Will lower gas prices spark switching in Europe and Asia?

In 2022, record high prices forced many European and Asian companies to switch from gas to alternative cheaper fuels, or reduce their output. The market will seek a new balance this year.

3 minute read

Lucas Schmitt

Principal Analyst, Short-Term LNG

Lucas Schmitt

Principal Analyst, Short-Term LNG

Lucas provides clients with data and insight on short-term gas and LNG markets.

Latest articles by Lucas

-

Opinion

Gas and LNG in 2025: a commodity trader’s guide

-

Opinion

International Energy Week 2025: our key takeaways for oil & gas

-

Opinion

Will lower gas prices spark switching in Europe and Asia?

-

Editorial

Satellite tracking, remote sensing: how we monitor the LNG market

Massimo Di Odoardo

Vice President, Gas and LNG Research

Massimo Di Odoardo

Vice President, Gas and LNG Research

Massimo brings extensive knowledge of the entire gas industry value chain to his role leading gas and LNG consulting.

Latest articles by Massimo

-

Opinion

The impact of the Israel-Iran conflict escalation on the global energy market

-

Opinion

Gas, LNG & The Future of Energy: investment momentum builds in a volatile market

-

The Edge

WoodMac’s Gas, LNG and the Future of Energy conference: five key themes

-

The Edge

Upside pressure mounts on US gas prices

-

Opinion

Video | Lens Gas & LNG: Will Russian gas and LNG come back?

-

The Edge

What a future Ukraine peace deal means for energy (part 1)

Record high prices devastated demand for gas and LNG across Asia and Europe last year. But with prices falling, companies are starting to re-evaluate the economics of using natural gas for their operations. So, what sectors could switch? At what price levels? And what volumes could be involved?

Our latest report draws on data from our LNG Short-term Analytics service to assess the scale of demand response to lower gas prices across a range of countries and sectors. Fill out the form to access a complimentary extract, and read on for an introduction.

Falling prices could motivate a return to gas

With gas and LNG prices averaging a record US$40/mmbtu last year, many companies were forced to rethink their requirements. As firms sought to limit their exposure to the spot market, switch to alternative fuels and reduce their output, demand for gas in Europe and for LNG in Asia fell.

The situation today looks very different. European gas and global LNG prices are now trading below US$15/mmbtu. If prices go down further, companies in Europe and Asia will have a strong incentive to switch back to gas from other fuels for specific uses.

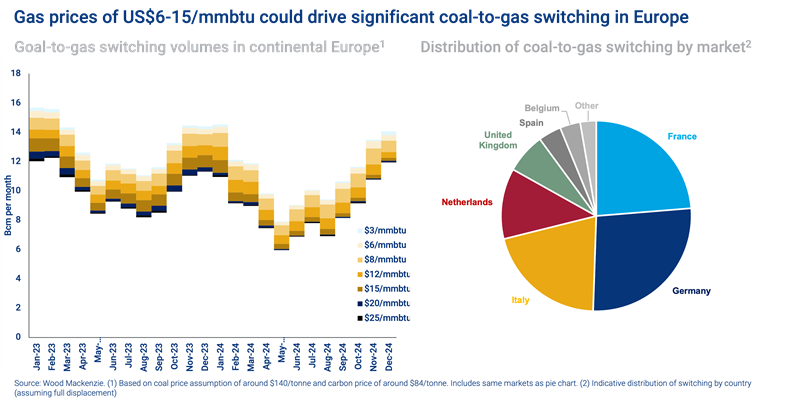

Coal-to-gas: current prices support some switching

Switching is most likely in Europe, where prices have reconnected to the upper range of the coal-to-gas switching band. This incentivises some gas demand response to emerge. Coal producers can reduce margins to some extent to stay competitive. However, coal will struggle below a price of US$80 per tonne – that translates into gas switching prices of around US$10/mmbtu. At that level, the market impact could be even more significant.

Dynamics are different in Asian countries, making switching less likely. For example, in Japan, price is only part of the story. Nuclear performance, high-quality coal procurement, plant location and emission concerns all affect demand. Switching either way has historically been limited.

Will it remain so? Read the full insight for our view. Fill in the form for your copy.

Ammonia production: the economics have flipped

Gas prices pushed the cost of producing ammonia so high in Europe last year that it became uneconomic for factories to operate. Most reduced production, while some even shut down temporarily.

As a result, European ammonia output averaged only around 50% of capacity in 2022. The loss of Russian ammonia due to the war in Ukraine further hit supplies, although imports from the US, Middle East, North Africa and Asia partly filled the gap.

However, since January 2023 the economics have flipped, with lower costs for gas making European ammonia production viable again. We estimate that could create up to 10 bcm of additional demand if factories were to return to full capacity over a full year. Having said that, the increased competition from cheap imports could limit the market for European production, while subdued demand for fertiliser is also a risk.

Trucked LNG: broader economic recovery will shape demand

In China, trucked LNG volumes are sensitive to price and have dropped sharply since Q3 2021. However, spot prices below US$15/mmbtu are low enough to start displacing some more expensive long-term contracted volumes in the trucking sector.

Ultimately, increased overall economic activity in China will be critical for any recovery for trucked LNG. The country’s earlier-than-expected reopening has noticeably improved GDP growth expectations, and household savings accumulated in 2022 are likely to support a spending spree.

If the economy recovers above our upgraded base case of 5.5% GDP growth, more demand could emerge.

Get a closer look at gas switching dynamics in Europe and Asia

The full insight provides detailed analysis of the scope, scale and price level at which gas switching could happen for multiple sectors and commodities across Asia and Europe. In addition to the topics covered here, the report includes analysis of oil-to-gas and refining, as well as key dynamics in other countries including India, Japan, South Korea, Egypt, Pakistan and Bangladesh.

Fill in the form at the top of the page for your complimentary extract.

Lens Gas & LNG

Our powerful data analytics solution for exploring industry data alongside leading expertise, analyses, and modelling insights to enable faster, more accurate operational and strategic planning and portfolio management decisions.

Learn More