Discuss your challenges with our solutions experts

What will it take to sustain corporate upstream growth to 2030?

Spending remains sluggish despite a looming production challenge next decade

1 minute read

Tom Ellacott

Senior Vice President, Corporate Research

Tom Ellacott

Senior Vice President, Corporate Research

Tom leads our corporate thought leadership, drawing on more than 20 years' industry knowledge.

View Tom Ellacott's full profileWhat does four years of low prices and brutal cost cutting mean for upstream corporate growth? Tom Ellacott, Senior Vice President of Corporate Research, and Norman Valentine, Director of Corporate Research, analyse one of the biggest threats to long-term upstream corporate growth – chronic underspend.

For the full story, purchase a copy of this report: Underspend threatens upstream corporate growth.

Conventional growth hoppers have shrunk

Oil and gas companies have rightly focused on profitability, cash flow generation and returns since the price collapse of 2014. Capital discipline has become the norm across the industry. But four years of deep capital rationing has had a severe impact on conventional resource renewal. More than half the companies in our coverage failed to replace production over 2016 and 2017.

Companies have been cherry picking the best greenfield conventional projects in their portfolios for development. But there's not enough new high-quality projects entering the pre-FID funnel to replace those that have left.

US tight oil resource continues to grow and grow

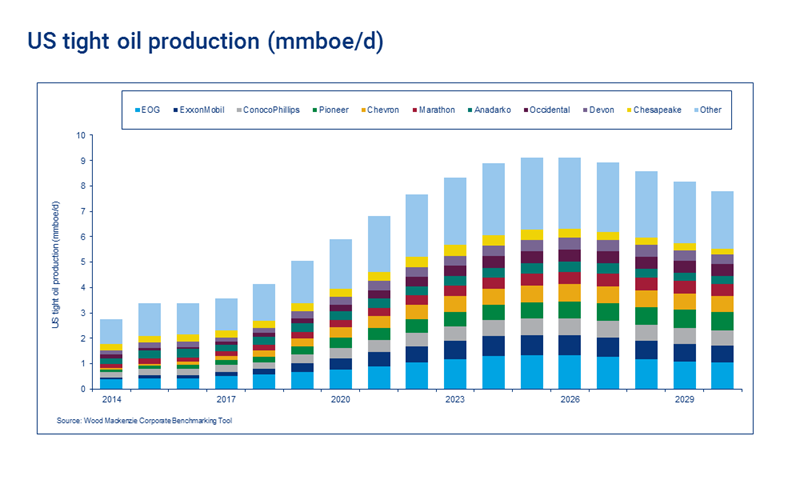

It’s a very different story in the US tight oil sector. The Permian has really taken off since 2014. There’s been a dramatic expansion in drilling inventories and development well returns have nearly trebled. This explains why US Independents are retrenching to tight oil. The Majors are also muscling in on the action, having made important strategic moves to get materiality in the play.

US tight oil play is now the main growth engine for most US Independents and core for ExxonMobil, Chevron, BP and Shell.

Only US tight oil looks set fair for consistent growth in investment in the next few years driven by the Permian, and there’s a new wave of big LNG projects coming. Elsewhere spend is ticking up but there’s no momentum. We think investment in conventional, deepwater US shale gas and oil sands will be stuck well below pre-downturn levels for the foreseeable future.

Norman Valentine

Director Corporate Analysis, Head of Corporate Power and Renewables Research

View Norman Valentine's full profileProduction problems loom next decade

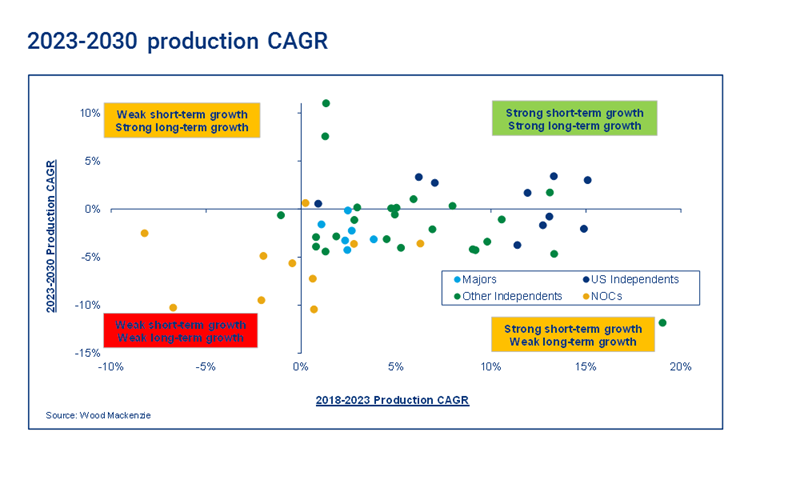

So what does four years of cherry-picking, low conventional resource renewal and the rise of tight oil mean for the peer group’s production? Most companies look good in the short run with production growth out to 2023. But some face a pressing challenge in the next few years. And beyond 2023, most companies enter production decline.

The US tight oil ‘haves’ standout with a decent outlook for investment and growth. But comparatively few companies have the luxury of a strong Permian position. The pipeline of potential future conventional projects is thin, and certainly not deep enough for many players to sustain production beyond the mid-2020s.

We’ll all look back at 2018 as a golden year. Oil and gas companies are raking it in with Brent set to average near US$75 per barrel and cost bases set at US$50 per barrel post-downturn. The money is real enough, but it would be wrong to see the windfall as indicative of an industry in robust health. Investment is still in a deep trough.

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

View Simon Flowers's full profileCapital allocation priorities will start to shift

The long-term growth challenge is daunting. Our peer group collectively needs to find and develop 16 million boe/d by 2030 to sustain the production peaks of the next few years. There is only a little over a decade in which to deliver the hundreds of developments that will be required.

But capital is still being heavily rationed, in spite of resurgent cash generation. There are few signs of a rush to reinvest – investment is lower in the capital allocation priority list than dividends and buybacks.

This disciplined approach will appease value-focused investors. It is also part of the adaption process to energy transition and the threat of peak demand, which pose serious challenges to long-term investment. Even so, a prolonged period of under-investment will be self-correcting - prices will adjust, and trigger a new investment cycle.

Capital allocation priorities will inevitably start to shift if the current levels of free cash are sustained – it is the way of the world in oil and gas. Market sentiment will switch back in favour of growth if companies present a persuasive case for value creation. And sound investments made now will be the cash cows that fund the shift into new energy that will gather pace next decade.