Get Ed Crooks' Energy Pulse in your inbox every week

The contrasting fortunes of solar and wind in the US

Solar installations have been outpacing wind, as grid congestion limits growth

11 minute read

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed examines the forces shaping the energy industry globally.

Latest articles by Ed

-

Opinion

Ceasefire in the Israel-Iran conflict

-

Opinion

The impact of the Israel-Iran conflict escalation on the global energy market

-

Opinion

EBOS: the unsung hero that’s accelerating clean energy deployment

-

Opinion

What the US attack on Iran’s nuclear installations means for energy

-

Opinion

How do we adapt to a warming world?

-

Opinion

What the conflict between Israel and Iran means for energy

In the race to build low-carbon electricity generation capacity in the US, wind power took an early lead. At the end of 2010, wind accounted for about 31% of all the renewable generation capacity installed in the US, with most of the rest coming from hydro. Solar was less than 1%.

Since then however, solar has been coming up fast. Installations of solar capacity have almost exceeded wind every year since 2016, and last year the divergence between the two technologies became extreme. In the first nine months of 2023, solar accounted for about 48% of all the generation capacity installed in the US, while wind was just 10%.

On Wood Mackenzie’s estimates, solar installations in the US last year were up 55% from 2022’s levels. Wind installations were down 45% to a seven-year low.

The diverging fortunes of solar and wind are driven by a range of factors, some of them temporary. We expect US wind installations to bounce back this year, while solar will make slower progress. But some of the issues are structural and point to a continued gap between the two sectors. In 2028, we expect about 18.5 gigawatts of wind capacity to be installed in the US, about the same as in 2020. For solar, we expect about 44.5 GW to be added, more than twice as much as in 2020.

There is still progress being made with offshore wind in the US, but it has faced a series of well-publicised challenges.

Onshore, the fundamental problem is that the best resource, and also the most available land, is generally in the heart of the country, from Montana and North Dakota down to west Texas, far from the main centres of population and demand for electricity.

The rapid build-out of capacity and the difficulty of building new transmission lines mean that grid congestion, curtailment of output and negative prices are growing problems. Already in 2022, on the Southwest Power Pool grid, which covers much of the central US, prices in the real-time market were negative for between 11% and 15% of the hours in the year, depending on the region.

Last year, those issues were compounded by the rise in interest rates and a surge in costs in the supply chain. With the future of the production tax credit (PTC) for wind apparently secured for 10 years by the Inflation Reduction Act, developers could afford to wait for a while for conditions to improve.

With US interest rates now potentially going into a downward trend, and supply chain inflation easing, wind installations are set to rebound. There is even some progress being made on long-distance transmission. Two large projects – SunZia and TransWest Express – which will connect wind farms in New Mexico and Wyoming, respectively, to markets in California and Arizona, started construction last year.

Even as those projects make progress, however, they have highlighted the challenges of infrastructure development in the US. Native American tribes and environmental groups last week filed a lawsuit asking a court to prevent any further work on the SunZia line, saying the San Pedro Valley on the project’s route would be “irreparably harmed if construction proceeds”.

Without much more investment in long-distance transmission, the problems created by grid congestion will be a long-term challenge for wind developers.

Solar projects have faced some of the same problems with objections to construction, but generally have less need for long-distance transmission. Over the past few years, the top states for solar investment have been California, Texas and Florida, where generation can typically be sited closer to demand centres.

About 25% to 30% of solar installations in the US are distributed, whether residential or commercial and industrial, so are unaffected by transmission issues. Residential solar sales in the US have been hit by higher interest rates driving up the cost of financing, and installations are set to decline this year, but we expect average annual growth of 10% over 2025-28.

Solar in the US has also been helped by a change in the Inflation Reduction Act, enabling projects to opt for the PTC as an alternative to the investment tax credit that was previously available. Making those tax credits transferable has also helped project economics: PTCs have been changing hands at prices of about 94-95 cents on the dollar, allowing developers to benefit from the credits even if they are not paying tax.

Meanwhile, the supply chain problems that hit the solar industry coming out of the pandemic eased significantly last year. A huge expansion of module manufacturing capacity in China has driven down prices around the world. By the fourth quarter of last year, Chinese module prices had fallen to a new record low of about 12-13 US cents per watt.

