Third wave US LNG: a $100 billion opportunity

A new wave of projects could add 70-190 mmtpa of capacity by 2030 and make the US the world’s largest LNG supplier by some margin. But cost inflation and competition are creating challenges for securing finance

5 minute read

Sean Harrison

Senior Research Analyst, Gas & LNG

Sean Harrison

Senior Research Analyst, Gas & LNG

Sean specialises in North America LNG research, focusing on assets analysis, project economics and LNG contracting.

Latest articles by Sean

-

Opinion

Video | Lens Gas & LNG: Golar and partners' FID set to revive Argentina's LNG export ambitions

-

Opinion

Shining a light on the “coal versus LNG emissions” debate

-

Opinion

Video | Lens Gas & LNG: What is Venture Global's LNG strategy?

-

Opinion

Woodside acquires Tellurian and the Driftwood LNG project

-

Opinion

The LNG Majors' strategies in five key charts

-

Opinion

Why is Ruwais LNG an attractive position for the selected partners?

Giles Farrer

Vice President Research, Commodities, Gas & LNG

Giles Farrer

Vice President Research, Commodities, Gas & LNG

Giles heads our LNG and gas asset research and manages our market-leading LNG Service & Tool and LNG Corporate Service.

Latest articles by Giles

-

Opinion

Debating the future direction of the LNG market

-

The Edge

Positioning for global LNG’s next big growth phase

-

Opinion

Third wave US LNG: a $100 billion opportunity

-

Opinion

LNG: seismic shifts as Russia/Ukraine conflict makes waves

-

Opinion

LNG regasification: why there’s still plenty of gas in the tank

-

Opinion

How coronavirus is driving down LNG demand in Asia and Europe – and hitting supply

The US is already set to become the world’s largest exporter of LNG in 2023 – but it won’t stop there. Record prices and the need for energy security are driving huge momentum for US LNG projects that could see over US$100 billion invested before the end of the decade.

Our latest North American LNG benchmarking report draws on insight from Lens Upstream and Lens Gas & LNG to provide a detailed economic breakdown of ten major new projects, which would collectively at least double US capacity.

Fill out the form to get access to a complimentary extract from the report, plus our asset profile of the Plaquemines project. And read on for an introduction.

What is the outlook for US LNG over the next five years?

At 76.4 million tonnes, US exports of LNG in 2022 were the third highest globally, behind Australia and Qatar. But with operations at the Freeport liquefaction facility set to resume in March, the US will easily exceed that figure this year to become the world’s largest exporter of LNG.

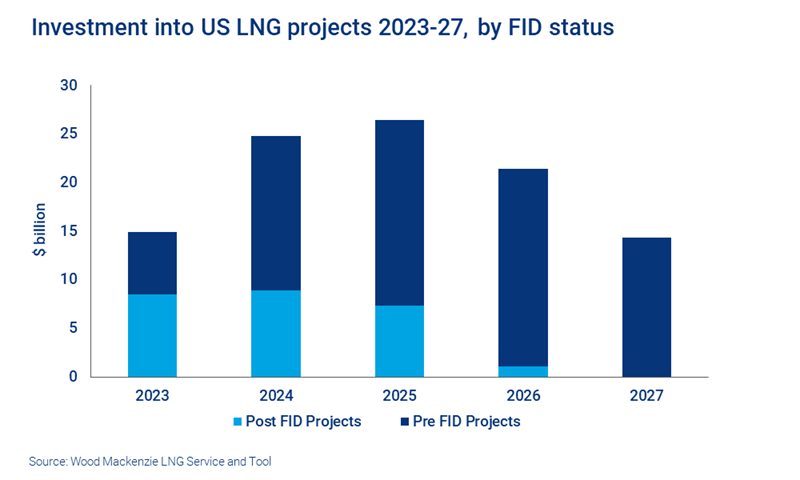

That, however, is just the start of the story, as the chart below indicates.

Over the past few years, final investment decisions (FIDs) have been taken on four new projects:

- Golden Pass LNG

- Plaquemines LNG Phase 1

- Corpus Christi Stage 3

- New Fortress Energy’s Louisiana Fast LNG project.

Together these projects will contribute almost 45 mmtpa of new US capacity from next year. For a complimentary asset profile of the Plaquemines project, fill in the form at the top of the page.

A wave of new FIDs could soon increase capacity even further. Last year saw European and Asian LNG prices hit record highs, while a challenging geopolitical environment underlined the need to invest in energy security. As a result, buyers, including portfolio players, and US producers and infrastructure companies lined up behind long-term deals with US LNG projects. A whopping 65 mmtpa of long-term contracts were signed in 2022 alone, dwarfing the 18.5 mmtpa of new contracts confirmed in the previous year.

