwanese firm CPC's purchase of a stake in Dorado. bp also acquired Shell's interest in the Browse development.

Angus said “most Australian deals are focused on LNG and domestic gas, such as EIG/MidOcean Energy’s move on APLNG, ConocoPhillips subsequently acquisition of an additional stake in the project, and Saudi Aramco then acquiring an interest in MidOcean. It’s interesting to note that Aramco made its first move towards becoming a global LNG player in an Australia-focused deal.”

And despite recent criticism from Tokyo that Australia’s investment climate was deteriorating, Japanese companies still closed two back-to-back upstream deals in August. LNG Japan (a 50/50 Sojitz and Sumitomo joint venture) acquired a 10% share in Woodside's Scarborough gas project, and TotalEnergies and Japan's INPEX acquired PTTEP's interest in the Cash/Maple fields, indicating continued investment in high-quality LNG assets and commitment to the country.

“Despite a more volatile risk environment, Australia is still attracting investment for a few key reasons,” said Angus. “Firstly, we can see companies are focusing on strengthening their LNG portfolios, demonstrating confidence that Australia’s world-class LNG assets will continue to play a key in the energy transition for decades to come. Secondly, tight conditions in domestic gas markets also creates opportunities, such as in the Perth basin hotspot. Lastly, it is worth noting that companies are not selling under current or perceived future duress - for deals with an announced consideration the asset pricing is at levels equivalent or higher than the global upstream average.”

Transactions in 2023 have seen both new entrants come into the Australia upstream sector, and existing players – such as TotalEnergies, ConocoPhillips and INPEX – strengthen their country positions. In our discussions with buyers and bankers, one message has come through consistently – while Australia may be slightly less attractive than it used to be, it is still far less risky than most other countries on their radar.

Increased M&A activity in Australia also comes at a time when the overall global market is picking up. The Majors, NOCs and North Asian players have all been more active buyers in 2023 than in previous years. This has in-part been driven by the invasion of Ukraine, which underlined the importance of energy security and the need to develop oil and gas supply for many years to come.

Anticipated deal landscape and potential challenges

Looking ahead, Wood Mackenzie anticipates more deals in the pipeline. Equity sell-downs of key assets, such as Scarborough, Crux, Narrabri, and Dorado, will likely be targeted by operators. Additionally, non-core and mature assets located offshore of Western Australia are likely to be put up for sale. M&A activities in the Perth basin are also expected to continue.

“We believe the asset market will continue to be active, but primarily for bigger, higher-quality and lower-risk assets – primarily in gas and LNG. The market for mature fields appears less competitive as decommissioning regulations tighten up,” said Angus.

The background political, legal and fiscal risks also cannot be ignored. The likelihood of more government intervention in domestic gas markets, and further delays in securing environmental approvals, are both high. If the regulatory volatility continues to increase, then it is inevitable that the M&A market will be impacted.