Discuss your challenges with our solutions experts

Offshore wind: German auction wins show Big Oil has not left the party

What made Germany’s 7 GW offshore wind tender so attractive – and what does it mean for other governments?

3 minute read

Søren Lassen

Head of Wind

Søren Lassen

Head of Wind

Søren tracks, analyses and forecasts value chain dynamics, technological advancements and the market outlook.

Latest articles by Søren

-

Opinion

The Danish government charts course through offshore wind headwinds

-

Featured

Wind: predictions for 2025

-

Opinion

Industry divergence on costs and turbine sizing manifests itself in the first commercial floating wind tender

-

Opinion

Offshore wind energy: what to look for in 2024

-

Featured

Wind 2024 outlook

-

Opinion

Elevated subsidies enable offshore wind to end 2023 on a high note

Big Oil has once again delved into its deep pockets to win material acreage for offshore wind generation projects. It’s a timely demonstration to stakeholders, especially by BP, that renewable power remains part of its low-carbon strategy. It’s also a reminder to the wider offshore wind sector that Big Oil has not left the party.

BP and TotalEnergies (TTE) will pay a total €12.6 billion for four sites – three in the North Sea and one in the Baltic Sea – with a potential 7 GW of generation capacity. That is €1.56-2.07 m/MW across the four sites, comparable to the total cost per MW of an onshore wind project in Germany. On the face of it, the winning price seems hefty. So, what made the German tender so attractive? Four reasons stand out.

Firstly, it’s not just about how much you pay, but also about when you pay

Unlike other tenders and auctions so far, companies will pay just 10% of the total fee upfront and spread the remainder over 20 years after commissioning for this tender. This shifts the upfront cost to US$750 million for BP and US$645 million for TTE, or around US$0.2m/MW. That’s not a big increment to capex. The ongoing fee will be US$75-100k/MW.

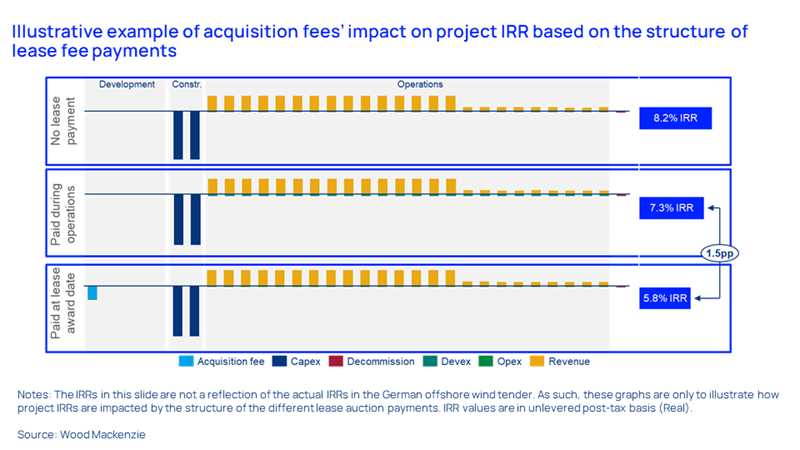

This set-up sacrifices some of the relatively high operating cash flow margin in offshore wind to protect internal rates of return (IRRs). Three graphs from our insight Offshore wind’s race for acreage: the cost of competition illustrate the benefits of this set-up.

The graphs are based on the actual capex, opex and revenue of an operational project. We then layered in the same acquisition fee in two different ways. One where the fee is paid upfront and the other where it’s paid during the operating lifetime. As shown, spreading the option fee over the operating lifetime, similar to what is done in the German tender, is much more favourable from a project IRR perspective.

Nevertheless, most lease auctions are structured so that the acquisition fee must be paid early in the project lifecycle.

Secondly, the construction of grid connections will be paid by the transmission system operator (TSO) and not the developers

Transmission costs are high in Germany, totalling north of 20% of total project capex. The setup therefore contributes positively to project IRRs.

We estimate that the transmission costs be comparable with the total lease payments. As the projects’ production is not subsidised that also means that the projects will in effect be subsidy-free.

Thirdly, project scale is also an important factor in the Majors’ win

There are few tenders where developers can add 3-4 GW to their development pipeline in one hit. BP’s net project pipeline, for example, leaps by over 75% to 9.2 GW. The Majors are also getting access to favourable site conditions in one of the world’s most established offshore wind markets, giving developers a strong understanding of the market-specific risks.

Additionally, the German market has some of the strongest offtake potential in Europe.

Lastly, it’s an opportunity to secure an advantage in the competition for offshore wind supply chain capacity

There will be a lot of demand for offshore wind supply chain capacity in the 2027-2030 period. Policymakers will push to realise their 2030 targets, which were mostly set in the last two years. However, BP and TTE can get to the front of the queue to secure part of the scarce supply capacity for their projects before governments in other markets, most notably the UK, Denmark, Netherlands and Belgium, tender large volumes of offshore wind targeting commissioning in the same period.

The pace at which BP and TTE can secure the relevant permits, and the timing and conditions of the tenders in the other markets, will determine how big this advantage will be.

The race for the scarce offshore wind supply chain capacity has accelerated significantly for the developers over the past two years. This tender shows how governments now also need to fight for the scarce capacity to realise their lofty offshore wind targets.

Want to keep pace with changes in the wind markets?

Our Global Wind Markets Service gives you the industry’s most in-depth and strategic overview of key market drivers and trends.