Discuss your challenges with our solutions experts

Factors to consider when choosing OEMs for renewables projects

Decision makers need to consider an increasingly complex range of factors when choosing equipment suppliers

5 minute read

Erin Carroll

Senior Vice President, Supply Chain Consulting

Erin Carroll

Senior Vice President, Supply Chain Consulting

Latest articles by Erin

-

Opinion

How to choose the right renewables project model

-

Opinion

Factors to consider when choosing OEMs for renewables projects

-

Opinion

How does the Inflation Reduction Act impact renewables project planning?

-

Opinion

How to manage renewables supply chain issues

For owners and developers, choosing the right original equipment manufacturers (OEMs) to supply a new renewables project is a potentially critical factor for the ultimate success or failure of a project.

Upfront capital costs will of course be a key consideration; however, a range of other factors should be taken into account that will impact the levelized cost of energy over a project’s lifespan. In addition, as part of the tendering process, owners and developers should evaluate a number of non-financial risk factors which could affect the viability of a project.

The introduction of the Inflation Reduction Act (IRA) and ongoing issues affecting the renewables supply chain add further layers of complexity to the decision-making process. Owners and developers need to account for all these factors to make the best decision when procuring equipment for a particular project.

Accounting for total cost of ownership

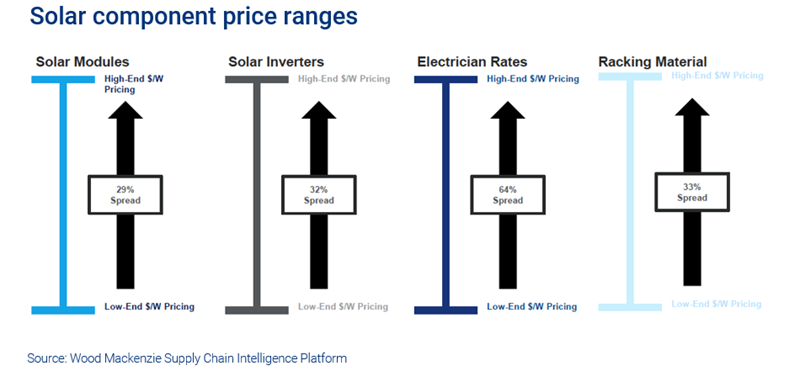

As a result of market uncertainty, the underlying cost drivers impacting project element costs vary even on like-for-like projects. The degree of variability of these costs depends on project type and the specific element, but market uncertainty means they can be significant even on like-for-like projects, as shown in the figure below.

However, this is only the tip of the iceberg. The total cost of ownership for a project involves all the project capital costs as well as the project operations and maintenance costs, and these can be affected by multiple factors.

A useful parallel is with buying a car. While the list price is important, ultimately it constitutes just one element of the overall cost of ownership. Discerning buyers will consider the cost of fuel, maintenance costs and insurance costs. They may also take into account factors which are not directly cost-related but will ultimately have an impact on the overall cost of ownership, including fuel economy, reliability, potential depreciation and level of use.

In the same way, choosing the most suitable equipment for a renewables project will involve accounting for every element that could impact the total cost of ownership. Owners need to be sure to ask the right questions to be able to make an informed decision.

Maintenance:

- What are the annual and lifetime maintenance requirements, both preventative and corrective?

- How many technicians are required for routine maintenance and repairs?

- What is the cost of consumables and other parts to maintain and/or repair equipment?

- Are parts available direct from the manufacturer or via a third party?

- Can equipment be overhauled or refurbished to extend its lifespan, and at what cost?

Warranties:

- How long is equipment warrantied for?

- What exactly is covered under the warranty?

Reliability:

- Does the manufacturer have a good track record for reliability?

- Does the specific equipment have proven reliability?

End-of-life disposal:

- Is equipment recyclable?

- Is there a viable secondary market for it?

- Does the manufacturer have a programme in place for end-of-life disposal?

- What are the costs involved?

Non-financial and risk factors

As well as factors affecting the total cost of ownership of equipment, owners should also consider a range of non-financial factors in making the final purchase decision.

- Availability: Does the manufacturer have sufficient production levels and/or capacity to fulfil a potential order in the relevant timescales?

- Viability: Is the manufacturing company financially sound and likely to remain in business over the lifespan of a project?

- Safety: Does the company’s equipment have a good safety record?

- Reputation: Is it possible to be reasonably confident the manufacturer will honour the terms of a contract?

- Partnership: To what extent does the manufacturer offer an ongoing post-purchase relationship?

- Regulatory: Will the equipment meet regulatory and import requirements?

The impact of the IRA on OEM selection

The potential financial benefits of using US OEMs create a further layer of evaluation and decision making in OEM selection. The IRA offers a domestic content bonus as part of the tax incentives aimed at boosting renewables investment in the US. However, the initial IRS guidance on domestic content is complex and will require substantial investment in the US supply chain to achieve the domestic content requirement (DCR) thresholds for solar and storage projects in .

Developers also need to consider the relatively higher upfront costs and additional risks of opting for a US manufacturer rather than sourcing from abroad. US manufacturing for renewables is less established than in many other countries, so attention to financial viability, scalability and security of supply and the potential for production delays are important factors to consider.

Clearly, doing nothing is not an option and ultimately procurement decisions need to be based on anticipated market conditions. However, risks should be minimised wherever possible. Developers and owners should ensure optionality by keeping a second choice of supplier in mind for key equipment. It’s also worth exploring partnering with a domestic OEM to help share risk and safeguard equipment supply.

Taking supply chain issues into consideration

Choosing to buy key equipment for renewables projects from an established foreign manufacturer has potential advantages both in terms of upfront costs and in relation to other key factors such as production capacity and proven reliability. However, sourcing equipment from abroad can involve its own problems in the shape of ongoing supply chain issues. As well as lengthy timescales for delivery and production delays, import regulations and rules designed to protect domestic manufacturers have become a significant stumbling block in recent years.

Making the right choice

With the market for renewables equipment constantly evolving and increasingly complex, tendering and procurement processes need to be carefully structured. We recommend the following:

- Develop a scorecard to identify and document all aspects that could affect the purchase decision.

- Develop a shortlist of OEMs and ensure you have secondary options for key components.

- Pulse the market throughout the planning and tendering phase to monitor the cost and risk involved with shortlisted manufacturers.

- Conduct careful due diligence:

- Seek written confirmation from manufacturers about all factors affecting buying decisions.

- Aim to confirm the veracity of information from secondary sources.

With the market constantly evolving, it can be difficult even for experienced developers and owners to pick winners. Wood Mackenzie’s analysts and researchers stay on top of every aspect of the market, ensuring our project consultants have access to a wealth of proprietary information to identify and evaluate the best potential OEMs for a client’s particular project.

Learn more

Find out more about the insight and analysis available from Supply Chain Intelligence by filling out the form at the top of the page.