Get Ed Crooks' Energy Pulse in your inbox every week

Pressures from investors and governments change the shape of the US tight oil industry

Pioneer’s US$6.4 billion deal for DoublePoint shows how demands for higher returns and lower emissions are driving consolidation among US E&Ps

1 minute read

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed examines the forces shaping the energy industry globally.

Latest articles by Ed

-

Opinion

What the "big beautiful bill" means for US energy

-

Opinion

Inside the ‘crazy grid’

-

Opinion

The Big Beautiful Bill is close to passing

-

Opinion

Ceasefire in the Israel-Iran conflict

-

Opinion

The impact of the Israel-Iran conflict escalation on the global energy market

-

Opinion

EBOS: the unsung hero that’s accelerating clean energy deployment

A classic theme of Western films is the taming of the frontier, as the Wild West becomes not so wild anymore, and the cowboys, gunslingers and outlaws have to reconcile themselves to civilisation. The US E&P industry has something of the same feel these days. Financial discipline and investor returns are the watchwords, and the days of headlong debt-fueled growth in tight oil production are supposedly confined to history. In the words of The Wild Bunch, “suddenly, their day was over”.

A process of steady consolidation is rolling up control of the key assets into a smaller number of hands, as a group of larger and financially stronger E&P companies buy out the smaller players. Lower costs and increased capacity to meet investors’ ESG requirements are among the factors driving M&A, encouraging those companies that can do deals to get bigger. They aim to be the industry’s long-term successes in this new era.

Pioneer Natural Resources is one of those consolidators. It closed its US$7.9 billion deal for Parsley Energy only in January, and then within three months announced another sizeable acquisition, agreeing to buy privately-owned DoublePoint Energy for US$6.4 billion including debt. Like Parsley, DoublePoint has assets only in the Permian Basin, and Pioneer says the acquisition will make it the largest producer there.

The deal is interesting in a number of respects. The price shows the return of “normal” valuations when WTI is close to $60 a barrel, rather than the “duress discounts” that were available when it was close to $40. It is also further evidence that there are likely to be a few key players in the industry’s consolidation, including Chevron, ConocoPhillips, EOG, Marathon Oil and Devon Energy as well as Pioneer. And at a time when privately-owned companies are ramping up activity in the US Lower 48 states faster than their listed peers, the deal will put a touch on the brakes. Scott Sheffield, Pioneer’s chief executive, said in a statement that one consequence of the acquisition would be “moderating growth for the US shale industry”. DoublePoint is running seven rigs on its assets, which Pioneer plans to cut to five by the end of this year.

Perhaps the most telling aspect of the deal, though, is the argument that bigger is better in tight oil. Four years ago, Pioneer projected that through organic growth it could reach production of 1 million barrels of oil equivalent by 2026. It has dropped that target date, but is now expanding rapidly through acquisitions. Scale is important, the company argues, because of the benefits of having an extended contiguous acreage. DoublePoint’s assets in the Midland Basin are a good fit with Pioneer’s, and the deal will make it easier to drill more wells with longer laterals and allow more efficient use of shared infrastructure such as gathering pipelines and water management facilities.

Increased scale also makes it easier to handle demands from investors, governments and customers for improved ESG performance. Methane leakage and flaring in the Permian has been rising in prominence as an issue for operators, and several of the larger E&Ps, including Pioneer, have been making commitments to cut emissions. The election of President Joe Biden, who has started the process of introducing new federal regulations for methane emissions, has added additional urgency to these moves.

The American Petroleum Institute, the industry group, in January came out in favour of direct regulation of methane emissions from new and existing sources, and said it would work with the Biden administration to develop “durable regulation that follows the law”. The API’s Climate Action Framework says it supports the development of methane detection technologies and ways to reduce flaring. The Texas Methane & Flaring Coalition, a consortium of seven industry associations and more than 40 companies, in February pledged to end routine flaring by 2030. Pioneer and Occidental Petroleum made the same commitment last year.

