Discuss your challenges with our solutions experts

Heat pumps: primed and ready to support Europe’s net zero and energy security goals

Policy change is crucial if heat pumps are to reach their full potential

4 minute read

Ahmed Jameel Abdullah

Research Analyst, European Power

Ahmed Jameel Abdullah

Research Analyst, European Power

Ahmed monitors power market trends across Europe.

Latest articles by Ahmed Jameel

-

Opinion

The global competitiveness of renewable LCOE (Levelised Cost of Electricity) is on the rise

-

Opinion

Renewable energy costs continue to fall across Europe

-

Opinion

Heat pumps: primed and ready to support Europe’s net zero and energy security goals

Energy-efficient heat pumps are set to be a vital element of the solution to carbon-intensive heating. The European market value of residential heat pumps is set to more than double to exceed €30 billion by 2030, and it’s one of the most significant new demand segments for the power sector.

However, realising the full potential of heat pumps will depend on adequate financial support, structural incentives and regulatory frameworks.

This article draws on findings from a recent insight from our Europe Power & Renewables Service: Europe electrification of heat demand outlook to 2050. Visit the store to access the full report , or read on for an introduction.

What is a heat pump – and why are they important to the energy transition?

Put very simply, air, ground and water source heat pumps efficiently capture heat from outside and move it inside. For each kW of electricity consumed by a heat pump, about 4kW of thermal energy is generated. This corresponds to a 300% efficiency, compared to the sub-100% efficiency of typical gas/oil boilers or direct electric heating systems.

This energy efficiency could play a crucial role in the energy transition. Right now, residential and commercial space heating is broadly reliant on hydrocarbons, with natural gas as the primary fuel globally. However, as the power sector continues to decarbonise, heating electrification rises up the agenda. Heat pumps, an established technology, are poised to play a key role.

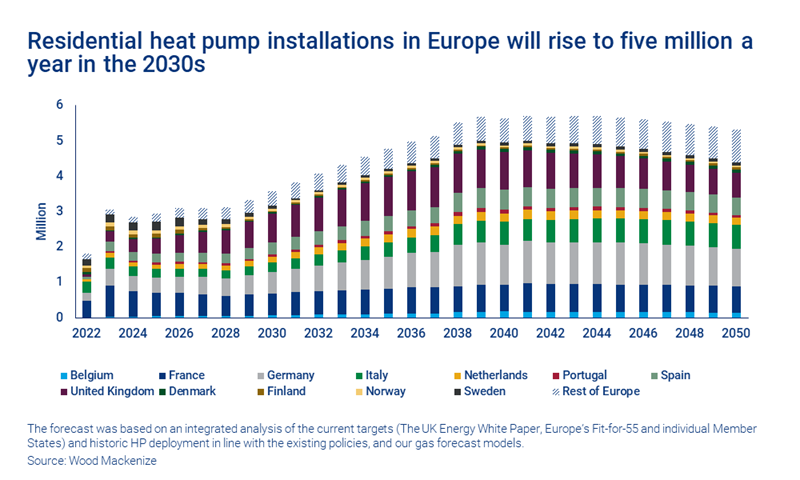

Europe is currently on track for 45 million residential heat pumps to be installed by 2030, with an annual growth of 17%. We expect heating electrification via heat pumps to account for 60% of European households by 2050.

Will the switch to heat pumps boost Europe’s energy security?

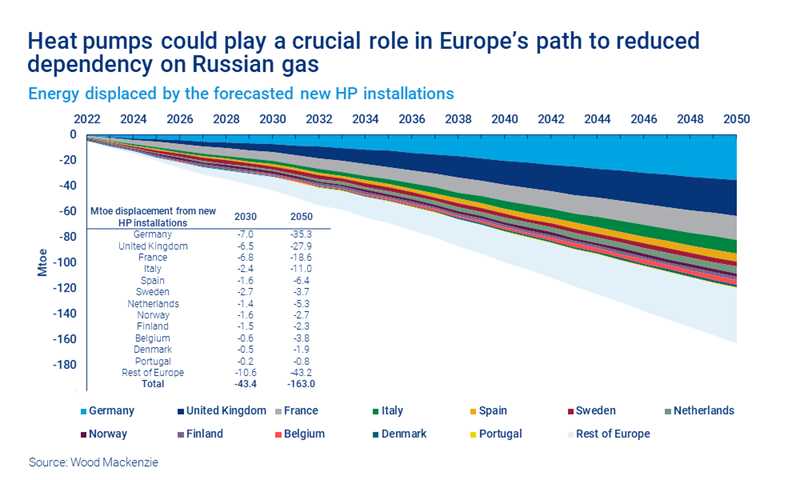

New heat pump installations can displace 43 Mtoe of heating demand by 2030 and 163 Mtoe by 2050. This demand would otherwise be met by other sources including natural gas, which in 2020 accounted for 32% of household final energy consumption. This supports Europe’s pivot away from Russian gas.

Our study also demonstrates that in markets with high renewable penetration, demand-side flexibility from heat pumps offers cost savings and contributes to a stable, secure supply of electricity. Read the full report for a closer look.

What are the barriers to heat pump deployment?

Transitioning to more energy-efficient heating will be a key element of achieving regional and national net zero targets. But there are barriers to cross if heat pumps are to reach their full potential. These include:

• Economics

Heat pumps suffer from high upfront costs – installation and sometimes building transformation, depending on the construction method. Plus, there is an imbalance between electricity and gas prices due to fossil fuel subsidies and electricity taxes.

-

Incumbent heating infrastructure

Existing fossil fuel-intensive network infrastructure can, to an extent, create a carbon lock-in. And consumers often favour the technological familiarity of gas boilers and instantaneous heat.

-

Grid stability

Large-scale uptake of new electric heating systems will substantially increase the peak and total demand for energy in electricity networks. Ensuring sufficient system capacity will require network reinforcement with long lead times, considerable cost and a change in operational procedures.

-

Policy and regulation

Policy reform is vital to accelerate heat pump deployment. It will call for financial support for property owners and structural incentives to bring life cycle costs of heat pumps below that of gas boilers. Regulatory action – such as bans on gas boilers in new build homes – would also support a switch. Establishing energy policies for existing building stock, through the development of energy codes or other legislation, would also accelerate the conversion to electricity.

The importance of policy support is clear. Norway, for instance, leads the way with early adoption triggered after the 1970s oil crisis. The country embraced heat pumps, fuelled by government subsidies, high fossil fuel taxes, low electricity prices and restrictions on oil boilers (which have been banned since 2020).

At the other end of the spectrum, the UK lags due to the construction methods of existing housing stock. Heat pumps are unsuitable to retrofit into many UK homes without significant insulation improvements – and therefore significant policy support. The government has however banned gas boilers in all new home builds after 2025, which should help to move the adoption dial.

Italy presents the most ambitious support model. In May 2020 a ‘super bonus’ was announced, and later extended until the end of 2022, to pay homeowners 110% of costs to eco-proof their homes (insulating walls and installing a heat pump). Italy’s power price outlook remains the main hurdle to a booming heat pump market.

Take a closer look at the growth trajectory of heat pumps – and the barriers

The full report, Europe electrification of heat demand outlook to 2050, takes a more detailed look at the path ahead. It includes:

- Heat pump market outlook – country by country

- Variable renewable energy (VRE) contribution

- The pricing gap between electricity and gas

- And more.

Visit the store to find out more.