Get Ed Crooks' Energy Pulse in your inbox every week

China’s solar growth sends module prices plummeting

Excess capacity in solar manufacturing creates challenges for the US and other countries attempting to develop their own industries

11 minute read

Ed Crooks

Vice-Chair, Americas

Ed Crooks

Vice-Chair, Americas

Ed examines the forces shaping the energy industry globally

Latest articles by Ed

-

Opinion

How global trade can help build the clean energy economy

-

Opinion

Biden exit shakes up US presidential race

-

The Edge

Is it time for a global climate bank?

-

Opinion

Are low profits to blame for the energy transition lagging?

-

Opinion

Day 3: How can we finance the energy transition? Discussions from the final day of the Reuters Global Energy Transition Conference 2024

-

Opinion

Day 2: The Energy Gang at The Reuters Global Energy Transition Conference 2024

Benjamin Disraeli described Britain in 1838 as “the workshop of the world”, because of its global dominance in manufacturing. In low-carbon energy today, it is China that has the undisputed right to that title. Chinese companies dominate global value chains for solar power, battery storage and electric vehicles, among others. A surge of investment in new capacity, currently under way, means that lead is being extended in several sectors.

In solar, China’s increased manufacturing capacity has sent prices tumbling. Wood Mackenzie’s new monthly PV Pulse note puts the price of modules in China at just 11 US cents a watt, down about 40% over the past year. Solar panels are now so cheap, they are being used to make garden fences in Germany and the Netherlands.

The plunge in prices is highlighting a central issue in the energy transition: falling equipment costs can accelerate the deployment of low-carbon technologies, but also cause economic strains that can undermine support for climate policies.

The ”China shock” is a term sometimes used to describe the impact on developed economies of China’s industrialisation since the 1980s. Now some commentators are talking about the prospect of a “China shock 2.0”, centred on low-carbon energy.

The Biden administration has attempted to win support for its climate strategy, particularly in the 2022 Inflation Reduction Act, by arguing that it will encourage investment and job creation in US manufacturing. As the price of Chinese equipment falls, it becomes harder for US companies to compete. Policies to support domestic manufacturing become more expensive, whether in terms of the greater subsidies that are needed, or the opportunity cost from not using imported products.

Janet Yellen, the US Treasury secretary, set out the administration’s concerns last week, when she visited a solar cell plant in Georgia where production is being restarted because of the incentives in the Inflation Reduction Act. China’s overcapacity in industries including solar, electric vehicles and lithium ion batteries “distorts global prices and production patterns and hurts American firms and workers, as well as firms and workers around the world,” she said.

President Joe Biden reiterated the message in a telephone call with President Xi Jinping of China on Tuesday. The White House said President Biden had raised continued concerns about China’s “unfair trade policies and non-market economic practices, which harm American workers and families.”

On Thursday Yellen arrived in China for five days of meetings, hoping to find ways to establish “a level playing field” between US and Chinese manufacturers in low-carbon energy sectors. She noted that other economies including Europe, Japan and Mexico were also worried about the pressure from Chinese competition backed by massive investment. The EU this week launched two investigations into Chinese solar manufacturers suspected of gaining an "unfair advantage” from "distortive" state subsidies.

The impact of rising Chinese production has been most dramatic in the solar industry. Wood Mackenzie data show that China’s module manufacturing capacity nearly tripled during 2022, from about 198 gigawatts a year to about 562 GW/year, and then rose by a further 84% to over 1 terawatt a year at the end of 2023. At the start of this year, China accounted for about 80% of total global module manufacturing capacity.

The world installed 417 GW of solar generation last year, almost twice as much as in 2022. China accounted for more than half of that, adding more in one year than the entire solar generation capacity of the US. But those installations were still much less than module manufacturing capacity in China alone.

That oversupply has caused the plunge in solar prices. Modules from US factories have also come down sharply in price, dropping by about 30% over the past year. But they are still much more expensive at about 27.5 US cents a watt, compared to 11 cents a watt for modules in China.

The US and other countries have made efforts to support their domestic solar module industries, but still find it difficult to compete. China’s solar module exports more than doubled between the first half of 2021 and the first half of 2023.

Chinese modules are kept out of the US market by high and unpredictable duties, but imports from Southeast Asia are not, for the time being at least. The US Department of Commerce ruled in August last year that some Chinese producers were “shipping their solar products through Cambodia, Malaysia, Thailand, and/or Vietnam for minor processing” in an attempt to avoid the duties.

