US non-residential storage system prices: Trends from 2019 to 2024

*Please note that this report only includes an Excel data file if this is indicated in "What's included" below

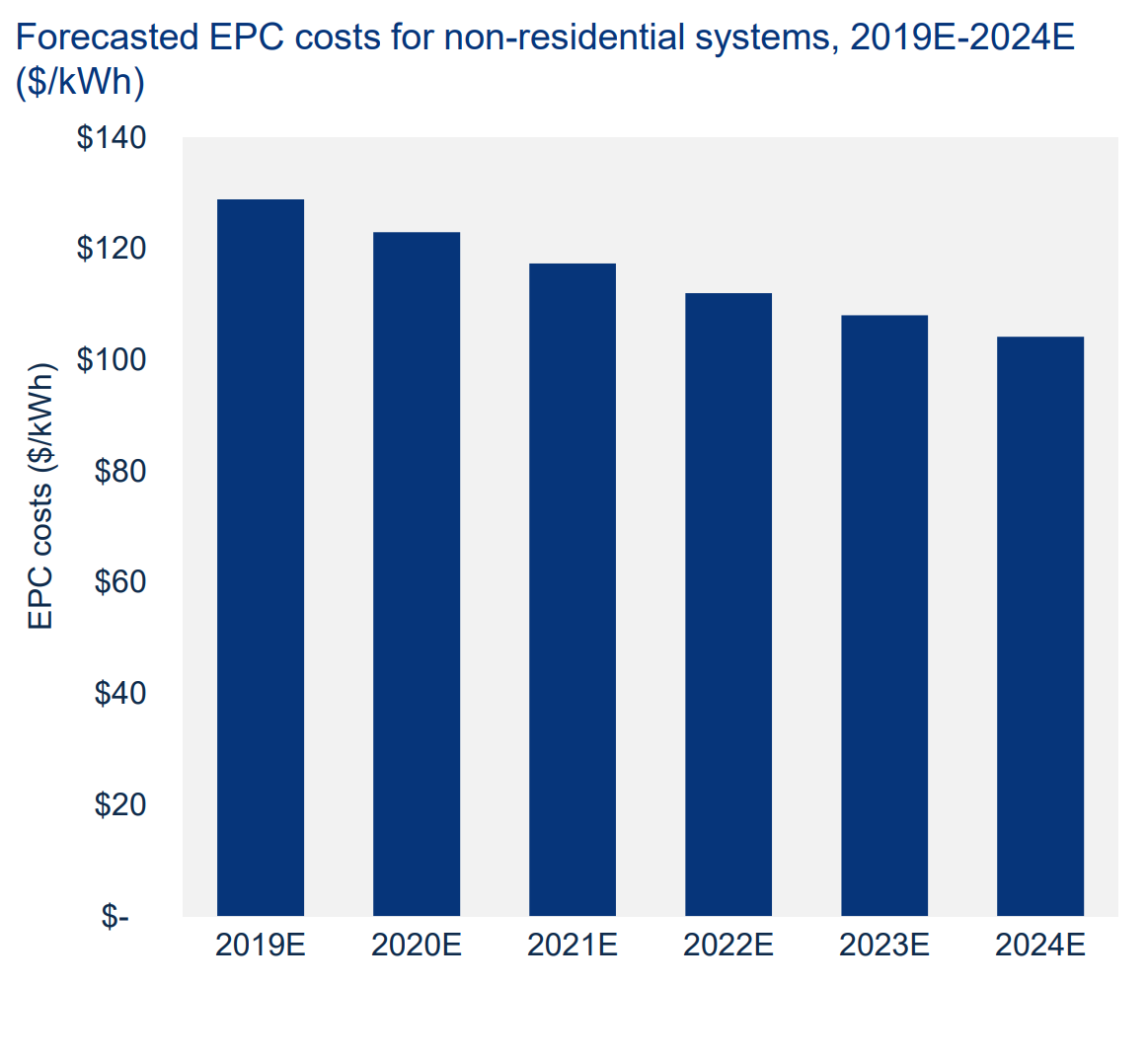

Over the coming years, the non-residential energy storage market in the US will experience substantial growth as system pricing continues to decline. The market will cross the 1 GWh annual deployment mark by 2021. In this report, Wood Mackenzie shares its system cost forecast for non-residential systems and also breaks out the forecast by battery prices and balance-of-system costs, including inverters, hardware, software, containerization, engineering, procurement and construction, and other soft costs.

Want more information?

Sample of companies mentioned in this report: LG Chem, Samsung SDI, Panasonic, CATL, BYD, Schneider Electric, ConEdison Solutions, NEC Energy Solutions, SunGrow, NexTracker, Convergent, General Electric, Lockheed Martin, Aggreko, Stem, Engie, SunPower, Enel X, Stem, Advanced Microgrid Solutions, Tesla, Fluence, IHI, Wartsila, Dynapower, SMA, Chint Power Systems, Delta, OutBack Power, ABB, Eguana Technologies, Power Electronics, EPC Power Corporation, Pika Energy, LS Energy Solutions

This report is also available as part of our Energy Storage Service.

Other reports you may be interested in

US energy storage monitor: Q2 2025

Q2 2025 ESM with new deployment data from Q1 2025, as well as a five-year market outlook by state out to 2029

$5,000Europe energy prices: June 2025

Europe energy prices provides a comprehensive outlook for fuel, carbon and power prices in Europe to 2050.

$15,000El Paso copper refinery

A detailed analysis of the El Paso copper refinery.

$2,250