Sign up today to get the best of our expert insight in your inbox.

The indefinite Inflation Reduction Act: will tax credits for renewables be around for decades?

5 minute read

Ryan Sweezey

Director, North America Power & Renewables

Ryan Sweezey

Director, North America Power & Renewables

Ryan focuses on coverage of North America power markets, producing forecasts of power, capacity and REC prices.

Latest articles by Ryan

-

Opinion

2025 global power market outlook: divergent paths in a transforming energy landscape

-

Opinion

The 2025 US power market outlook

-

Opinion

The global power market outlook: can global power generation keep up with the energy transition?

-

Opinion

North American power markets: navigating a trickier path to decarbonisation

-

Opinion

The Inflation Reduction Act and its impact so far

-

Opinion

The Inflation Reduction Act one year on

The Inflation Reduction Act (IRA) of 2022 provided substantial long-term clean energy policy certainty for the power sector. However, there is a common misconception that the centerpieces of the IRA – key renewable tax credits – are only extended through 2032.

Based on the language in the IRA, our view is that these tax credits will be extended for substantially longer than 2032 – perhaps even 30-40 years. Absent IRA repeal, this means that instead of several hundred billion dollars in tax credits for new renewables and storage through 2032, the real money on the table is on the order of trillions of dollars over multiple decades.

A brief history of the Production Tax Credit (PTC) and Investment Tax Credit (ITC)

The PTC was first established in 1992 and provides a production-based (per kWh) tax credit that is valid for 10 years after an eligible project is placed in service. While wind energy is the largest beneficiary of the PTC, other technologies – such as biomass and geothermal – are also eligible.

Unlike the PTC, the solar ITC does not provide a production-based incentive; rather, projects receive a tax credit based on a percentage of eligible equipment costs. The solar ITC was first established in 2005.

While both tax credits have seen multi-year extensions since their creation, extensions have predominantly been of a short-term nature. At various points in their history, the credits even temporarily lapsed and were extended retroactively. Before the IRA, the most recent short-term extension occurred in 2020.

The IRA extends existing tax credits and establishes new credits

The IRA definitively ends this short-term cycle of uncertainty. The law extended both the existing PTC and ITC through the end of 2024. It also created two new technology-neutral credits to replace the traditional PTC and ITC for projects placed in service starting in 2025.

For the first time, standalone storage is now eligible on its own for the ITC. Previously, storage could only access the ITC if paired with solar and if it charged at least 75% from the solar array – as opposed to the grid – on an annual basis. Solar also gained eligibility for the PTC under the IRA.

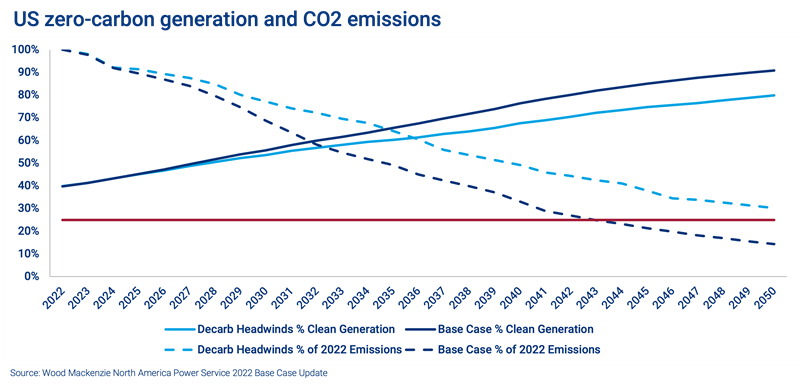

The IRA established very specific phaseout schedules for the new technology-neutral tax credits. The credits are in effect either until the later of 2032, or until US electricity sector carbon dioxide emissions are equal to or below 25% of 2022 levels. Reaching this threshold triggers a three-year phaseout with defined annual step-downs in tax credit value. In our view, the US will cross the 25% of 2022 emissions threshold substantially later than 2032.

In addition to the PTC and ITC extensions, the IRA established PTCs for both existing nuclear plants and clean hydrogen, and enhanced incentives for carbon capture and storage (CCS). Unlike the technology-neutral PTC and ITC, these credits have a firm expiration date of the end of 2032.