The usual result of such a finding would be duties on imports of cells and modules from those four countries. However, in June 2022 President Joe Biden issued a presidential proclamation suspending collection of any duties for a two-year “emergency period”, to give US importers time to find new suppliers. That moratorium is scheduled to end in June.

The moratorium exposed the fundamental dilemma at the heart of the Biden administration’s strategy. On the one hand, the plummeting cost of solar is a triumph for low-carbon energy. Just 13 years ago, in 2011, panels were selling for about $1.48 a watt, and the stretch goal was to reach 50 US cents a watt. Now prices in China are closing in on just a fifth of that level.

But on the other hand, for governments that need to convince their electorates of the case for low-carbon energy, the scale and competitive advantage of Chinese manufacturing is a big problem.

Manufacturers have big plans to develop module production in the US. If all the proposed module factories in the US get built, production capacity would rise from about 15 GW a year at the end of 2023 to over 100 GW a year at the end of 2025. But given the intensity of global competition and the downward pressure on module prices worldwide created by excess capacity, there are doubts over how many of those proposed plants in the US will actually come into operation.

To an extent, that excess capacity in solar manufacturing will be self-regulating. Wood Mackenzie analysts estimate that over 190 GW of planned new wafer, cell and module production capacity has already been terminated or suspended in the past year.

But there is still momentum behind solar production in China. The government has identified the “new three” export industries – solar, EVs and batteries – as critical for its strategy of strengthening economic growth in the face of headwinds from past over-investment in property and high levels of debt.

Xinhua, the state news agency, recently published a commentary arguing that talk about an “overcapacity problem” was “just a pretext for certain Western countries to poison the environment for China's domestic development and international cooperation and take more protectionist measures for their own industries.” The piece added that China had “greatly accelerated… the global transition towards efficient, clean and diversified energy supplies.”

This is the difficult position that Janet Yellen has to navigate to find a path that will allow continued growth in the solar manufacturing industry in the US.

Disraeli’s point about Britain’s 19th century dominance in manufacturing was that the countries of Continental Europe would not be prepared to tolerate it forever. He was proved right before the century was out, as Germany industrialised rapidly thanks to the new sectors of chemicals and electrical engineering. The resulting international tensions ultimately had catastrophic consequences. We have to hope that the strains created by China's manufacturing dominance can be managed more successfully.

In brief

The US Environmental Protection Agency has announced US$20 billion in grants to support investments in emissions reduction. The money comes from the new Greenhouse Gas Reduction Fund, created in the Inflation Reduction Act of 2022. The grants are intended to support an additional US$130 billion of private sector investment. Organisations being supported include the Climate United Fund, which works primarily in disadvantaged and low-income communities, and the Coalition for Green Capital, which works with state, local, and nonprofit green banks.

Iran has threatened retaliation against Israel after a strike on a building in Damascus that reportedly killed 13 people, including two generals in the Iranian Revolutionary Guards. Tehran’s representative at the UN told the Security Council that Iran had “exercised considerable restraint, but it is imperative to acknowledge there are limits to such forbearance.” She added: “Iran reserves its right [to]… a decisive response.” Israel has not confirmed that it was responsible for the strike.

The OPEC+ group’s Joint Ministerial Monitoring Committee kept their agreement on production curbs unchanged at an online meeting on Wednesday. The ministers welcomed pledges from Iraq and Kazakhstan to stay within their agreed output limits and compensate for past overproduction, and reiterated their “readiness to take additional measures at any time.”

The US government has stopped its purchases of crude oil to refill the Strategic Petroleum Reserve. The Department of Energy said it was “keeping the taxpayer's interest at the forefront” in stopping planned purchases totaling three million barrels of oil that had been scheduled for delivery to the SPR in August and September. About 275 million barrels were sold from the reserve between the summer of 2021 and the summer of 2023. Since then, about 17 million barrels have been replaced.

The energy department had set a ceiling of US$79 a barrel for purchases for the reserve, and West Texas Intermediate was trading on Friday morning at around US$87 a barrel. Brent crude was about US$91 a barrel, up about US$5 a barrel on the week. The energy department said it would resume oil purchases in the future “as market conditions allow."

Tesla has reported disappointing sales for the first quarter of 2024. The company delivered 386,810 vehicles in the quarter, down from 422,875 in the first quarter of 2023. It said the decline in volumes was partially due to being in the early phase of the production ramp-up for the updated Model 3 at its Fremont factory in California, and was also affected by disruptions to production including shipping diversions to avoid the Red Sea and an arson attack at its gigafactory outside Berlin.