Larger operators have backed regulations on flaring and leakage for some time. ExxonMobil last year launched its model framework for industry-wide methane regulations, and back in 2017 made commitments to cut its own leakage, despite the deregulation then in progress under President Donald Trump. BP and Shell last year joined some large investors in urging Texas to ban routine flaring by 2025.

It has long been argued that the burden of complying with leakage and flaring regulations will hit small producers the hardest because there are significant fixed costs involved. The rising pressure for action, from investors as well as from the administration, is another reason to think that for Permian operators, bigger will indeed be better.

Why Bitcoin could be valuable for a low-carbon grid

Bitcoin, the most popular of the many cryptocurrencies, with a total value of about $1 trillion at today’s prices, has attracted widespread criticism because of the demand for electricity that it creates. New coins are created by “mining”: solving numeric problems that require a lot of computer power to find the answer. Each problem solved earns a reward of 6.25 bitcoins, worth about $360,000 at today’s prices, creating an effective incentive for companies and individuals to commit resources to mining. Bitcoin is expected to use about 140 terawatt hours of power this year, more than Sweden or Ukraine, and about 0.6% of total world electricity consumption.

Cryptocurrency enthusiasts have taken to claiming that “Bitcoin is a battery”, which is a misleading assertion. The most important characteristic of a battery is that it can supply power when needed, and Bitcoin obviously cannot do that. There is no need to overclaim for it: at the right times and places, the services Bitcoin can offer could be genuinely valuable to a lower-carbon grid.

Wood Mackenzie’s Isaac Maze-Rothstein has highlighted two opportunities in Bitcoin mining that could make a significant contribution to cutting greenhouse gas emissions. The first is in creating opportunities for demand response: flexible load that can be reduced as needed, which is becoming an increasingly important service as the proportion of variable renewables on the grid rises.

Typically, demand response might involve shutting off the air-conditioning for awhile or stopping production at a factory. A Bitcoin mine usually runs 24/7, performs operations that are not time-critical, and has economics that are is highly sensitive to electricity prices, making it a perfect facility to provide rapid demand response.

The second opportunity for Bitcoin is in supporting the economics of under-utilised low-carbon generation. At times of high output from renewables, in the middle of the day for solar in California or at night for wind in west Texas, power prices can drop to very low levels or even turn negative. Bitcoin miners could pay above-zero prices for that power and still have lower costs than rivals elsewhere. Some miners have already been moving to west Texas to take advantage of those low prices.

With customers pushing for shorter terms for power purchase agreements, wind and solar projects are facing more exposure to wholesale power prices. As Bitcoin grows, it could make significant contribution to the economics of these investments. “We foresee large solar and wind projects benefitting from five-to-ten-year off-take contracts with bitcoin mines to mitigate merchant risks”, Maze-Rothstein says.

In brief

The US and Iran have this week held indirect talks using European diplomats as intermediaries, beginning a process that could ultimately lead to a lifting of US sanctions and an increase in Iranian oil exports. The talks are an attempt to revive the international agreement over Iran’s nuclear programme, which the US withdrew from under President Trump in 2018. The other parties to the agreement — Russia, China, Germany, France and Britain — hope to persuade the US to rejoin, which the Biden administration has said it will do if Iran complies with restrictions on its nuclear activities.

Although initial signs indicated that the talks had gone well, President Biden’s special envoy Robert Malley, who is one of the US negotiators, suggested that reaching agreement could be a long and complex process that would go on after the Iranian elections in June. “If we could reach an understanding before the elections, fine. And if we can't, we'll continue after that with whoever is in office in Tehran”, he said.

Saudi Arabia’s first utility-scale renewables project, the 300 MW Sakaka Solar PV Plant, was formally opened this week by Crown Prince Muhammad Bin Salman. He also announced that the kingdom has signed power purchase agreements for seven new solar plants.

The US Army Corps of Engineers was expected on Friday to announce a decision on the Dakota Access pipeline, which could lead to it being shut down. The pipeline was the subject of a hearing in federal court, following a ruling last year that the Trump administration had not adequately considered the project’s potential environmental impact. DAPL can carry up to 570,000 b/d of crude from North Dakota, and shutting it down would have a significant impact on regional crude pricing, Wood Mackenzie analysts say.