Prices in the US are significantly higher, because of import duties, but have also been falling sharply. “Module prices in the US have really decreased significantly in the past six months,” says Sylvia Leyva Martinez, Wood Mackenzie’s principal analyst for North America utility-scale solar.

With a supportive tax framework thanks to the Inflation Reduction Act, and a downward trend in its levelised cost of energy, all the conditions seem set fair for US solar. The one issue that is threatening to put an increasing burden on the industry is the growing difficulty of securing grid connections for generation. In the early 2000s, securing a connection for a project in the US generally took less than two years. Today, it is typically five to seven years, driven by the twin challenges of building new infrastructure and overloading the administrative system that governs interconnection agreements.

Most of the solar capacity expected to come into service over the next five years has already secured interconnection agreements. But by the end of the decade, the typical time needed will have extended to eight to 10 years, creating another significant brake on the pace of the industry’s expansion, according to Wood Mackenzie’s Leyva Martinez.

The Federal Energy Regulatory Commission last year issued new rules on interconnection, intended to reduce backlogs for projects seeking to connect to the transmission system. Those rules have a deadline of 5 April for full compliance. If they achieve their goal of accelerating agreements and reducing the backlog of projects waiting in the queue, the impact on the industry would be significant.

The Biden administration’s objective of putting the US on course for a 100% low-carbon power grid by 2035 is extremely demanding. Even the rapid growth of solar projected in our forecasts does not deliver that outcome. It will be even harder to reach if the bureaucratic obstacles to low-carbon investment are not cleared away.

Biden administration puts a brake on LNG export approvals

The US overtook Qatar and Australia to become the world’s largest LNG exporter in 2023, and the current surge in investment in new capacity means it should retain that leading position for many years to come. Increased US exports are playing an important role in world markets, replacing the gas flows to Europe that were shut off after the invasion of Ukraine.

For the Biden administration, however, this expansion has been a cause of growing concern because of its potential impact on greenhouse gas emissions. There were signs last year that the administration was rethinking its position on approvals for LNG exports, and some of its rules were duly tightened.

On Friday, the White House announced “a temporary pause” on approvals of gas exports to countries that do not have a Free Trade Agreement with the US. The administration said the pause would last until the Department of Energy had updated the economic and environmental analysis underlying its authorisation decisions, reflecting factors including “potential energy cost increases for American consumers and manufacturers… the impact of greenhouse gas emissions... [and] risks to the health of our communities”.

It was reported by Bloomberg News that the new procedures could result in projects being delayed “for months, if not longer”. Almost 80% of US LNG exports since 2016 have gone to countries that do not have a Free Trade Agreement, including members of the EU, the UK, Japan and China.

One project that could be affected by delays could

be Venture Global’s Calcasieu Pass 2 in Louisiana, an expansion of the existing Calcasieu Pass facility that began production in 2022. The project had increasingly become a target for environmental campaigners. The Sierra Club last year described it as “the next carbon bomb”. Several other proposed LNG export projects in the US are also aiming to move towards a final investment decision and could be affected by the new rules.

Wood Mackenzie analysts warned that future LNG supplies could threatened by a pause in export approvals. “Time is of the essence for LNG project developers,” the analysts said. “They require finalised permits, firm customer offtake agreements and financing commitments before starting construction, which typically takes four or more years.”

US LNG export projects have already faced a slowing regulatory approval process. The average time for the Department of Energy to issue an export license to sell gas to a country that does not have a free trade agreement with the US has climbed under the Biden administration to over 330 days, from 155 days under the Obama administration and just 49 days under the Trump administration.

In brief

The Hinkley Point C nuclear power plant, under construction in southwest England, has been hit by further delays and cost increases. The new plant, a flagship project for the UK’s nuclear industry, is now expected to be operational by 2031, four years later than previously planned and 15 years after the final investment decision was given in 2016. Stuart Crooks, the project’s managing director, said in a message to staff: “Like other major infrastructure projects, we have found civil construction slower than we hoped and faced inflation, labour and material shortages, on top of Covid and Brexit disruption.”

The delay to the Hinkley Point C has raised fresh doubts over the opposition Labour Party’s goal of achieving a 100% low-carbon electricity system for the UK by 2030. Labour currently has a commanding lead in the polls, and a general election must be held by 28 January 2025.

