Get Ed Crooks' Energy Pulse in your inbox every week

US E&Ps on a capital-raising spree

Near-zero interest rates and higher oil prices have created ideal conditions for E&Ps to issue debt. Will the capital inflows enable them to ramp up activity faster?

1 minute read

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed examines the forces shaping the energy industry globally.

Latest articles by Ed

-

Opinion

What the "big beautiful bill" means for US energy

-

Opinion

Inside the ‘crazy grid’

-

Opinion

The Big Beautiful Bill is close to passing

-

Opinion

Ceasefire in the Israel-Iran conflict

-

Opinion

The impact of the Israel-Iran conflict escalation on the global energy market

-

Opinion

EBOS: the unsung hero that’s accelerating clean energy deployment

Mike Winkelmann, also known as Beeple, is a graphic designer from South Carolina whose website self-effacingly declares that he makes “a variety of art crap”. This month he made history by selling a Non-Fungible Token — a unique file on a blockchain, attached to a digital artwork — for a record price of US$69 million. Winkelmann, who until October had never sold a print for more than $100, is now in the same bracket as Jeff Koons and David Hockney, as the creator of the third-most expensive work ever sold at auction by a living artist.

The relevance of this sale to the energy industry is that it shows that for the right proposition, there is plenty of liquidity available. The US Federal Reserve has been holding the federal funds rate close to zero, and it has been suggested that rates may not rise until 2024. Congress this month agreed to a $1.9 trillion stimulus package, including about $160 million in cheques for people on low and middle incomes and support for state and local governments. The US economy is still suffering badly from the impact of the Covid-19 pandemic. Only about 57.6% of the working age population is employed, a lower proportion than at the depths of the great recession of 2007-10. US policymakers are determined that if the economy does falter, it will not be because they have not done enough to support liquidity.

US exploration and production companies have been among the beneficiaries of this easy money policy. Taking advantage of abundant liquidity and the rise in oil prices, they have raised about US$12.8 billion from bond sales so far this year, according to FactSet. That makes this the strongest single quarter for issuance since 2010, with the exception of the third quarter of 2019, when Occidental Petroleum sold debt to finance its US$55 billion acquisition of Anadarko Petroleum.

The interest rates on some of those new bonds have looked very attractive for borrowers. Diamondback Energy, which is ranked roughly in the middle of the rankings in Wood Mackenzie’s Financial Health Outlook for Lower 48 operators, last week sold debt, including 30-year bonds, paying about 4.4%. That was a spread of only about 2 percentage points over 30-year US Treasuries.

There has even been interest in an E&P equity sale. Vine Energy, a gas producer operating in the Haynesville Basin in Louisiana, last week floated on the stock market, in the first IPO for a US shale operator since 2017. The price of US$14 a share was below the indicated range of US$16-US$19, but it was still noteworthy that the sale went ahead at all.

With the E&P sector’s cash flows strengthening as a result of higher oil prices, the obvious question is whether this latest inflow of capital will finance another surge in activity and production. The count of active rigs in the US published by Baker Hughes has already risen by 167 from its low point last summer to 411 as of last week. The oil and gas activity index in the latest quarterly survey from the Federal Reserve Bank of Dallas soared to its highest level in the survey’s five-year history.

The message from E&P management teams has been that they are prioritising debt reduction and returns to shareholders over production growth. The fear is that those assurances will be forgotten, and the US industry will go through another cycle of soaring production and downward pressure on crude prices.

The good news for anyone worried by that prospect is that most of the debt issuance so far seems to be about liability management, rather than raising capital for faster growth. Companies are putting their balance sheets on a more stable footing by refinancing at lower interest rates and for longer terms. Diamondback, for example, has been taking advantage of the cost of capital arbitrage opportunities created by its US$2.2 billion acquisition of QEP Resources.

Wood Mackenzie’s tracker of upstream companies’ capital spending guidance shows US-focused producers in aggregate planning to spend slightly less this year than they did in 2020. “Nobody is going to change course just yet. We are only one quarter into the year”, says Robert Polk, a principal analyst with Wood Mackenzie’s US Corporate Research team. “The second quarter earnings announcements in July and August will probably be the earliest we might see companies start to revise up their capital spending plans, if their discipline doesn’t hold”.

One qualification to that picture is that privately-owned companies often face less pressure to demonstrate capital discipline than their listed rivals, and have been ramping up activity more rapidly. So far in 2021, almost half of the drilling permits awarded in the New Mexico section of the Delaware Basin have been issued to private companies.

Still, the outlook for US tight oil production for now looks like continued decline for 2021 as a whole, followed by a rebound in 2022. Increased US oil supply could in time be one consequence of easy credit, but it does not seem to be happening yet.

