Get Ed Crooks' Energy Pulse in your inbox every week

Biden’s clean energy plan aims at job creation

As the US faces economic crisis, the Democratic presidential challenger sees opportunities for stimulus in the energy transition

1 minute read

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed examines the forces shaping the energy industry globally.

Latest articles by Ed

-

Opinion

What the "big beautiful bill" means for US energy

-

Opinion

Inside the ‘crazy grid’

-

Opinion

The Big Beautiful Bill is close to passing

-

Opinion

Ceasefire in the Israel-Iran conflict

-

Opinion

The impact of the Israel-Iran conflict escalation on the global energy market

-

Opinion

EBOS: the unsung hero that’s accelerating clean energy deployment

When he won the nomination to be the Democratic presidential candidate in the 1932 election, Franklin D. Roosevelt said Americans wanted two things above anything else: security for their families, and “work, with all the moral and spiritual values that go with it”. The jobs market in the US is not in such a catastrophic state today as it was during the Great Depression, but it is still dire, and facing huge uncertainty. For Joe Biden, who is seeking like Roosevelt to win an election during an economic crisis, promising to create jobs is an important part of his campaign.

The US unemployment rate of 11.1% is down from its peak in April, as the economy has tentatively started to reopen, but is still three times what it was at the start of the year. Concerns are growing about the recovery, as several states have paused or started to reverse the process of reopening. Congress has not yet started negotiating on a new round of economic stimulus, and the additional unemployment benefit payments agreed in March will run out at the end of this month, threatening to cut the incomes of tens of millions of people.

So when Biden on Tuesday set out his energy and climate plan, headlined “Build Back Better”, it was no surprise that jobs were a central theme. His message was that if he becomes president, he will deliver a programme of investment in new infrastructure, electric vehicles, building upgrades and environmental cleanup that will “create millions of good-paying jobs that provide workers with the choice to join a union and bargain collectively with their employers”.

The words “Green New Deal” were not used in the policy paper or in Biden’s speech at the launch event. But there are clear similarities between the thinking behind his proposals and the plan for Green New Deal proposed by Democratic Congresswoman Alexandria Ocasio-Cortez and other advocates of radical climate action. The strategy of the Green New Deal is to win support for the energy transition and emissions reductions by highlighting immediate benefits such as job creation, and that is the approach Biden is adopting now.

Ideas that could cost jobs, including the ban on “new oil and gas permitting on public lands and waters” that was included in Biden’s previous climate plan, were not mentioned. Instead, the focus was all on the new opportunities that his programme is intended to create.

The specific measures include:

- Making power generation 100% carbon-free by 2035

- $2 trillion of investment in new and upgraded infrastructure including power lines, trains and broadband networks

- Creating a million jobs in the electric vehicle and charging value chains

- Creating a million jobs in energy efficiency for buildings

- Creating 250,00 jobs in plugging abandoned oil and gas wells and reclaiming old mines

- Supporting energy innovation in areas including batteries; direct air capture of CO2; carbon storage in concrete; green hydrogen; and advanced nuclear power

The view of Wood Mackenzie’s analysts is that these objectives are achievable, but will be enormously challenging on the timetable that Biden has set out, and in some cases will be very expensive. A future Biden administration would face an array of obstacles to achieving its goals: legal, political, economic, and technical.

Getting the US power grid to be 100% carbon-free, for example, will be much more difficult than making it 80% carbon-free, because the remaining 20% of demand cannot easily be met with the available technologies of wind and solar power and battery storage.

The goal of making green hydrogen, produced by electrolysing water using renewable energy, cost-competitive with conventionally produced hydrogen within a decade is at least ten years ahead of the schedule projected by Wood Mackenzie.

If a Biden administration does succeed in accelerating the decarbonisation of electricity generation, however, it will have profound implications for coal-fired and gas-fired power plants currently in service.

Chris Seiple, Wood Mackenzie’s vice-chair of energy transition, power and renewables said: “The emphasis on energy efficiency could result in next to no demand growth, as electric cars are unlikely to grow fast enough in the near term to offset the impact of energy efficiency initiatives. So we will be adding lots of new supply into a market that doesn’t need new supply.”