If the Republican party wins control of both houses of Congress and the White House in this year’s US elections, it may not result in a comprehensive roll-back of the tax credits for low-carbon energy introduced in the Inflation Reduction Act, the NextEra chief executive John Ketchum has said. Speaking on the company’s fourth quarter earnings call, he said repealing tax credits was always difficult in the US political system, “no matter what the political winds are”. He added that the increased investment supported by the Inflation Reduction Act benefited both Republican and Democratic areas. “It’s flowing to Republican states and it’s flowing to parts of those states that are really difficult to stimulate economically,” he said.

Mining companies Vale and BHP, and their joint venture Samarco, have been ordered by a Brazilian judge to pay about US$9.7 billion in damages for a tailings dam collapse in 2015, Reuters reported.

Tellurian, which aims to export LNG from the US, has hired Lazard as financial adviser to explore a possible sale of the company, Bloomberg reported.

Oil prices crept higher during the week, with Brent crude rising from under US$79 a barrel on Monday to about US$82 a barrel on Friday.

Other views

2023: the year the European renewables bubble burst – Rory McCarthy

The Chesapeake-Southwestern deal: ten key takeaways – Robert Clarke, Dulles Wang and Alex Beeker

Electric vehicle and battery supply chain: 5 things to look for in 2024 – Max Reid

The lithium revolution has arrived at California’s Salton Sea – Sammy Roth

Low-carbon tech: is geothermal close to a breakthrough? - Simon Flowers

Quote of the week

“The Chinese car companies are the most competitive car companies in the world. So, I think they will have significant success outside of China depending on what kind of tariffs or trade barriers are established… Frankly, I think, if there are not trade barriers established, they will pretty much demolish most other companies in the world.” – Elon Musk, chief executive of Tesla, spoke on the company’s earnings call about the growing competitive threat from China’s electric vehicle manufacturers in markets around the world.

Chart of the week

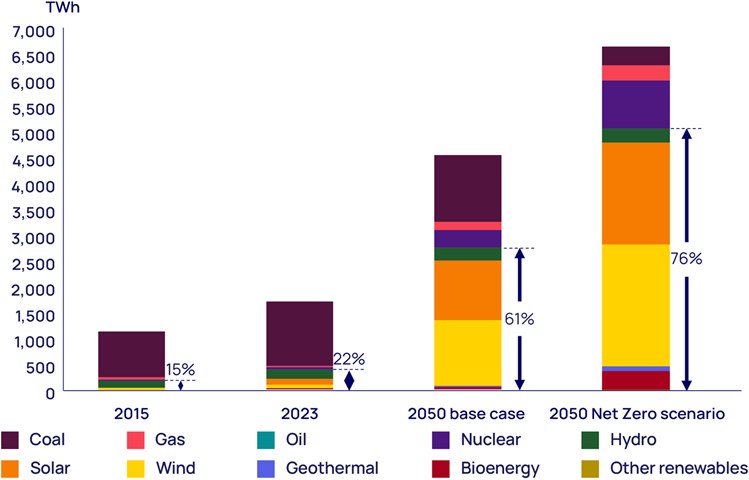

This chart shows India’s power generation mix, in the recent past and in two possible views of the future. It comes from our recent Horizons report, Chance of a lifetime: can India show the developing world a unique path to net zero?, led by Prakash Sharma, Wood Mackenzie’s vice-president for scenarios and technologies.

The bars on the right show two versions of the picture in 2050. In the second-right bar, we show our base case forecast: the outcome that we think is most likely. That shows a massive transformation in India’s electricity system over the next 25 years or so: a huge increase in output, and a radical shift in the generation mix towards low-carbon sources, particularly wind and solar.

For India to play its full part in helping the world achieve net zero emissions by 2050, the change would have to be even more dramatic, with even larger total electricity supply and renewables providing about three-quarters of that output.

Take a look at the full report for our views on how India has a unique opportunity to transform itself into a low-carbon economic powerhouse.

Get The Inside Track

Ed Crooks’ Energy Pulse is featured in our weekly newsletter, alongside more news and views from our global energy and natural resources experts. Sign up today using the form at the top of the page to ensure you don’t miss a thing.