Expectations for IRA tax credit phaseouts

Wood Mackenzie’s North America Power Service produces semiannual forecasts for all US and Canadian power markets through 2050. Our latest base case outlook was published in December 2022 and fully reflects the IRA policy framework. In this outlook, we expect the US electricity sector won’t cross the 25% threshold until 2044, more than twenty years after passage of the IRA. At this point in the future, we expect zero-carbon generation to account for 84% of total generation – up from approximately 40% today.

This is accomplished by significantly scaling up annual renewable and storage capacity additions, and by widespread preservation of the existing nuclear fleet. Long-term demand pressures from the electrification of buildings and transportation require additional deployment of zero-carbon generation to hit the threshold. At the end of our forecast in 2050, zero-carbon generation is approximately 90% of total US generation.

Once the 25% threshold is reached, the three-year phaseout ensures that projects entering service through at least 2047 will be eligible for the technology-neutral tax credits. However, the Internal Revenue Service’s (IRS) Continuity Safe Harbor provision provides an additional nuance to this expectation. Under this provision, projects are allowed to reach commercial operations up to four years after they initially qualify for either the PTC or ITC.

Thus, a project qualifying for a tax credit in 2047 has until the end of 2051 to commence commercial operations. If the IRS continues to allow for Continuity Safe Harbor in the future, we expect projects entering service for nearly the next 30 years to receive the technology-neutral tax credits.

What could cause the IRA tax credit phaseouts to shift earlier or later?

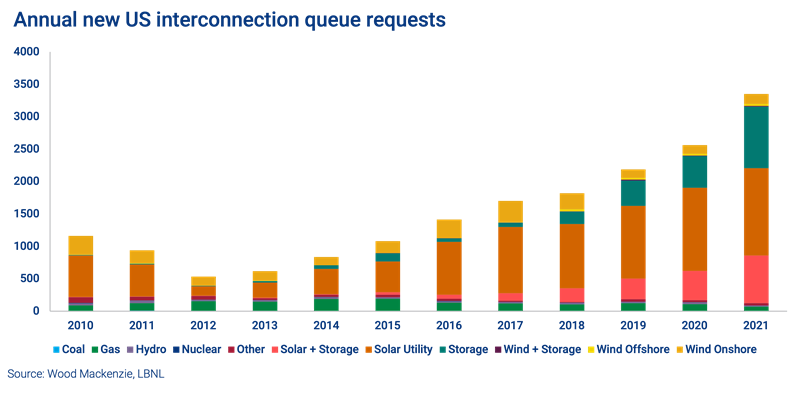

In our view, the risks to expected phaseout timing are weighted toward a later phaseout than occurs in our base case. However, if an earlier phaseout were to occur, it would undoubtedly be the result of reforms to successfully relieve interconnection queue bottlenecks and to accelerate the buildout of large-scale transmission – both issues that the IRA largely does not address.

The US would also need to substantially accelerate the deployment of other zero-carbon generation technologies like new small modular nuclear reactors (SMRs), hydrogen-powered generation and generation equipped with carbon capture and sequestration (CCS).

Obstacles to transmission development and interconnection queue bottlenecks could delay the pace of electricity sector decarbonization in the US. In recent years, these issues have emerged as significant hurdles to electricity decarbonization. In our recent Decarbonization headwinds outlook, these issues result in reduced uptake of new renewables, compared to our base case.

In this alternative scenario, the US does not cross the 25% threshold within our 2050 forecast horizon. Electricity sector emissions sit at 30% of 2022 levels at the end of the forecast, corresponding to 80% zero-carbon generation. While we do not explicitly forecast past 2050, extrapolating emissions results in the US crossing the 25% threshold in 2055, more than 30 years after passage of the IRA.

With the three-year phaseout and Continuity Safe Harbor provision, this would result in projects entering service with the technology-neutral tax credits through the early-2060s.

IRA tax credits are here to stay – for now

While there is uncertainty on the exact timing, it is abundantly clear that the central provisions – the technology-neutral tax credits – of the IRA will be here for decades to come. This is a drastic reversal from three decades characterized by short-term clean energy policy.

Buckle up, as this is going to be a ride for the long haul.