Discuss your challenges with our solutions experts

Can the US make the switch to electric heavy-duty trucks?

With BYD, Volvo, Freightliner and Tesla all launching electric trucks, the transition to heavy-duty vehicle electrification could be accelerating

1 minute read

The electrification of transport is happening at pace. But while electric cars are in the fast lane, heavy-duty trucking faces a longer, slower journey. These vehicles are often considered to be the most difficult to electrify, due to the range challenges associated with long-haul trips – but is that really a major roadblock?

A new report, US heavy-duty truck electrification: far-fetched dream or reality? draws on insight from our Electric Vehicle & Battery Supply Chain Service to explore the challenge. In it, we ask: how many heavy trucks actually travel long distances rather than making many short haul trips? How many vehicles can be electrified based on the range required? And what does all of this mean for electric vehicles’ share of total Vehicle Miles Travelled (VMT) and oil displacement?

Visit the store to access the full report or read on for an overview.

Heavy-duty truck electrification: current state of affairs

Heavy-duty transport is a critical sector to decarbonize. While heavy-duty electric trucks account for only 2.7% of all US trucks, they amount to almost 22% of fuel use from the trucking sector and 7% of total road transport emissions.

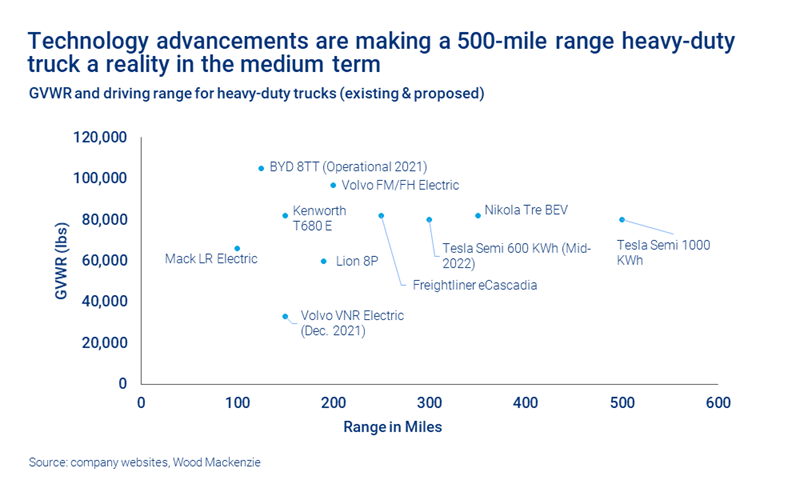

Progress is being made. BYD and Volvo delivered day-use Class 7 and Class 8 heavy trucks in 2021. Freightliner and Tesla will deliver heavy truck models this year with a range of 250 and 300 miles, respectively. Strong commitment and action from traditional diesel truck manufacturers to launch electric trucks is pointing to a promising move towards heavy duty electrification.

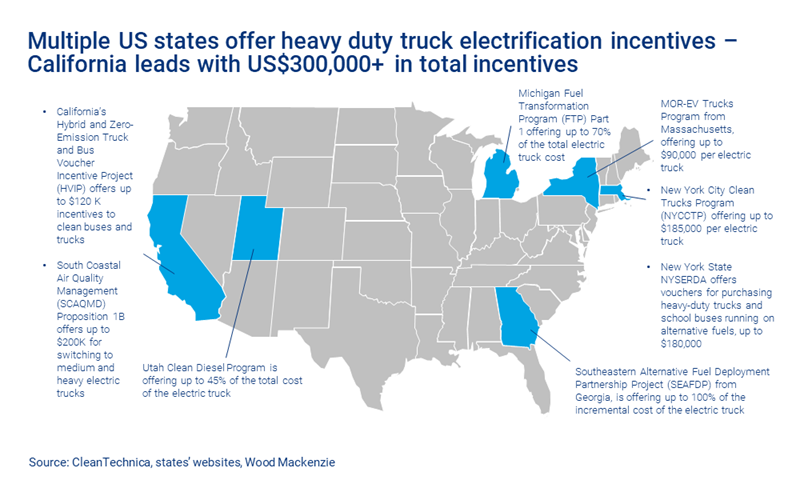

Policy in several states support the move to heavy-duty electrification. These incentives range from anywhere between US$90,000 to US$300,000 for certain vehicle models and technologies. These policies reduce the upfront cost of switching and make the total cost of ownership for electric trucks significantly lower compared to diesel trucks.

Evaluating the range requirements of heavy-duty trucks

Range is a common concern in the electrification of transport. But heavy duty trucks may not be as focused on long haul journeys as they are often perceived to be. Data from the Bureau of Transportation Statistics’ 2002 Vehicle Use and Inventory Survey shows that 44% of heavy-duty combination trucks and 95% of single trucks drive less than 50,000 miles annually, or about 170 miles daily. Vehicles less than two years old tend to drive more; in this category the above metric falls to 15% for heavy-duty combination and 89% for single trucks. Since this survey was undertaken, our assessment is that US heavy-duty annual miles driven have remained relatively stable. But long haul trips have become less common due to the faster shipping and shorter supply chain needs of today’s world.

This shows that there is a big market for heavy duty electrification, even with the models and battery range that will be launched this year. We used this Vehicle Miles Travelled (VMT) share by truck fleet data to evaluate hypothetical US heavy-duty electrification as technology develops and higher range heavy duty trucks become available.

As new trucks, under two years old, drive significantly more than older trucks the daily range requirement is higher and the electrification potential is lower. For these trucks, we estimate that about 42% of heavy-duty single and combination vehicle sales and 21% of VMT can be hypothetically electrified, based on the 250-300-mile range available on the models to be released this year. With the Tesla Semi’s 1,000 KWh battery option, a range of 500 miles is possible. With this larger battery size, we estimate that 94% of all new US heavy-duty vehicle sales and 80% of all heavy-duty VMT could be potentially electrified.

This is a promising electrification story, but we have several hurdles to clear to make this a reality.

What are the barriers to heavy-duty truck electrification?

Changing heavy-duty fleets, installing charging stations and optimizing charging schedules for a smooth transition to electric fleets will require a lot of effort, capital and policy incentives. These factors will slow down EV adoption.

While 42% of heavy-duty vehicles are hypothetically electrifiable today, lack of model availability, capacity concerns, new technology adoption and battery supply chain issues will result in a slower ramp-up of electrification over the next several years.

The full report explores this topic in more detail, including charts on the US new heavy truck sales outlook and diesel/gasoil displacement volumes. Visit the store to find out more.