Asia’s power sector feels the burn

End-users bracing for tariff hikes as costs continue to rise

1 minute read

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin oversees our Europe, Middle East and Africa research.

Latest articles by Gavin

-

The Edge

Unlocking the potential of white hydrogen

-

The Edge

Is it time for a global climate bank?

-

The Edge

Are voters turning their backs on the EU’s 2030 climate objectives?

-

The Edge

What will define LNG’s three phases of market growth?

-

The Edge

The coming low carbon energy system disruptors

-

The Edge

Could US data centres and AI shake up the global LNG market?

Everything across Asia’s power sector is heading north. With electricity demand continuing to climb, power prices are being pushed significantly higher by increasing fuel, equipment, land, and labour costs. Rising interest rates add further complexity.

To understand what these challenges mean for the region’s future generation mix, investment outlook, and growth in renewables I spoke to Alex Whitworth, head of APAC Power & Renewables research.

How is the current crisis impacting Asia’s power markets?

It’s all about costs. In our latest APAC Power & Renewables Strategic Planning Outlook we expect Asia’s power generation costs to rise by around US$650 billion per year for the next three years - equivalent to a two-thirds increase over 2021 levels. Not great news for consumers who must now brace for their electricity bills to go up by an average of 27% through to 2025.

The most immediate impact has been on gas-fired power as war in Ukraine pushed already surging LNG prices through the roof. With European LNG demand forecast to grow by 25 Mt this year as the continent looks to reduce dependence on Russian pipeline supply, something had to give. Price sensitive Asian buyers baulking at spot prices are the safety valve, with significantly lower imports already in 2022 expected to continue through the rest of the year.

With reduced gas demand in the power sector due to high prices, coal-fired power has often filled the gap - even as gas-to-coal switching has led to higher coal prices and hence power prices. But for those with low-cost domestic coal supply the logic has been even more compelling, with China, India, Indonesia, and Vietnam all significantly increasing coal-fired output. Today, it is those markets with more liberalised electricity pricing systems that are feeling the most pain.

What does this mean for Asia’s generation mix?

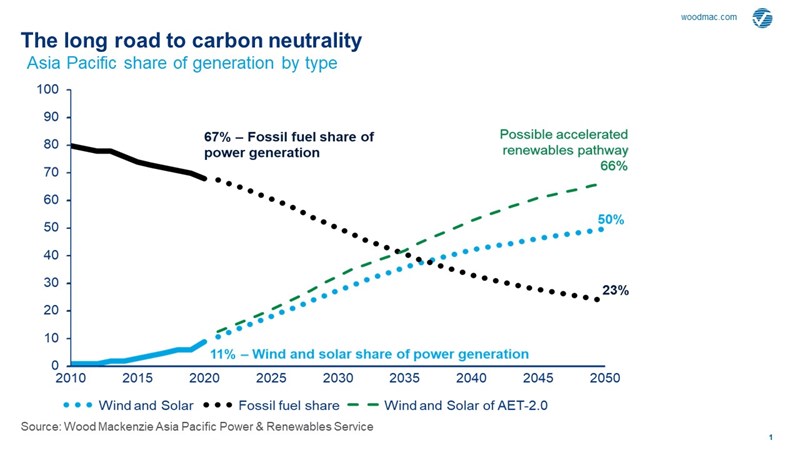

Asia’s economic dynamism drove a 200% increase in power demand over the past two decades. This was dominated by fossil fuels: 67% of power in 2021 came from coal and gas, while renewables accounted for only 11% last year.

With net-zero and decarbonisation targets now set across the region, this has to change. While our base case assumes a slower rate of growth, power demand still increases by over 90% through to 2050. Renewables will play a far greater role in meeting this, with wind and solar generating half of Asia’s electricity by this time, potentially rising to two-thirds in our accelerated energy transition scenario.

Our structurally higher gas price outlook means gas struggles to maintain its market share across Asia, falling slightly to around 10% of total generation by 2050. Nevertheless, given the strength of Asian power demand growth we still see gas demand in the sector rising from 315 bcm in 2022 to reach over 500 bcm by 2050.

How much investment is now needed?

After crunching the numbers, we now expect investment in Asia’s power market will hit US$2.9 trillion over the next decade. This is a 28% increase from where we were just a year ago. Two key drivers of this upward revision are cost inflation and China.

The impact of higher energy prices on coal and gas generation is well understood, but renewables are also feeling the pain. The sector has been hit by cost inflation of up to 20% over the past year and we don't see that going away any time soon.

With its dominant supply chain, China has avoided the worst of inflation across renewables. This is supporting an impressive 50% increase in planned wind and solar capacity buildout to help China manage its fuel import costs and meet demand growth. Through to 2030, over 60% of Asia’s power sector investment comes from China.

For other countries across the region, it’s a different story. We now see a lower capacity build outlook as developers take fright at increasing uncertainty and rising costs.

How are renewable developers responding?

With such a huge volume of renewable investment in the pipeline, opportunities abound. But as market conditions quickly transform, we now see three key risks across the sector.

Top of the list is cost inflation. Equipment costs are up, logistics costs have more than doubled and labour is getting more expensive. Combine this with the obvious impact of interest rate hikes and it’s easy to see the risks cost inflation poses to the sector.

Next, revenue. Curtailment risks are rising as solar and wind capacity heads towards 90% of peak grid load in some markets by 2030. We don't see anything like enough investment in battery storage, and grid investments are also falling behind.

A further risk for renewables is market exposure. Renewable developers are already seeing price cannibalisation as projects fight to get on the grid. We also see more volatility in prices and pass-through of system costs to developers. On top of this, end-users are becoming less willing to sign long-term contracts and are instead demanding lower prices for clean power.

What's next?

More uncertainty. Governments must play a key role and we continue to expect that those markets with the greatest ambition around policies and infrastructure to reduce uncertainty for investors will come out strongest.

Conversely, those that instead push risks back onto overly enthusiastic developers and allow market forces to decide outcomes increase the prospect of investments under-performing through avoidable boom-and-bust cycles.

APAC Energy Buzz is a weekly blog by Wood Mackenzie Asia Pacific Vice Chair, Gavin Thompson. In his blog, Gavin shares the sights and sounds of what’s trending in the region and what’s weighing on business leaders’ minds.