Suez Canal blockage disrupts global oil and LNG flows

The container ship Ever Given, which has blocked the Suez Canal by getting wedged across it, captured the imagination of the world this week, inspiring a range of responses from funny gifs to children’s ideas on how to shift it to thoughtful comments on the critical chokepoints for global trade. In energy markets, the impacts so far have been limited, although they are likely to become more significant the longer the ship remains stuck.

On Wednesday, there were 16 laden crude and products tankers delayed because they could not pass through the canal, according to Wood Mackenzie’s Vesseltracker AIS data. At that point, there did not appear to be any tankers that had been diverted to alternative routes.

For crude, the Sumed pipeline in Egypt is used as an alternative to the canal for flows of oil from the Middle East to Europe, so the impact is likely to remain minimal. Crude prices briefly rose in response to the news that the canal was blocked, but by Friday morning, Brent was trading at about $64 a barrel, and WTI and about $61, both close to where they were when they started the week.

The impact on product markets could be more significant. If the canal remains blocked, it will reduce the availability of naphtha, petrochemical feedstocks and fuel oil from Europe and the Mediterranean in the Asia-Pacific region, supporting Asia product prices. Flows of some chemicals, such as olefins that are imported from the Middle East to Europe, could also be disrupted.

For LNG, the market impact was also muted. The canal is a key route for cargoes from the Middle East to Europe, and it carries about 8% of the global LNG trade. As of Friday, there were about 15 LNG tankers apparently hoping to pass through the canal in either direction in the coming days. Two more, en route from the US, appeared to have been diverted to go round the Cape of Good Hope instead.

The disruption helped support European gas prices: on Thursday LNG delivered to northwest Europe was trading at about US$6.10 per million British Thermal Units, up about 6% from the previous week. In northeast Asia, meanwhile, the price was about US$7.055 / mmBTU, up about 3%.

Lucas Schmitt, a Wood Mackenzie’s principal analyst for LNG, said that in the spring “shoulder season”, when demand for gas is lowest, “the market can probably absorb some disruption”. For as long as the Ever Given remains stuck, though, it will add cost to LNG cargoes coming from the Middle East to Europe. The route through the canal takes about 15 days, but the alternative round the Cape of Good Hope takes about 24-25 days, an increase of about 60%.

The reasons why the Ever Given ran aground have not yet been fully explained. A fascinating piece on FT Alphaville explained some of the critical factors, including the mysteries of hydrodynamics and the consequences of building ever-larger container ships.

In brief

The disruption to supply chains caused by the blockage of the Suez Canal comes as the petrochemical industry is still recovering from the impact of the brutal winter storm that hit Texas last month. Operations at US Gulf Coast petrochemical facilities have yet to recover fully, more than a month after cold weather triggered widespread power outages and plant shutdowns.

More than 80% of US olefins capacity was offline at one point, and by mid-March there only about 60% of capacity was back in operation, according to Genscape, a Wood Mackenzie company. With supply down and demand still robust, ethylene prices have risen close to seven-year highs. Polymer grade propylene prices touched all-time highs immediately after the freeze, and although they have since fallen back are still close to three-year highs.

Meanwhile, the human cost of the disaster is becoming clearer. At least 111 people died in Texas as a result of the winter storm, mostly from hypothermia, according to the Department of State Health Services.

Saudi Aramco reported net income of US$49 billion for 2020, down 44% from 2019. Earnings were hit by lower crude prices and production volumes, and weaker margins for the company’s downstream refining and chemicals operations. Despite the sharp drop in profitability, the company stuck to its planned annual dividend of US$75 billion. Amin Nasser, chief executive, said that “in one of the most challenging years in history, Aramco demonstrated its unique value proposition through its considerable financial and operational agility”. The company has cut its planned capital spending for this year from US$40-US$45 billion to US$35 billion. The new plan is still higher than the US$27 billion that Aramco spent last year.

BP published its annual report, under the headline “performing while transforming”. In his letter to shareholders, chief executive Bernard Looney talked about beginning “our transformation from an International Oil Company to an Integrated Energy Company”. He added: “I wholeheartedly believe we will not just restore, but will enhance the long-term sustainable value of your company through the actions we are taking to reinvent BP”. One notable change for this year: reserves replacement is no longer included in the Key Performance Indicators that are used to assess the success of the company’s strategy and to determine executive remuneration.

The US has reiterated its opposition to the Nord Stream 2 gas pipeline from Russia to Germany, and raised again the possibility of sanctions against companies that help to complete the project. Antony Blinken, the US secretary of state, said at a meeting with NATO Secretary-General Jens Stoltenberg in Brussels: "President Biden has been very clear, he believes the pipeline is a bad idea, bad for Europe, bad for the United States, ultimately it is in contradiction to the EU's own security goals”.