In another sign of the challenges facing EVs, Ford has decided to delay the launches of two new battery electric vehicles: a large SUV and a pickup truck. The vehicles are now scheduled to be on sale in 2027, having previously been expected in 2025 or 2026. Ford said it was continuing to invest in electric vehicle programmes as it worked “to build a full EV line-up”, while also strengthening its position in hybrid vehicles, which have been selling strongly in some markets. By the end of the decade, Ford plans to offer hybrid powertrains across its entire range of gasoline-fueled models in North America. Meanwhile, design work continues on future EVs, “including a flexible small and affordable EV platform by a skunkworks team in California.”

Other views

Why the transition needs smart upstream taxes – Simon Flowers and others

Deepwater decommissioning: three key things to know – Luiz Hayum and Amanda Bandeira

How will the EU’s CBAM impact global iron and steel? – Nuomin Han

The biggest takeaways from our PJM and ERCOT spring outlook webinars – Jessalyn Chuang and others

Curb Your Enthusiasm: Bridging the gap between the UK’s CCUS targets and reality – Lorenzo Sani

Bending the (cost) curve: upstream emissions and O&G competitiveness – Nolan Lindquist

Time to rethink retirement: Larry Fink’s 2024 annual chairman’s letter to investors – Larry Fink (scroll down for the discussion of his evolving views on energy)

Quote of the week

“I am going to lecture you on climate change. Because we have kept this forest alive, that stores 19.5 gigatons of carbon, that you enjoy, that the world enjoys, that you don’t pay us for, that you don’t value, that you don’t see a value in, that the people of Guyana has kept alive. Guess what? We have the lowest deforestation rate in the world. And guess what? Even with our greatest exploration of the oil and gas resource we have now, we will still be net zero… This is the hypocrisy that exists in the world. The world in the last 50 years has lost 65% of all its biodiversity. We have kept our biodiversity. Are you valuing it? Are you ready to pay for it? When is the developed world going to pay for it?... Are you and your system in the pockets of those who destroyed the environment through the Industrial Revolution and [are] now lecturing us?... There is no hypocrisy in our position.” – President Mohamed Irfaan Ali of Guyana, in an interview with the BBC, pushed back against questioning over the greenhouse gas emissions resulting from his country’s growing oil and gas production.

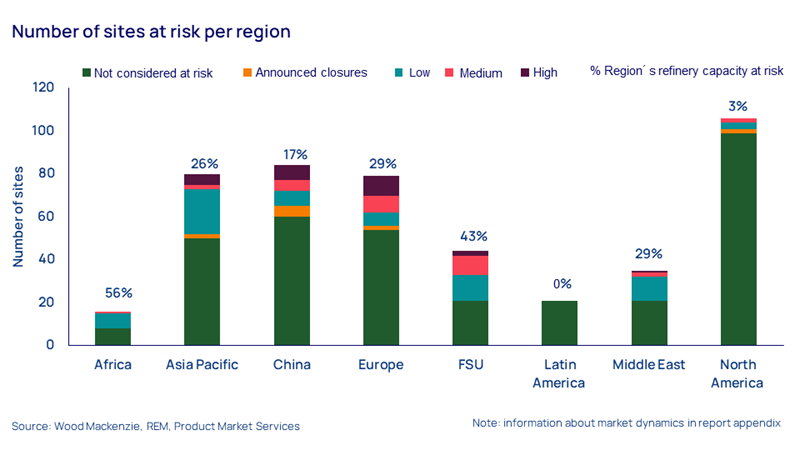

Chart of the week

This comes from a new note by Emma Fox, a senior oils and chemicals analyst at Wood Mackenzie, showing our assessment of where refinery sites are at risk of closure around the world. There is a shortlist of 120 out of 465 refining assets in total that we assess as at high, medium, or low risk of closure, based on 2030 net cash margin (NCM) forecasts. As much as 3.6 million barrels a day of refinery capacity worldwide is at high risk of closure, with a further 19.95 million b/d at some risk, our analysts believe. Europe and China, two of the economies that are leading the world in terms of EV adoption, also lead the way in terms of high-risk refining sites. We expect total world refining capacity to increase every year between 2024 and 2026, but after that we expect it to go into decline, as refinery closures outweigh new construction and expansions.

Get The Inside Track

Ed Crooks’ Energy Pulse is featured in our weekly newsletter, alongside more news and views from our global energy and natural resources experts. Sign up today to ensure you don’t miss a thing.