The American Petroleum Institute, the industry group, said it shared the goal of “a massive amount of infrastructure buildout”, but warned that an attack on oil and gas producers could damage Biden’s chances in the election.

Mike Sommers, the API’s president, said the group would work with both Democrats and Republicans to “advance real solutions to climate change that build on American energy leadership and protect the good-paying union jobs our industry supports in states like Ohio and Pennsylvania and across the country.” Pennsylvania in particular is a state that Biden is likely to need to win to enter the White House.

OPEC+ sticks to plan to ease production curbs

In April the OPEC+ group of countries committed to emergency treatment for the oil market, agreeing an unprecedented 9.7 million barrels per day production cut. The treatment worked, and the patient has stabilised. Brent crude has risen from a low point below $20 a barrel in April to about $43 this week. But as with any urgent intervention, starting to withdraw the treatment is a delicate business. Get it wrong, and the patient will suffer a relapse.

The OPEC+ group’s Joint Ministerial Monitoring Committee, co-chaired by the energy ministers of Saudi Arabia and Russia, on Wednesday decided that the market was healthy enough for them to start easing up on their production cuts as planned.

The original plan in April was to impose the full 9.7 million b/d reduction only in May and June, and then relax that to a 7.7 million b/d cut for the rest of 2020. The 9.7 million b/d reduction was extended for another month, into July, because of concerns about the pace of the recovery in demand. But this week the ministers on the JMMC concluded that if they went ahead with the easing to a 7.7 million b/d cut as scheduled in August, “the extra supply resulting from the scheduled easing of the production adjustment will be consumed as demand recovers”.

The decision does not mean that there will immediately be another 2 million b/d coming on to the market. The group has agreed a “compensation” mechanism, which means countries that produced above their agreed limits now have to produce less, and those restrictions have been put in place until September. The JMMC said in its statement that 100% compliance with the production limits was “not only fair, but vital for the ongoing rebalancing efforts and to help deliver long term oil market stability”.

The JMMC announcement had been expected, and did not cause any disturbance in the market, apparently vindicating the ministers’ view that it was safe to begin unwinding the production curbs.

Douglas Thyne, Wood Mackenzie’s research director for global oil supply, expects a tightening trend in the supply and demand balance through the second half of 2020. “OPEC+ cuts, a steep decline in US Lower 48 production and continued demand recovery are carving into the oversupply swiftly, which will support prices,” he said.

In brief

The US has stepped up its rhetoric on oil and gas development and other activities in the disputed South China Sea. The Department of State said the US was backing the 2016 decision of an arbitration tribunal, which had rejected China’s claims over the disputed waters as “having no basis in international law”. The US statement said: “Any PRC [People’s Republic of China] action to harass other states’ fishing or hydrocarbon development in these waters – or to carry out such activities unilaterally – is unlawful.”

China’s oil imports surged last month, rising 34% from June 2019’s levels to hit 12.9 million b/d, customs data showed. Some of that increase appears to have been the result of purchases benefitting from very low prices in the previous couple of months. But the increase highlights the fact that China’s oil consumption is still on a rising trend, while the majority of its production comes from mature onshore fields that are in long-term decline.

The Trump administration’s Council on Environmental Quality has published the final version of its new regulations for administering the National Environmental Policy Act, with the aim of streamlining the process of securing approvals for infrastructure projects, including pipelines. It is the first comprehensive update to the regulations since 1978. The Natural Resources Defense Council, one of the environmental groups that has objected to the new regulations, said: “We will not let this stand”.

Meanwhile, the administration’s move to relax regulations controlling gas flaring and leakage on federal and tribal lands has been blocked by a US federal court in California. The judge said the government’s Bureau of Land Management had “ignored its statutory mandate… repeatedly failed to justify numerous reversals in policy positions previously taken, and failed to consider scientific findings” in drawing up its new regulations.

Travis County, Texas, is offering additional tax breaks to Tesla to locate its new Cybertruck electric truck factory there, close to Austin.

A group of 15 US states and the District of Columbia are working together to boost the market for electric medium and heavy trucks and buses, with the aim of phasing out diesel-powered vehicles by 2050.

