Ethylene: global carbon contributor

The ethylene industry is tackling emissions through a raft of new carbon-cutting measures. These bring promise, but also considerable challenges, as some regions face the fall-out of their carbon pricing policies

4 minute read

Catherine Tan

Principal Analyst, Asia Olefins

Catherine Tan

Principal Analyst, Asia Olefins

Catherine is responsible for Wood Mackenzie's ethylene and propylene analysis in Asia.

Latest articles by Catherine

-

Opinion

Ethylene: global carbon contributor

-

Opinion

Part 1: unlocking the value of refinery-petrochemicals integration

-

Opinion

Propylene: through the downcycle and beyond

-

Opinion

Propylene: picking the winners and losers

Siddhant Warrier

Research Analyst, Chemicals

Siddhant Warrier

Research Analyst, Chemicals

Siddhant primarily covers the olefins and ethylene oxide & glycols markets for the Americas region.

Latest articles by Siddhant

View Siddhant Warrier's full profileShruthi Vangipuram

Senior Research Analyst, Base Chemicals

Shruthi Vangipuram

Senior Research Analyst, Base Chemicals

Shruthi leads our research coverage for the Americas olefins market.

Latest articles by Shruthi

-

Opinion

Plastic demand could reduce by up to 30% in an accelerated energy transition scenario

-

Opinion

Which global steam crackers are at most risk of closure?

-

Opinion

Ethylene: global carbon contributor

-

Opinion

Part 2: unlocking the value of refinery-petrochemicals integration

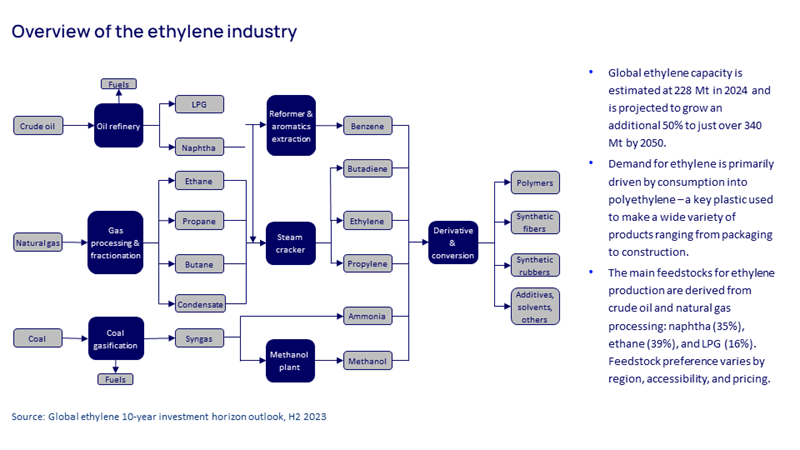

Ethylene is the key component in polyethylene, the most widely-used plastic in the world. Found in everything from packaging and healthcare products to the construction industry, it is in high demand, with global capacity projected to grow by 50% by 2050. Ethylene is also a significant carbon contributor; production of ethylene is responsible for almost 13% of the global petrochemical industry’s CO2 emissions. The issue is the manufacturing method: steam cracking is an energy intensive process which generates 1.2 tons of CO2 emissions per ton of ethylene produced.

With the market for ethylene projected to grow to 340 Mt by 2050 and a commitment to achieve net-zero carbon emissions in the same time frame, the industry is facing some pressing challenges. Intensive investments in novel technologies are underway in the ‘cat and mouse’ chase to curb carbon emissions that continue to grow by the year.

Wood Mackenzie has enhanced our Ethylene Asset Benchmarking Tool (E-ABT) to include analysis of carbon emissions and cost analysis at the asset level. The model considers both Scope 1 and Scope 2 emissions, focusing on key parts of the steam cracking process, including fuel usage, flaring, and electricity consumption. It clarifies the role of feedstock and fuel selection on carbon emissions, and allows scenario modelling – for example, by simulating the effects of changing carbon prices in different regions. Taking in the broader economic picture, it also reveals the knock-on effects that proposed carbon-reducing technologies and policies may have on the markets.

In this report, we have used the E-ABT to gain insights into CO2 sources, explore the impact of feedstock and fuel sources on emissions intensity, and track emissions-reducing technologies. Fill in the form for an extract of ‘decarbonisation strategies for the ethylene industry, navigating a path to net zero’, or read on for a summary.

The race to net zero

The ethylene industry is adopting a diverse approach to net zero, with major producers now investigating a full suite of possibilities. Efforts are being made to improve the efficiency of existing production processes, and some producers are investigating alternative energy sources such as electrification. Some regions are shifting towards renewable feedstocks – making use of plastics waste instead of oil or gas-derived sources, for example. A raft of carbon capture technologies are being developed with the aim of preventing emissions from reaching the atmosphere in the first place, and R&D projects are exploring new, low emission cracking techniques.

Challenges persist with all options, however. Many technologies are not yet scalable or economically viable, and policies are not yet settled. Tackling these obstacles will require a coordinated effort from key industry players, from policy makers to investors and researchers. Governments will play a crucial role here in encouraging investment, and in some regions mandates are already being implemented. Carbon taxes, energy targets and new regulations for energy efficiency are steadily being introduced.

The industry must stay committed to its net-zero target for 2050, but all of these decarbonisation investments are in their early stages – indeed many are on unsteady ground, with question marks around their cost effectiveness. Responding to this rapidly-changing investment market, Wood Mackenzie’s Ethylene Asset Benchmarking Tool can model the impact of these new technologies on ethylene-related carbon emissions. The tool equips users with detailed carbon emissions and cost analysis modelling at the asset level, and can be used to explore the emissions impact of feedstock and fuel. You can watch a video about the E-ABT here.

High price to pay

The economic future of ethylene is tied to that of carbon, since dominant ethylene feedstocks are industrially sourced from crude oil and natural gas processing: naphtha, ethane, and LPG. Growth in the ethylene market is likely to be focussed on regions with access to low cost NGLs such as North America and the Middle East, as well as high demand areas like China, and developing economies in the rest of Asia.

Clearly, carbon prices will affect the cost of steam cracking. Our model shows that an increase in the average global average carbon price to $100/t by 2030 will increase ethylene production costs by nearly $70/t. This impact will not be uniform across the asset base, though, and is likely to be affected by several regional factors including the local market conditions, availability of alternative feedstocks, access to carbon capture infrastructure and the local policies and offset schemes.

We do know that Europe’s steam crackers will face the greatest pressure. While its emissions intensity is similar to that of the Middle East and North America on a per ton high-value chemicals basis, the region has among the most stringent carbon pricing policies in the world. Ethylene-producing assets in the region may be less competitive globally, as a result.

For more details about ethylene industry growth, steam cracking process and decarbonisation strategies from the major players, fill in the form for an extract of ‘Decarbonisation strategies for the ethylene industry, navigating a path to net-zero’.