The American Petroleum Institute, the influential oil and gas industry group, has set out its support for a price on carbon emissions across the US economy, as part of its broader climate strategy. The API’s industry action plan also includes a call for the US government to fast-track the commercial deployment of carbon capture, utilisation and storage.

The US National Renewable Energy Laboratory has set out scenarios for how the city of Los Angeles could achieve the goal of 100% renewable energy.

The US Navy is looking at flywheel technology to store and quickly release energy for railguns and laser weapons.

And finally: the awe-inspiring properties of the geothermal gradient. A viral video shot by a drone this week showed a close-up view of the eruption of the long-dormant Fagradalsfjall volcano in Iceland. The eruption was not dangerous — scientists at the foot of the volcano used it to cook hot dogs — but it was a spectacular reminder of Iceland’s geothermal energy resources. About 66% of the country’s primary energy comes from geothermal sources: it heats about 90% of Iceland’s homes, and generates about 25% of its electricity.

Iceland is lucky — from the geothermal energy perspective — in being located on one of the earth’s major plate boundaries: the Mid-Atlantic ridge, where the North American and Eurasian tectonic plates diverge. It has been theorised that it sits on a deep mantle plume — an upswell of hot rock — that causes a hot spot near the surface. Iceland’s underground temperatures can reach 250 °C less than 1,000 metres down.

However, this kind of geology is not essential to make geothermal power work. According to a study published in the Journal of Cleaner Production last year, the areas of highest potential for geothermal energy are spread widely around the world: along the entire west coast of the Americas, in central and east Europe, in central, east and southeast Asia, and in east and south Africa.

Other views

Robert Clarke — What a 40-year-old shale well can tell us about the future of the Lower 48

Simon Flowers — How solar is central to the energy transition

Gavin Thompson — China’s war on waste means more than just clean plates

Søren Lassen and Norman Valentine – Big Oil’s impact on offshore wind

Kate Aronoff — Can OPEC rescue the planet?

Ilissa Ocko — A US economy-wide methane target: essential, achievable, affordable

Helen Thompson — The geopolitical fight to come over green energy

Shannon Osaka — Why Biden’s climate agenda might be very, very ‘quiet’

John Kemp — India and Saudi Arabia spar over oil prices

Quote of the week

“The decidedly oil and gas unfriendly Biden administration has us in the crosshairs. I believe that it is their goal to effectively shut down our industry, and they will pursue that end with great energy. I am happy that my career is nearly over and am worried about the future of our industry.” — One respondent to the Federal Reserve Bank of Dallas’s latest quarterly survey of the energy industry expressed concern about the impact of the new administration’s climate policies. Nervousness over the administration’s intentions was a common theme among respondents, although the general tone of the survey was positive about the industry’s outlook.

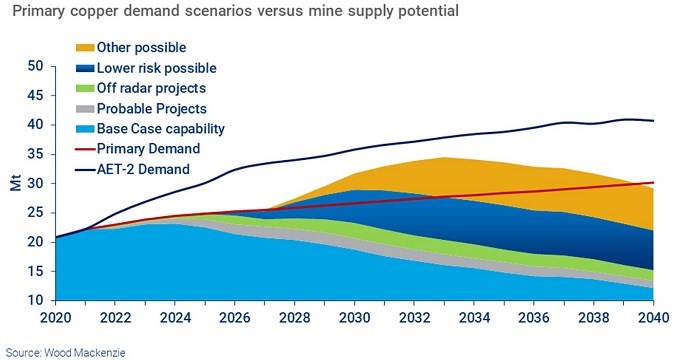

Chart of the week

The price of copper has surged over the past year, raising questions about whether we are now entering a period of a tight market that could last for several years. The answer, according to Julian Kettle, Wood Mackenzie’s vice-chair of metals and mining, depends in large part on the pace of the energy transition. Our base case view of future copper demand, representing our assessment of the most likely outcome, is shown here by the red line. If that projection is correct, then demand can be met by the tiers of supply shown by the solid wedges until the mid-2020s. Beyond that, lower-risk possible projects would meet requirements until the mid-2030s. In a world where governments set policy to limit global warming to 2 °C, however, copper demand would grow much more rapidly, as shown by the dark grey line. In that market, Kettle says, “Even allowing for all probable projects to be developed (albeit with delays), supply would be unable to meet requirements, thereby becoming a constraint on an accelerated energy transition.” His conclusion: “Without decisive action, the lack of supply development really could come back to bite the copper industry.”