The UK government is planning to launch a new state-backed “green investment bank”, to support emissions-reducing technologies.

British Airways is scrapping its entire fleet of 31 Boeing 747 Jumbo jets, bringing forward its plan to retire them in 2024. It will be replacing them with more fuel-efficient aircraft. The airline reportedly does not expect passenger numbers to return to pre-pandemic levels until 2024 at the earliest. Qantas has this week been running farewell flights for its 747s, which are also going out of service.

In the US shale industry, oil services companies are experimenting with hydraulic fracturing on two horizontal wells at the same time, using a single pressure pumping fleet.

And finally: the latest corporate initiative to cut greenhouse gas emissions. Livestock are responsible for an estimated 14.5% of global greenhouse gas emissions, with about 39% of that coming from the methane produced by ruminants’ digestive processes. (The gas mostly comes from cows’ burps, although for obvious reasons the farts have tended to attract the most attention.)

This week Burger King launched an entertaining marketing campaign, intended to highlight their efforts to reduce those emissions. By adding lemongrass to the cows’ diet, it can cut their emissions by up to 33%, Burger King’s parent Restaurant Brands International says. It might sound funny, but the issue is no laughing matter. And if the lemongrass diet was rolled out across the entire global beef and dairy industry, total world greenhouse gas emissions could in principle be cut by up to 1.9%.

However, the claims about the benefits of changing cows’ diets have yet to be fully tested. Changing humans’ diets to cut out meat and diary still looks like a more guaranteed way to reduce their carbon footprints.

Other views

Gavin Thompson — The art of never letting a crisis go to waste

Simon Flowers — Monetising the East Med’s giant gas finds

Mitalee Gupta and Molly Cox — Solar and storage prices are falling faster than expected

Justin Guay — The world needs a cash-for-coal-clunkers programme

Nick Butler — How the oil majors bought into green energy

Anne Bradbury — Pipelines have a place in clean energy

Michael Webber — The colour of energy

Quote of the week

“There are still risks ahead in this ‘crisis like no other’, as the IMF described it. The world economy is still learning how to live with the virus. But we have shown the value of collaboration, commitment and, especially, discipline in facing this extraordinary challenge.” — In his opening statement to the OPEC+ Joint Ministerial Monitoring Committee on Wednesday, Saudi Arabia’s energy minister Prince Abdul Aziz Bin Salman hailed the effectiveness of the group in working together to stabilise the oil market.

Chart of the week

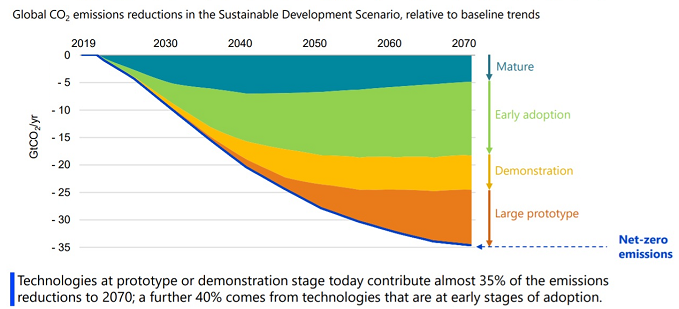

This comes from the International Energy Agency’s recent report on clean energy innovation, showing why more progress is needed in technologies to cut greenhouse gas emissions. The shaded area shows a scenario for how global emissions could be reduced to net zero by 2070, broken down by the current maturity of the technology. The IEA suggests that only 25% of the potential emissions reductions might come from technologies that are already mature, and about 35% might come from technologies that are at either the prototype or demonstration stage. Several companies and countries have pledged to cut emissions more quickly, to achieve objectives for being at net zero by 2050, but the IEA warns that there is a disconnect between those goals and the technologies that are currently available. It adds: “Without a major acceleration in clean energy innovation, net-zero emissions targets will not be achievable.”

Crude for Thought - Ep 10: Joe Biden Energy Plan - What's In Store For US Oil & Gas?

Ben Shattuck sits down with Ed Crooks to discuss what Biden's Energy Plan might mean for the US oil & gas industry. Why the Gulf of Mexico is most at risk and the balancing act Biden must perform.