Buoyed by this record contracting, a host of pre-FID US LNG projects have moved forward. Many are now either close to or have reached the contracted offtake threshold for raising debt. Indeed, several developers with fully permitted projects have already signed or are negotiating engineering, procurement and construction (EPC) contracts for their projects.

The likely outcome is a further series of FIDs during 2023 and 2024.

Our analysis indicates that if current momentum continues between 70 mmtpa and 190 mmtpa could be added to US LNG capacity before the end of the decade. That would more than double current exports.

These FIDs could lead to an investment of over US$100 billion in US LNG production over the next five years.

Giles Farrer

Vice President Research, Commodities, Gas & LNG

Giles heads our LNG and gas asset research and manages our market-leading LNG Service & Tool and LNG Corporate Service.

Latest articles by Giles

-

Opinion

Debating the future direction of the LNG market

-

The Edge

Positioning for global LNG’s next big growth phase

-

Opinion

Third wave US LNG: a $100 billion opportunity

-

Opinion

LNG: seismic shifts as Russia/Ukraine conflict makes waves

-

Opinion

LNG regasification: why there’s still plenty of gas in the tank

-

Opinion

How coronavirus is driving down LNG demand in Asia and Europe – and hitting supply

Who’s investing in new US LNG capacity?

If approved, we calculate these FIDs could lead to an investment of over US$100 billion in US LNG production over the next five years. Three-quarters of that total is expected to be invested in pre-FID projects. This figure is based on bottom-up estimates of existing EPC costs and project facilities, and factors in cost inflation. (Ultimately, the total will depend on how many projects can secure financing and reach FID).

Both privately and publicly-owned developers are expected to invest in building new capacity. Most pre-FID project developers are currently seeking external financing for this investment. In most cases, project financing will support between 60-80% of the required capital, with the remainder either financed via equity raises or balance sheet.

Major EPC player Bechtel has already agreed contracts with numerous advanced pre-FID projects. Further contract wins are likely for the company, assuming it can resource them effectively.

Other EPC providers, including McDermott, Kiewit, Zachary and JGC, are eyeing developments but remain cautious, having suffered from major cost overruns in the past.

Equipment manufacturers Baker Hughes and Chart both have multiple orders for various plant components. These include liquefaction trains and turbines, as well as other plant items. If projected investment goes ahead, they and other selected service providers could further benefit.

What are the risks to growth?

While the outlook for US LNG is highly positive, the situation is not without risks:

- Cost increases. Our benchmarking analysis indicates significant inflation in the cost of US Gulf Coast projects built in the last five years

- Overruns. Previous projects in the last wave of US LNG construction suffered major overruns

- Resourcing. Demand for both manpower and services is likely to outstrip supply as developers rapidly push projects forward – this could increase costs and cause delays

- Competitive pressure. Despite rising costs, our contract database and liquefaction fee benchmarking shows that projects have been forced to keep fixed fees low because of competition between developers to access buyers

- Tight margins. Overall, our economic models indicate that because fixed fees which define project revenue have been kept low, project returns are tight. We estimate unlevered internal rates of return (IRRs) as low as 5-6% for some projects. Based on these returns, some projects are finding it challenging to secure finance, particularly via equity raises

How are US LNG developers mitigating these risks?

With profits squeezed, developers will be looking for opportunities to generate upside and make projects more attractive to equity investors and customers.

Rerating trains for higher capacity, debottlenecking and adding further trains should provide opportunities to increase production in the future. Further revenue could come via efficient feedgas procurement and sale of pre-commercial volumes. Another source of additional returns could be through retaining access to the potential upside from high global commodity prices.

Developers are also looking at ways to mitigate value chain emissions. This could make the emissions characteristics of projects more attractive, allowing projects to charge premiums to customers and therefore increasing returns.

Options include reducing liquefaction emissions by either using electric drive (with renewable power) or hydrogen-fueled turbines, or installing carbon capture, utilisation and storage (CCUS) on gas-powered turbines. Developers are also focusing on sourcing feedgas from projects with certifiably low upstream emissions (responsibly procured gas) and from renewable natural gas sources as well.

The full North American LNG benchmarking report is featured in our LNG Service. It compares US LNG facilities across value, cost and contract metrics, including IRR, net present value (NPV), breakeven, liquefaction fees, EPC terms and commercial structures. We have also just published new individual LNG Service Asset reports with full economic details for many projects with more to follow in the coming weeks.

For a complimentary extract of the report, plus our asset profile of the Plaquemines project, fill in the form at the top of the page.

Lens Gas & LNG

Our powerful data analytics solution for exploring industry data alongside leading expertise, analyses, and modelling insights to enable faster, more accurate operational and strategic planning and portfolio management decisions.

Learn More