The non-profit organisation Nature Conservancy is conducting an internal review of its portfolio of carbon offset projects, following concerns that it is facilitating the sale of meaningless credits, Bloomberg reported.

Malaysia is returning hundreds of containers of plastic waste back to their countries of origin, after becoming the world’s leading destination for exports of non-recyclable rubbish. Malaysia is a signatory to the Basel Convention on international trade in hazardous waste, which allows trade only in clean plastic waste for recycling.

More than 100 manufacturing suppliers to Apple have pledged to use only renewable energy for the products they sell to the tech giant. The move is an example of how emissions commitments by large companies are driving changes through the supply chain. Apple is aiming for net zero emissions by 2030.

And finally: a fun factoid, courtesy of ExxonMobil. A cubic foot of natural gas weighs about the same as a sugarcube-sized piece of gold, the company said in a recent advert. I have to admit I was surprised by that and actually took the time to check it, but of course it is correct. And if you take that cubic foot of natural gas and liquefy it into LNG, it will have the same volume as about 46 sugarcubes, a reduction of about 600 to 1.

Other views

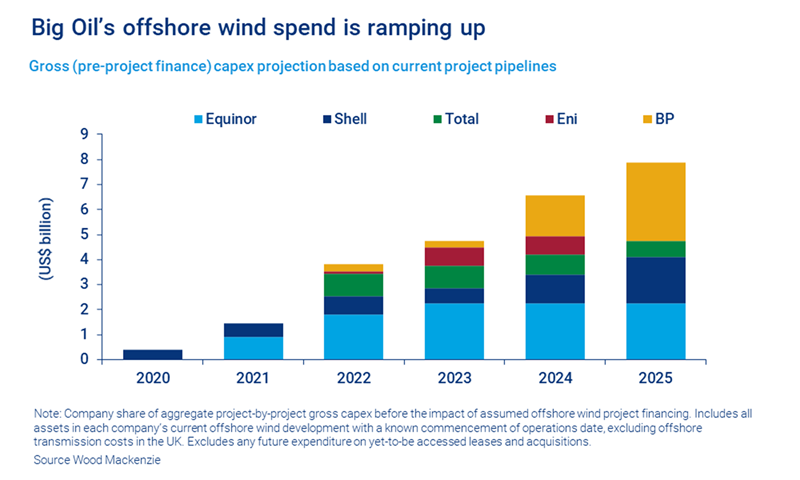

Valentina Kretzschmar — Why are the oil Majors investing in offshore wind?

Graham Kellas — How carbon pricing could reshape upstream oil and gas economics

Julian Kettle — Build or buy: are the copper Majors rising to the growth challenge?

Daniel Liu and Leila Garcia da Fonseca — Rethinking solar operations with digital technology

Björn Nykvist and Olle Olsson — The feasibility of heavy battery electric trucks

Zeke Hausfather — Absolute decoupling of economic growth and emissions in 32 countries

David Zipper — What if working at home makes us drive more, not less?

Quote of the week

“Ensuring the continuing security of China’s energy needs remains our highest priority – not just for the next five years but for the next 50 and beyond.” —Amin Nasser, chief executive of Saudi Aramco, gave this assurance in a speech delivered by video link to the China Development Forum last month. As Wood Mackenzie’s analysts have been highlighting recently, China’s push for energy security is one of the key factors shaping natural resources industries worldwide.

Chart of the week

This comes from a recent report by Søren Lassen, Norman Valentine and Valentina Kretzschmar, giving more detail on the outlook for one of the key trends in offshore wind: the European oil Majors’ rapid growth of investment in the sector. As these projections show, offshore wind is becoming an increasingly important destination for capital spending by the leading European IOCs. With BP planning total capital spending of $13 billion this year and Equinor planning $9-$10 billion, it is clear that these investment plans are going to be highly material to these companies.